Assessing Horizon Robotics After 22% Drop and AI Hardware Market Surge in 2025

Reviewed by Bailey Pemberton

Thinking about what to do with Horizon Robotics stock at this crossroad? You’re not alone. The company’s share price has been on a wild ride lately, and for anyone with skin in the game, those big swings can make decisions anything but straightforward. In the past week alone, Horizon Robotics dropped by 11.1%, and over the last 30 days, the stock slipped a notable 22.8%. Yet, if you take a step back, you’ll see the year-to-date return standing strong at 129.3%. That kind of run-up usually says a lot about changing sentiment around innovation and market potential in the AI hardware space, which has dominated headlines recently.

If you’re wondering whether all this volatility spells opportunity or risk, a good place to start is the stock’s valuation. Looking at six widely used valuation checks, Horizon Robotics scores a 2, meaning it’s considered undervalued in two of those areas. That’s fewer boxes ticked than some might hope, but it could also mean there are hidden advantages or growth angles the raw numbers aren’t capturing.

Next, we’ll break down what these valuation approaches really reveal about Horizon Robotics. But stick around, as the most insightful measure of value might not be what you expect.

Horizon Robotics scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Horizon Robotics Dividend Discount Model (DDM) Analysis

The Dividend Discount Model, or DDM, estimates a stock’s value based on its expected future dividends, discounting them back to today’s terms. This approach is especially relevant for companies that pay regular dividends, offering a lens on both the sustainability and growth of those payouts.

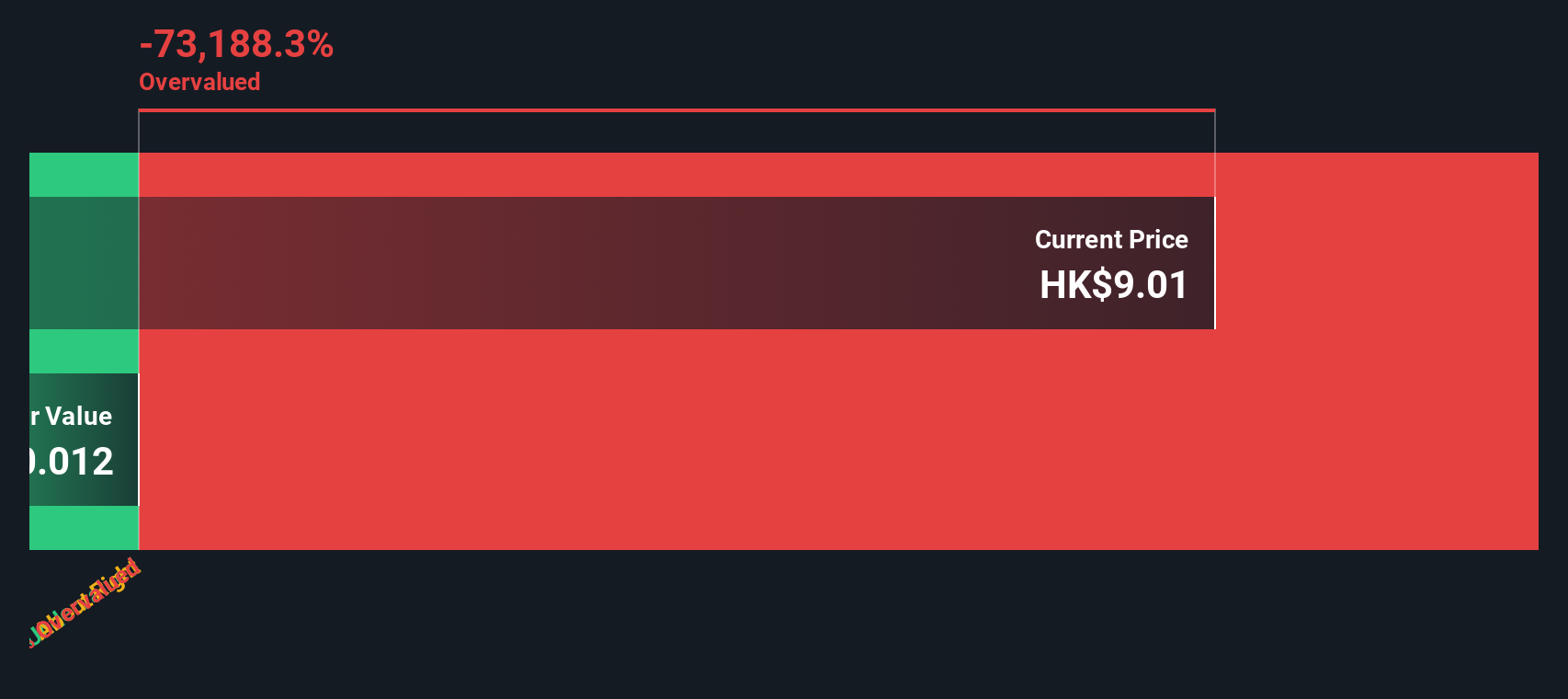

For Horizon Robotics, the latest data shows a tiny dividend per share (DPS) of just CN¥0.00075, with an anticipated growth rate in line with the risk-free rate at about 2.69%. However, the company currently posts a negative return on equity, at -24.05%, and there are no clear indications of how much future earnings could actually be paid out as dividends in the near term.

Based on the DDM calculation, Horizon Robotics’s intrinsic value comes out at HK$0.01 per share. When compared to the current share price, this result implies that the stock is trading at a massive premium. The analysis indicates it is more than 65,000% overvalued according to the dividend-based approach. Such a wide gap is a cautionary signal for investors who rely on income or seek value tied to dividend payouts.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests Horizon Robotics may be overvalued by 65618.0%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Horizon Robotics Price vs Earnings (P/E) Ratio Analysis

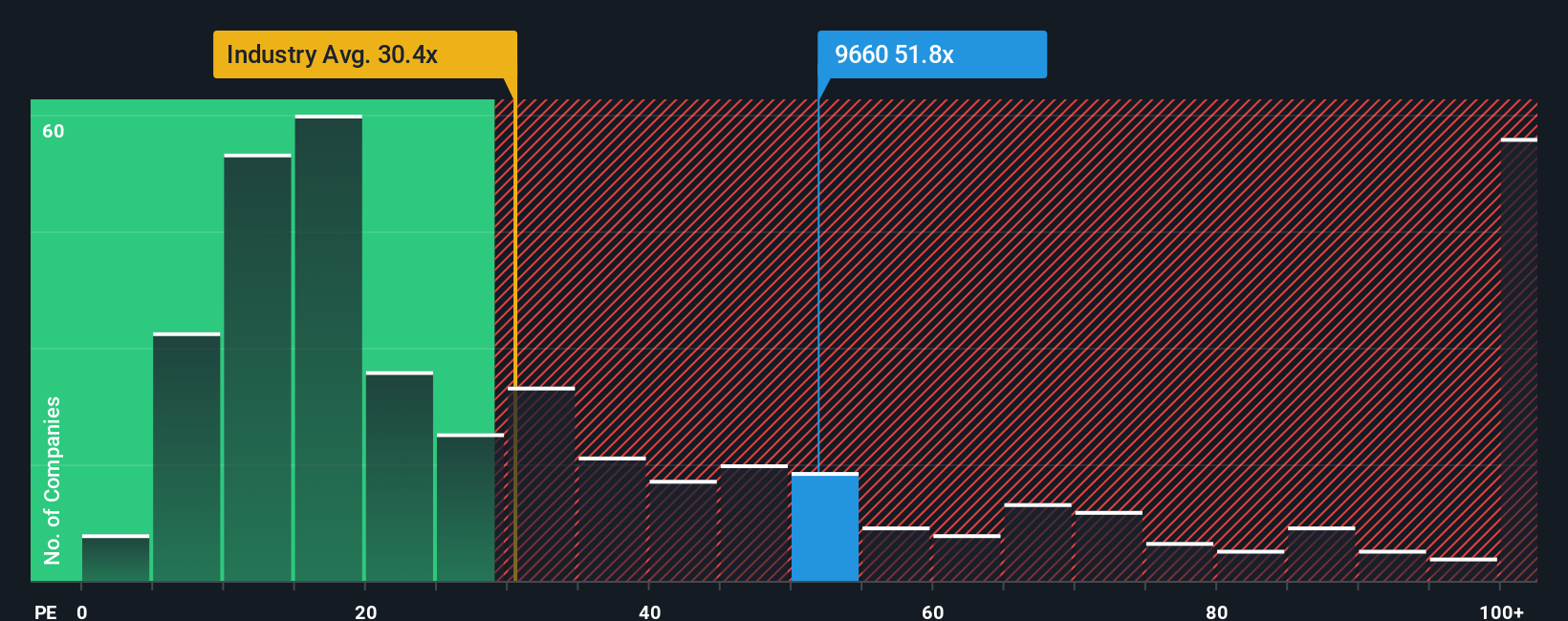

The price-to-earnings (P/E) ratio is a cornerstone metric when valuing profitable companies, as it relates a company’s share price to its earnings. Investors lean on the P/E ratio to gauge what the market is willing to pay today for a company’s potential future profits. In general, higher growth expectations and lower risk justify a higher, or “fair,” P/E ratio. Companies with limited growth or higher risks typically command lower multiples.

Horizon Robotics currently trades at a P/E of 46.5x. When placed side by side with the software industry’s average P/E of 29.3x and the peer group’s average of 50.3x, Horizon Robotics leans toward the upper end but does not stand wildly apart from some of its industry counterparts. This suggests investors are pricing in significant growth or are willing to pay a premium for perceived potential.

Enter the “Fair Ratio,” a proprietary assessment from Simply Wall St that calculates the justified P/E multiple by factoring in not just sector and peer comparisons, but also Horizon Robotics’s own growth prospects, margins, market cap, and specific risk profile. Because it is customized, the Fair Ratio (36.7x) offers a more tailored benchmark than generic industry or peer comparisons. In Horizon’s case, the current P/E is meaningfully above this Fair Ratio, signaling that the market may be expecting more than what is fundamentally warranted based on these holistic factors.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Horizon Robotics Narrative

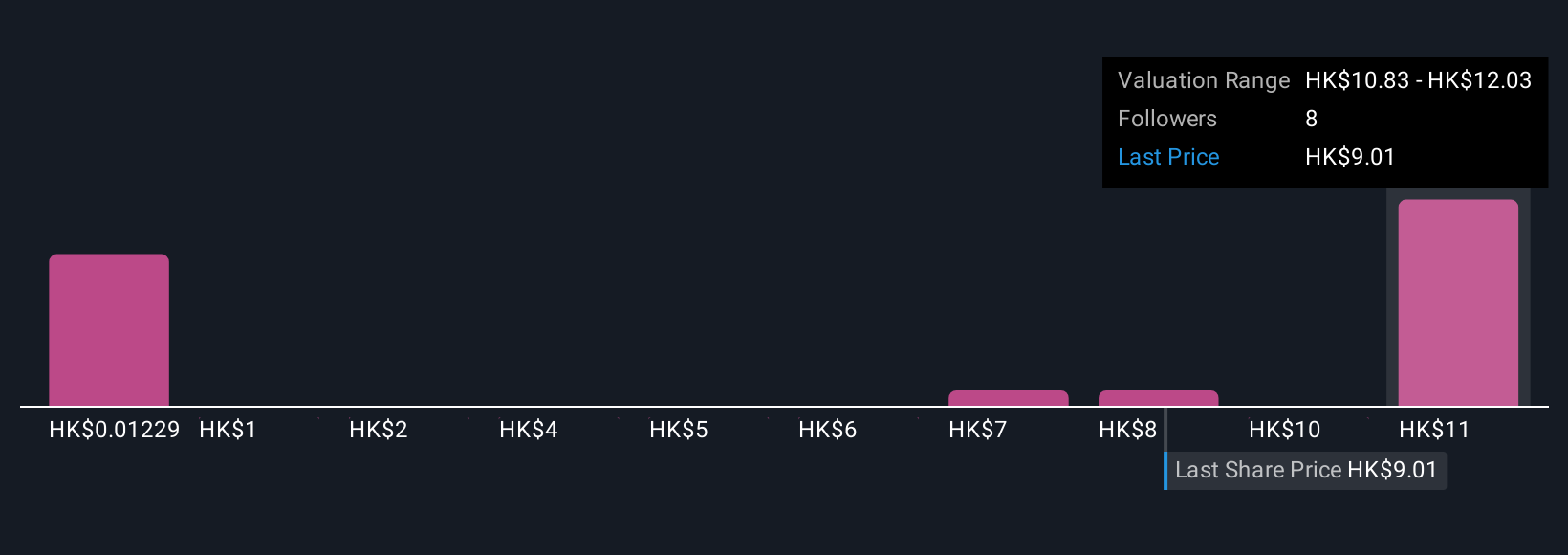

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story about a company’s future. It connects your personal view and assumptions about Horizon Robotics with a specific financial forecast and, ultimately, a fair value for the stock. Narratives go beyond the usual ratios by letting you set out your expectations for future revenue, profits, and margins, then instantly see how that story stacks up against the current share price.

On Simply Wall St’s Community page, used by millions of informed investors, you can easily create or explore Narratives and see how different perspectives drive dramatically different fair values. By comparing your Narrative-based fair value to the live market price, you get a much clearer, tailored signal about when to consider buying or selling. Best of all, Narratives are updated automatically whenever fresh news or earnings are released, so your analysis is always relevant and dynamic. For example, some investors see Horizon Robotics as fairly valued only if revenues double in the next few years, while others remain cautious unless growth exceeds even more ambitious targets.

Do you think there's more to the story for Horizon Robotics? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Horizon Robotics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9660

Horizon Robotics

An investment holding company, provides automotive solutions for passenger vehicles in China.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives