- Hong Kong

- /

- Communications

- /

- SEHK:1202

Chengdu SIWI Science and Technology Company Limited's (HKG:1202) Shares Climb 39% But Its Business Is Yet to Catch Up

Chengdu SIWI Science and Technology Company Limited (HKG:1202) shareholders would be excited to see that the share price has had a great month, posting a 39% gain and recovering from prior weakness. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

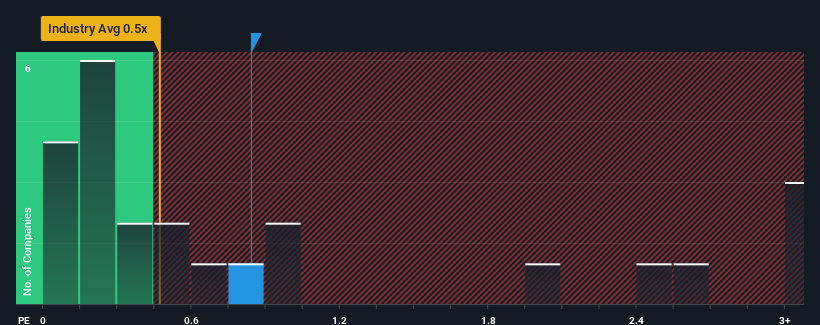

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Chengdu SIWI Science and Technology's P/S ratio of 0.8x, since the median price-to-sales (or "P/S") ratio for the Communications industry in Hong Kong is also close to 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Chengdu SIWI Science and Technology

What Does Chengdu SIWI Science and Technology's Recent Performance Look Like?

Recent times have been quite advantageous for Chengdu SIWI Science and Technology as its revenue has been rising very briskly. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. Those who are bullish on Chengdu SIWI Science and Technology will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Chengdu SIWI Science and Technology will help you shine a light on its historical performance.How Is Chengdu SIWI Science and Technology's Revenue Growth Trending?

Chengdu SIWI Science and Technology's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 33%. The strong recent performance means it was also able to grow revenue by 69% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 47% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

In light of this, it's curious that Chengdu SIWI Science and Technology's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

The Key Takeaway

Chengdu SIWI Science and Technology appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Chengdu SIWI Science and Technology revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

It is also worth noting that we have found 3 warning signs for Chengdu SIWI Science and Technology (2 are significant!) that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1202

Chengdu SIWI Science and Technology

Engages in the manufacture and sale of telecommunications cables in the People's Republic of China.

Adequate balance sheet and overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026