- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:1050

Karrie International Holdings Limited's (HKG:1050) 32% Price Boost Is Out Of Tune With Earnings

Despite an already strong run, Karrie International Holdings Limited (HKG:1050) shares have been powering on, with a gain of 32% in the last thirty days. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 15% over that time.

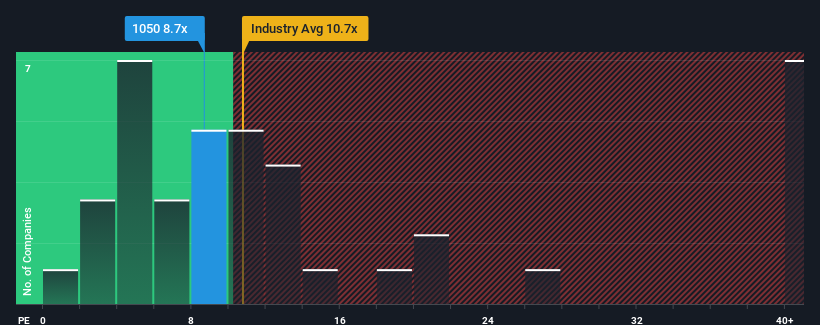

Although its price has surged higher, you could still be forgiven for feeling indifferent about Karrie International Holdings' P/E ratio of 8.7x, since the median price-to-earnings (or "P/E") ratio in Hong Kong is also close to 10x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times have been quite advantageous for Karrie International Holdings as its earnings have been rising very briskly. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for Karrie International Holdings

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like Karrie International Holdings' is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered an exceptional 80% gain to the company's bottom line. However, this wasn't enough as the latest three year period has seen a very unpleasant 44% drop in EPS in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

In contrast to the company, the rest of the market is expected to grow by 21% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we find it concerning that Karrie International Holdings is trading at a fairly similar P/E to the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Key Takeaway

Its shares have lifted substantially and now Karrie International Holdings' P/E is also back up to the market median. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Karrie International Holdings revealed its shrinking earnings over the medium-term aren't impacting its P/E as much as we would have predicted, given the market is set to grow. Right now we are uncomfortable with the P/E as this earnings performance is unlikely to support a more positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Karrie International Holdings (at least 1 which can't be ignored), and understanding these should be part of your investment process.

Of course, you might also be able to find a better stock than Karrie International Holdings. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Karrie International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1050

Karrie International Holdings

An investment holding company, manufactures and sells metal, plastic, and electronic products in Hong Kong, Japan, Mainland China, Asia, North America, and Western Europe.

Excellent balance sheet established dividend payer.