Beisen Holding Limited (HKG:9669) Shares May Have Slumped 25% But Getting In Cheap Is Still Unlikely

The Beisen Holding Limited (HKG:9669) share price has softened a substantial 25% over the previous 30 days, handing back much of the gains the stock has made lately. The last month has meant the stock is now only up 3.6% during the last year.

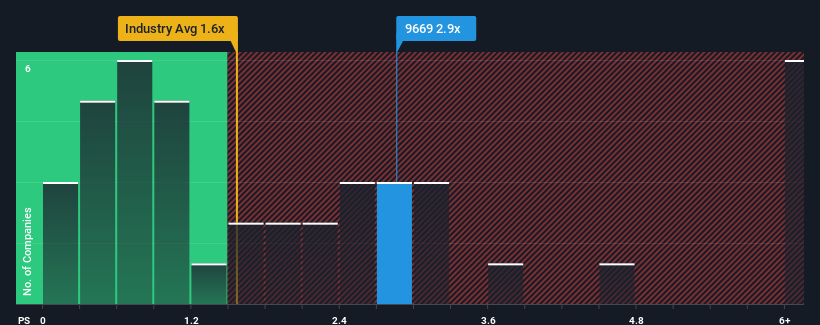

In spite of the heavy fall in price, you could still be forgiven for thinking Beisen Holding is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.9x, considering almost half the companies in Hong Kong's Software industry have P/S ratios below 1.6x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Beisen Holding

What Does Beisen Holding's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Beisen Holding has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Beisen Holding will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

Beisen Holding's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered a decent 14% gain to the company's revenues. The latest three year period has also seen an excellent 54% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 16% each year during the coming three years according to the four analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 15% per year, which is not materially different.

With this in consideration, we find it intriguing that Beisen Holding's P/S is higher than its industry peers. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Beisen Holding's P/S?

Despite the recent share price weakness, Beisen Holding's P/S remains higher than most other companies in the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Given Beisen Holding's future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Beisen Holding with six simple checks.

If you're unsure about the strength of Beisen Holding's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Beisen Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9669

Beisen Holding

An investing holding company, provides cloud based human capital management (HCM) solutions for enterprises to recruit, evaluate, manage, develop, and retain talents in the People’s Republic of China.

Flawless balance sheet very low.

Market Insights

Community Narratives