- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:1050

Karrie International Holdings Limited's (HKG:1050) CEO Might Not Expect Shareholders To Be So Generous This Year

Key Insights

- Karrie International Holdings to hold its Annual General Meeting on 30th of August

- Total pay for CEO Cheuk Fai Ho includes HK$4.83m salary

- Total compensation is 94% above industry average

- Over the past three years, Karrie International Holdings' EPS fell by 28% and over the past three years, the total loss to shareholders 25%

Shareholders will probably not be too impressed with the underwhelming results at Karrie International Holdings Limited (HKG:1050) recently. At the upcoming AGM on 30th of August, shareholders can hear from the board including their plans for turning around performance. This will be also be a chance where they can challenge the board on company direction and vote on resolutions such as executive remuneration. We present the case why we think CEO compensation is out of sync with company performance.

See our latest analysis for Karrie International Holdings

How Does Total Compensation For Cheuk Fai Ho Compare With Other Companies In The Industry?

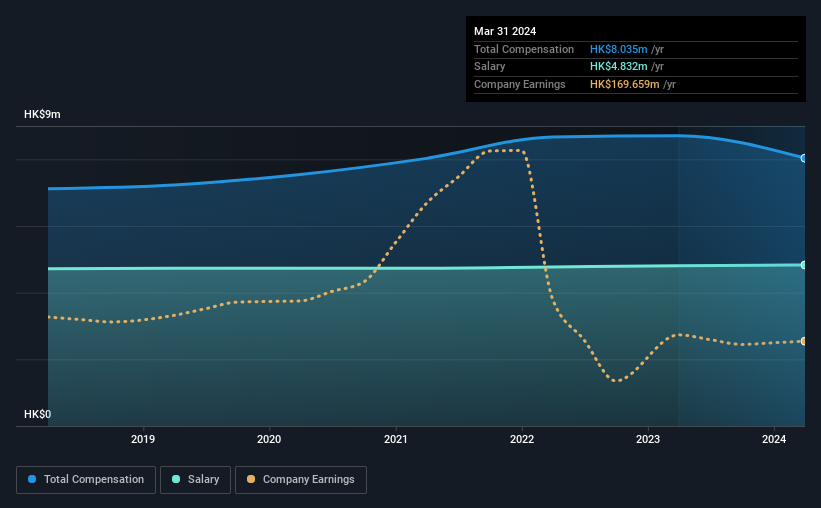

According to our data, Karrie International Holdings Limited has a market capitalization of HK$1.4b, and paid its CEO total annual compensation worth HK$8.0m over the year to March 2024. That's a slight decrease of 7.7% on the prior year. We note that the salary portion, which stands at HK$4.83m constitutes the majority of total compensation received by the CEO.

In comparison with other companies in the Hong Kong Electronic industry with market capitalizations ranging from HK$780m to HK$3.1b, the reported median CEO total compensation was HK$4.1m. Hence, we can conclude that Cheuk Fai Ho is remunerated higher than the industry median. Furthermore, Cheuk Fai Ho directly owns HK$198m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | HK$4.8m | HK$4.8m | 60% |

| Other | HK$3.2m | HK$3.9m | 40% |

| Total Compensation | HK$8.0m | HK$8.7m | 100% |

Talking in terms of the industry, salary represented approximately 78% of total compensation out of all the companies we analyzed, while other remuneration made up 22% of the pie. In Karrie International Holdings' case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Karrie International Holdings Limited's Growth Numbers

Over the last three years, Karrie International Holdings Limited has shrunk its earnings per share by 28% per year. In the last year, its revenue is down 5.4%.

Few shareholders would be pleased to read that EPS have declined. And the impression is worse when you consider revenue is down year-on-year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Karrie International Holdings Limited Been A Good Investment?

With a three year total loss of 25% for the shareholders, Karrie International Holdings Limited would certainly have some dissatisfied shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Given that shareholders haven't seen any positive returns on their investment, not to mention the lack of earnings growth, this may suggest that few of them would be willing to award the CEO with a pay rise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We did our research and identified 3 warning signs (and 1 which is significant) in Karrie International Holdings we think you should know about.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Karrie International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1050

Karrie International Holdings

An investment holding company, manufactures and sells metal, plastic, and electronic products in Hong Kong, Japan, Mainland China, Asia, North America, and Western Europe.

Excellent balance sheet established dividend payer.