Shareholders May Not Be So Generous With Linklogis Inc.'s (HKG:9959) CEO Compensation And Here's Why

Key Insights

- Linklogis' Annual General Meeting to take place on 17th of June

- Total pay for CEO Song Qun includes CN¥2.19m salary

- Total compensation is 51% above industry average

- Linklogis' three-year loss to shareholders was 86% while its EPS grew by 124% over the past three years

Shareholders of Linklogis Inc. (HKG:9959) will have been dismayed by the negative share price return over the last three years. What is concerning is that despite positive EPS growth, the share price has not tracked the trend in fundamentals. The AGM coming up on the 17th of June could be an opportunity for shareholders to bring these concerns to the board's attention. They could also try to influence management and firm direction through voting on resolutions such as executive remuneration and other company matters. We discuss below why we think shareholders should be cautious of approving a raise for the CEO at the moment.

View our latest analysis for Linklogis

Comparing Linklogis Inc.'s CEO Compensation With The Industry

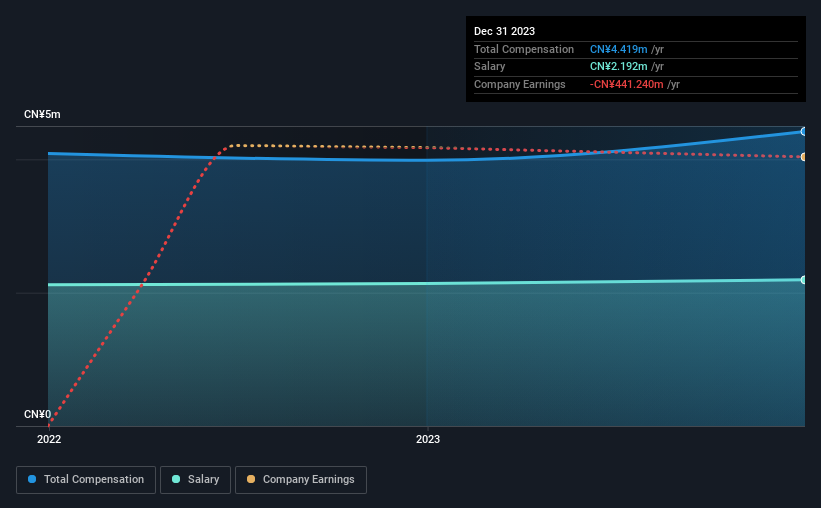

According to our data, Linklogis Inc. has a market capitalization of HK$4.3b, and paid its CEO total annual compensation worth CN¥4.4m over the year to December 2023. Notably, that's an increase of 11% over the year before. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at CN¥2.2m.

On examining similar-sized companies in the Hong Kong Software industry with market capitalizations between HK$1.6b and HK$6.3b, we discovered that the median CEO total compensation of that group was CN¥2.9m. This suggests that Song Qun is paid more than the median for the industry. Moreover, Song Qun also holds HK$592m worth of Linklogis stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CN¥2.2m | CN¥2.1m | 50% |

| Other | CN¥2.2m | CN¥1.8m | 50% |

| Total Compensation | CN¥4.4m | CN¥4.0m | 100% |

On an industry level, roughly 56% of total compensation represents salary and 44% is other remuneration. In Linklogis' case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at Linklogis Inc.'s Growth Numbers

Linklogis Inc. has seen its earnings per share (EPS) increase by 124% a year over the past three years. In the last year, its revenue is down 6.1%.

This demonstrates that the company has been improving recently and is good news for the shareholders. While it would be good to see revenue growth, profits matter more in the end. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Linklogis Inc. Been A Good Investment?

The return of -86% over three years would not have pleased Linklogis Inc. shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

The fact that shareholders are sitting on a loss on the value of their shares in the past few years is certainly disconcerting. The stock's movement is disjointed with the company's earnings growth, which ideally should move in the same direction. Shareholders would probably be keen to find out what are the other factors could be weighing down the stock. These concerns should be addressed at the upcoming AGM, where shareholders can question the board and evaluate if their judgement and decision making is still in line with their expectations.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 2 warning signs for Linklogis that investors should think about before committing capital to this stock.

Important note: Linklogis is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9959

Linklogis

An investment holding company, provides supply chain finance technology and data-driven emerging solutions in the People’s Republic of China and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion