- Hong Kong

- /

- Communications

- /

- SEHK:1523

High Growth Tech Stocks In Hong Kong Including Plover Bay Technologies

Reviewed by Simply Wall St

The Hong Kong market has been experiencing a mix of volatility and resilience, with the Hang Seng Index recently giving up 0.43% amid weak inflation data from China. In this dynamic environment, identifying high-growth tech stocks becomes crucial for investors looking to capitalize on potential opportunities; companies like Plover Bay Technologies exemplify the innovative edge necessary to thrive in such conditions.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.37% | 25.47% | ★★★★★☆ |

| MedSci Healthcare Holdings | 48.74% | 48.78% | ★★★★★☆ |

| Inspur Digital Enterprise Technology | 25.37% | 39.10% | ★★★★★☆ |

| RemeGen | 26.30% | 52.19% | ★★★★★☆ |

| Akeso | 33.07% | 54.67% | ★★★★★★ |

| Cowell e Holdings | 31.82% | 35.43% | ★★★★★★ |

| Innovent Biologics | 22.35% | 59.39% | ★★★★★☆ |

| Biocytogen Pharmaceuticals (Beijing) | 21.53% | 109.17% | ★★★★★☆ |

| Beijing Airdoc Technology | 37.47% | 93.35% | ★★★★★☆ |

| Sichuan Kelun-Biotech Biopharmaceutical | 24.70% | 8.53% | ★★★★★☆ |

Click here to see the full list of 45 stocks from our SEHK High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Plover Bay Technologies (SEHK:1523)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Plover Bay Technologies Limited, an investment holding company with a market cap of HK$4.07 billion, designs, develops, and markets software-defined wide area network routers.

Operations: Plover Bay Technologies generates revenue primarily from the sales of SD-WAN routers, with mobile-first connectivity contributing HK$59.87 million and fixed-first connectivity contributing HK$15.19 million. Additionally, the company earns from software licenses and warranty and support services amounting to HK$31.86 million.

Plover Bay Technologies, a player in Hong Kong's tech scene, has demonstrated significant financial growth with a 41.4% increase in earnings over the past year, outpacing the Communications industry's average. This growth is underpinned by robust R&D investments, which are crucial for maintaining its competitive edge and fostering innovation. Recent financial results show a surge in half-year sales to USD 57.3 million from USD 44.63 million and net income rising to USD 19.1 million from USD 12.32 million year-over-year. Additionally, the company declared an interim dividend of HKD 0.1083 per share, underscoring its commitment to shareholder returns amidst this growth phase.

- Take a closer look at Plover Bay Technologies' potential here in our health report.

Understand Plover Bay Technologies' track record by examining our Past report.

XD (SEHK:2400)

Simply Wall St Growth Rating: ★★★★★☆

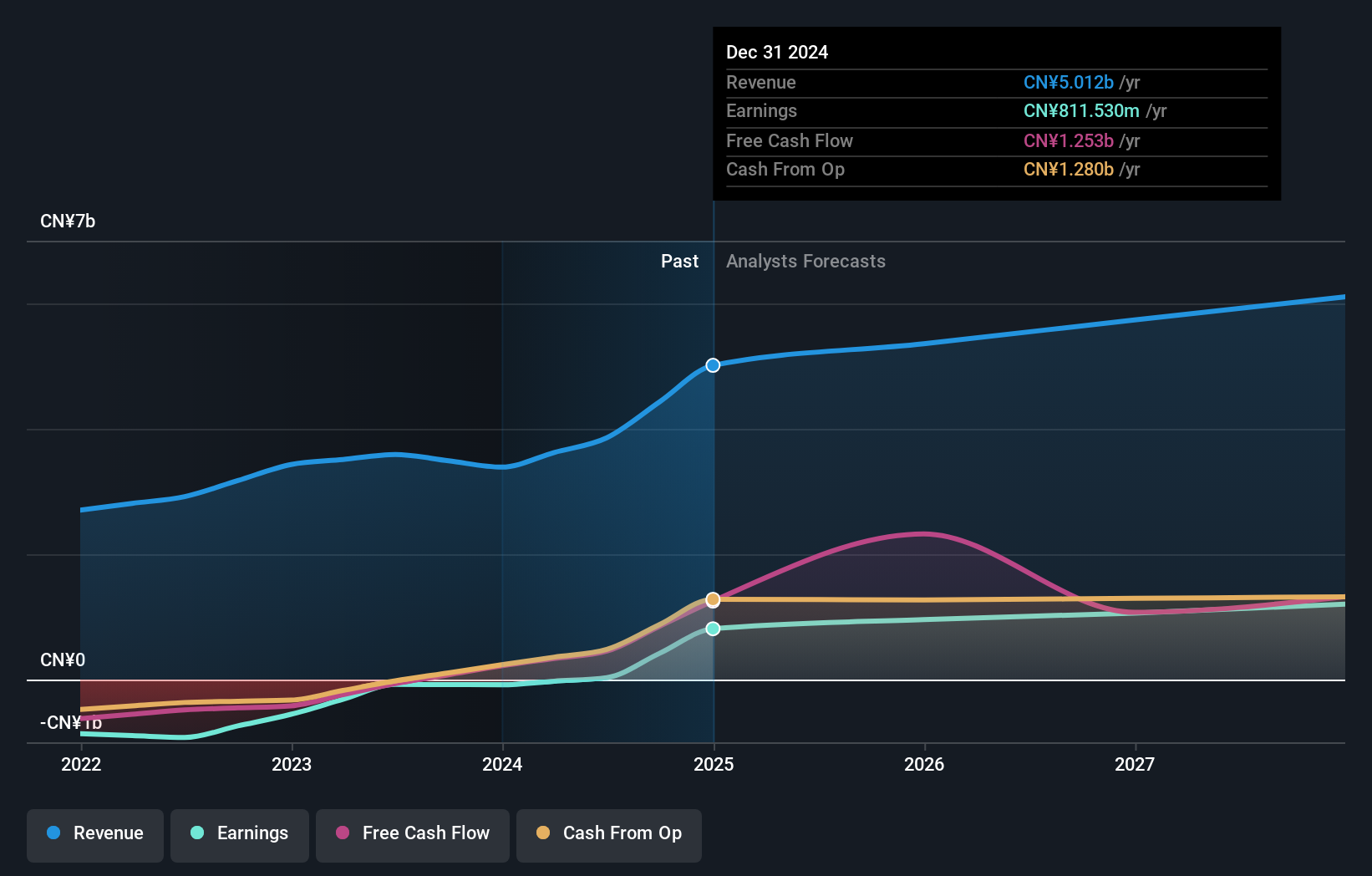

Overview: XD Inc. (SEHK:2400) is an investment holding company that develops, publishes, operates, and distributes mobile and web games in Mainland China and internationally, with a market cap of HK$8.81 billion.

Operations: XD Inc. generates revenue primarily from its game development and publishing segment (CN¥2.43 billion) and the TapTap platform (CN¥1.43 billion). The company operates both in Mainland China and internationally, focusing on mobile and web games.

XD Inc., a Hong Kong-based tech firm, recently reported a substantial half-year revenue of CNY 2.22 billion, marking a significant increase from CNY 1.75 billion in the previous year. This growth is supported by an impressive 53.2% forecast in annual earnings growth and a robust R&D expenditure strategy that aligns with its innovative drive, particularly in new gaming titles and tech services. The company's commitment to innovation is evident as it channels substantial resources into R&D—14.7% of its revenue—fueling advancements and maintaining competitiveness in the fast-paced tech sector. Moreover, XD has successfully leveraged its market position to achieve a net income surge to CNY 205.1 million from CNY 90.19 million year-over-year, underscoring effective operational execution and strategic market expansions.

- Dive into the specifics of XD here with our thorough health report.

Gain insights into XD's past trends and performance with our Past report.

Ming Yuan Cloud Group Holdings (SEHK:909)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ming Yuan Cloud Group Holdings Limited, an investment holding company, provides software solutions for property developers in China with a market cap of HK$3.22 billion.

Operations: The company generates revenue primarily from two segments: Cloud Services (CN¥1.32 billion) and On-premise Software and Services (CN¥281.71 million). The focus on cloud services indicates a significant shift towards digital transformation in the property development sector in China.

Ming Yuan Cloud Group Holdings, amidst a challenging fiscal period, reported a narrowed net loss to CNY 115.37 million from CNY 323.32 million year-over-year, reflecting significant operational improvements and cost management strategies. The company's revenue trajectory is poised for recovery with an anticipated growth rate of 9.7% annually, outpacing the broader Hong Kong market's 7.3%. This growth is underpinned by strategic share repurchases initiated in July 2024, aimed at enhancing shareholder value through earnings per share improvements. Despite current unprofitability, Ming Yuan’s commitment to innovation remains robust with R&D expenses strategically allocated to foster long-term technological advancements within the software sector—critical for transitioning into profitability and capturing market share in Hong Kong’s competitive tech landscape.

- Click here and access our complete health analysis report to understand the dynamics of Ming Yuan Cloud Group Holdings.

Learn about Ming Yuan Cloud Group Holdings' historical performance.

Taking Advantage

- Get an in-depth perspective on all 45 SEHK High Growth Tech and AI Stocks by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1523

Plover Bay Technologies

An investment holding company, designs, develops, and markets software defined wide area network routers.

Outstanding track record with excellent balance sheet.