- Hong Kong

- /

- Diversified Financial

- /

- SEHK:8279

AGTech Holdings (HKG:8279) Is In A Good Position To Deliver On Growth Plans

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

So should AGTech Holdings (HKG:8279) shareholders be worried about its cash burn? In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

Check out our latest analysis for AGTech Holdings

How Long Is AGTech Holdings' Cash Runway?

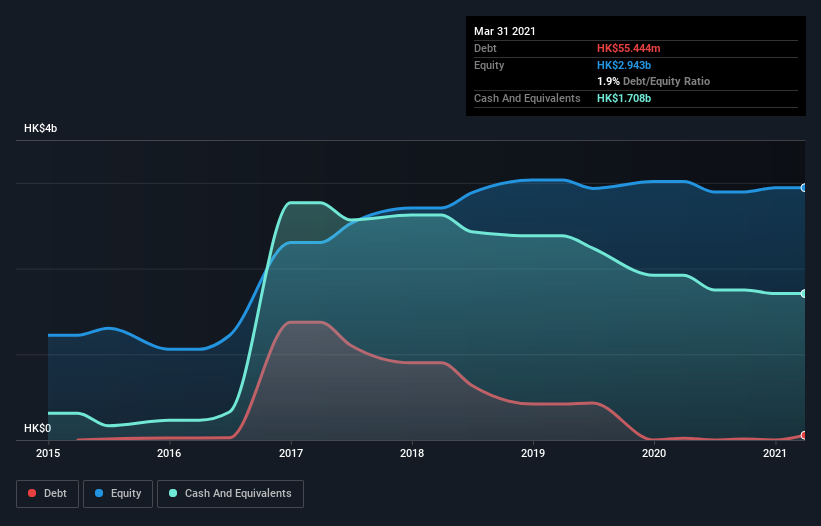

A company's cash runway is calculated by dividing its cash hoard by its cash burn. As at December 2020, AGTech Holdings had cash of HK$1.7b and no debt. In the last year, its cash burn was HK$99m. That means it had a cash runway of very many years as of December 2020. Even though this is but one measure of the company's cash burn, the thought of such a long cash runway warms our bellies in a comforting way. You can see how its cash balance has changed over time in the image below.

How Well Is AGTech Holdings Growing?

It was fairly positive to see that AGTech Holdings reduced its cash burn by 42% during the last year. However, operating revenue was basically flat over that time period. On balance, we'd say the company is improving over time. In reality, this article only makes a short study of the company's growth data. You can take a look at how AGTech Holdings has developed its business over time by checking this visualization of its revenue and earnings history.

How Hard Would It Be For AGTech Holdings To Raise More Cash For Growth?

We are certainly impressed with the progress AGTech Holdings has made over the last year, but it is also worth considering how costly it would be if it wanted to raise more cash to fund faster growth. Companies can raise capital through either debt or equity. Commonly, a business will sell new shares in itself to raise cash and drive growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

AGTech Holdings has a market capitalisation of HK$3.2b and burnt through HK$99m last year, which is 3.1% of the company's market value. Given that is a rather small percentage, it would probably be really easy for the company to fund another year's growth by issuing some new shares to investors, or even by taking out a loan.

Is AGTech Holdings' Cash Burn A Worry?

As you can probably tell by now, we're not too worried about AGTech Holdings' cash burn. For example, we think its cash runway suggests that the company is on a good path. Its weak point is its revenue growth, but even that wasn't too bad! Looking at all the measures in this article, together, we're not worried about its rate of cash burn; the company seems well on top of its medium-term spending needs. On another note, AGTech Holdings has 2 warning signs (and 1 which is a bit unpleasant) we think you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:8279

AGTech Holdings

An investment holding company, provides digital banking and payment, and other related services in the Mainland of China, Macau, and internationally.

Flawless balance sheet with weak fundamentals.

Market Insights

Community Narratives