What Kind Of Shareholder Appears On The Ahsay Backup Software Development Company Limited's (HKG:8290) Shareholder Register?

If you want to know who really controls Ahsay Backup Software Development Company Limited (HKG:8290), then you'll have to look at the makeup of its share registry. Generally speaking, as a company grows, institutions will increase their ownership. Conversely, insiders often decrease their ownership over time. I quite like to see at least a little bit of insider ownership. As Charlie Munger said 'Show me the incentive and I will show you the outcome.

Ahsay Backup Software Development is a smaller company with a market capitalization of HK$68m, so it may still be flying under the radar of many institutional investors. Taking a look at our data on the ownership groups (below), it's seems that institutional investors have not yet purchased shares. Let's delve deeper into each type of owner, to discover more about Ahsay Backup Software Development.

Check out our latest analysis for Ahsay Backup Software Development

What Does The Lack Of Institutional Ownership Tell Us About Ahsay Backup Software Development?

We don't tend to see institutional investors holding stock of companies that are very risky, thinly traded, or very small. Though we do sometimes see large companies without institutions on the register, it's not particularly common.

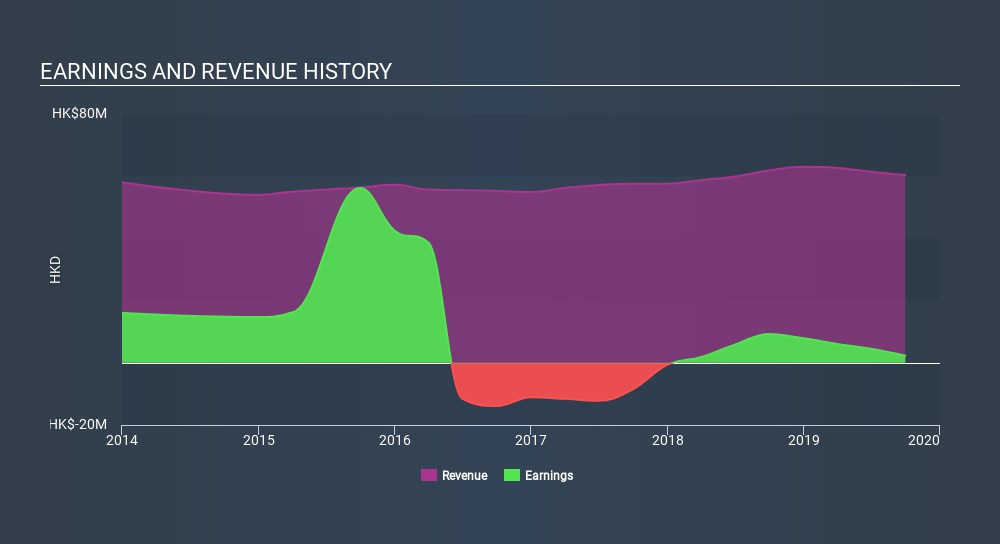

There are multiple explanations for why institutions don't own a stock. The most common is that the company is too small relative to fund under management, so the institition does not bother to look closely at the company. Alternatively, there might be something about the company that has kept institutional investors away. Institutional investors may not find the historic growth of the business impressive, or there might be other factors at play. You can see the past revenue performance of Ahsay Backup Software Development, for yourself, below.

We note that hedge funds don't have a meaningful investment in Ahsay Backup Software Development. From our data, we infer that the largest shareholder is King Fan Chong (who also holds the title of Top Key Executive) with 75% of shares outstanding. Its usually considered a good sign when insiders own a significant number of shares in the company, and in this case, we're glad to see a company insider play the role of a key stakeholder.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. Our information suggests that there isn't any analyst coverage of the stock, so it is probably little known.

Insider Ownership Of Ahsay Backup Software Development

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. The company management answer to the board; and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board, themselves.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our information suggests that insiders own more than half of Ahsay Backup Software Development Company Limited. This gives them effective control of the company. That means they own HK$51m worth of shares in the HK$68m company. That's quite meaningful. Most would argue this is a positive, showing strong alignment with shareholders. You can click here to see if those insiders have been buying or selling.

General Public Ownership

With a 25% ownership, the general public have some degree of sway over 8290. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Ahsay Backup Software Development (at least 2 which shouldn't be ignored) , and understanding them should be part of your investment process.

Of course this may not be the best stock to buy. Therefore, you may wish to see our free collection of interesting prospects boasting favorable financials.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:8290

Ahsay Backup Software Development

An investment holding company, provides online backup software solutions in the United States of America, Hong Kong, and internationally.

Flawless balance sheet and overvalued.

Market Insights

Community Narratives