- Hong Kong

- /

- Diversified Financial

- /

- SEHK:9923

Is Now The Time To Put Yeahka (HKG:9923) On Your Watchlist?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Yeahka (HKG:9923). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

See our latest analysis for Yeahka

How Fast Is Yeahka Growing Its Earnings Per Share?

In business, though not in life, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS). So like the hint of a smile on a face that I love, growing EPS generally makes me look twice. It is therefore awe-striking that Yeahka's EPS went from CN¥0.47 to CN¥1.45 in just one year. Even though that growth rate is unlikely to be repeated, that looks like a breakout improvement.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). It seems Yeahka is pretty stable, since revenue and EBIT margins are pretty flat year on year. That's not bad, but it doesn't point to ongoing future growth, either.

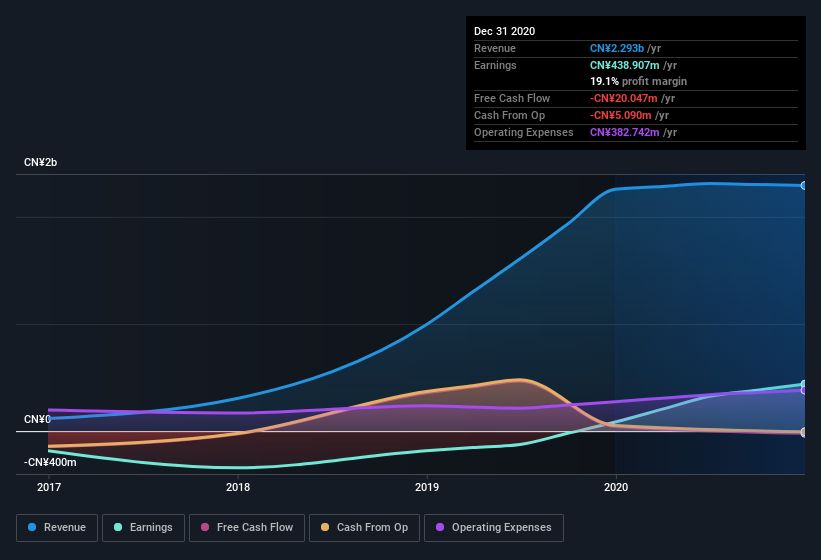

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Yeahka's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Yeahka Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. As a result, I'm encouraged by the fact that insiders own Yeahka shares worth a considerable sum. Given insiders own a small fortune of shares, currently valued at CN¥506m, they have plenty of motivation to push the business to succeed. This should keep them focused on creating long term value for shareholders.

Does Yeahka Deserve A Spot On Your Watchlist?

Yeahka's earnings have taken off like any random crypto-currency did, back in 2017. That EPS growth certainly has my attention, and the large insider ownership only serves to further stoke my interest. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So to my mind Yeahka is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. Don't forget that there may still be risks. For instance, we've identified 2 warning signs for Yeahka (1 is significant) you should be aware of.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:9923

Yeahka

An investment holding company, provides payment and business services to merchants and consumers in the People’s Republic of China.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives