As global markets show signs of optimism with cooling inflation and strong bank earnings, investors are exploring opportunities beyond the traditional large-cap stocks. Penny stocks, often representing smaller or newer companies, remain a relevant investment area despite their somewhat outdated terminology. With robust financials and potential for growth, these stocks can offer surprising value and stability for those willing to explore beyond the mainstream market segments.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.40 | MYR1.11B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.68 | HK$42.36B | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.74 | MYR437.82M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.00 | HK$634.79M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.964 | £156.82M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.875 | MYR290.45M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.395 | £178.93M | ★★★★★☆ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.48 | £66.75M | ★★★★☆☆ |

Click here to see the full list of 5,705 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Youzan Technology (SEHK:8083)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Youzan Technology Limited is an investment holding company offering online and offline e-commerce solutions in China, Japan, and Canada with a market cap of HK$3.44 billion.

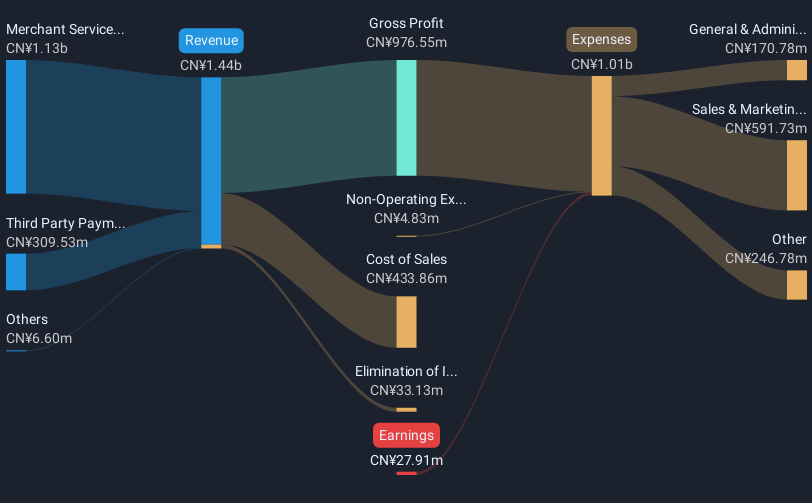

Operations: The company generates revenue primarily through Merchant Services (CN¥1.13 billion) and Third Party Payment Services (CN¥309.53 million).

Market Cap: HK$3.44B

Youzan Technology Limited, with a market cap of HK$3.44 billion, generates revenue primarily from Merchant Services (CN¥1.13 billion) and Third Party Payment Services (CN¥309.53 million). Despite being unprofitable, the company has reduced losses over the past five years and maintains a positive free cash flow with a cash runway exceeding three years. Its short-term assets surpass both short-term and long-term liabilities, indicating financial stability despite increased debt levels over time. A recent strategic alliance with ISP Global Limited aims to enhance its global presence in e-commerce solutions, potentially strengthening its market position amidst share price volatility.

- Jump into the full analysis health report here for a deeper understanding of Youzan Technology.

- Gain insights into Youzan Technology's future direction by reviewing our growth report.

Chongqing Zaisheng Technology (SHSE:603601)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Chongqing Zaisheng Technology Co., Ltd. engages in the research, manufacture, and marketing of glass microfiber products for purification and energy-saving markets in China, with a market cap of CN¥3.40 billion.

Operations: Chongqing Zaisheng Technology Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥3.4B

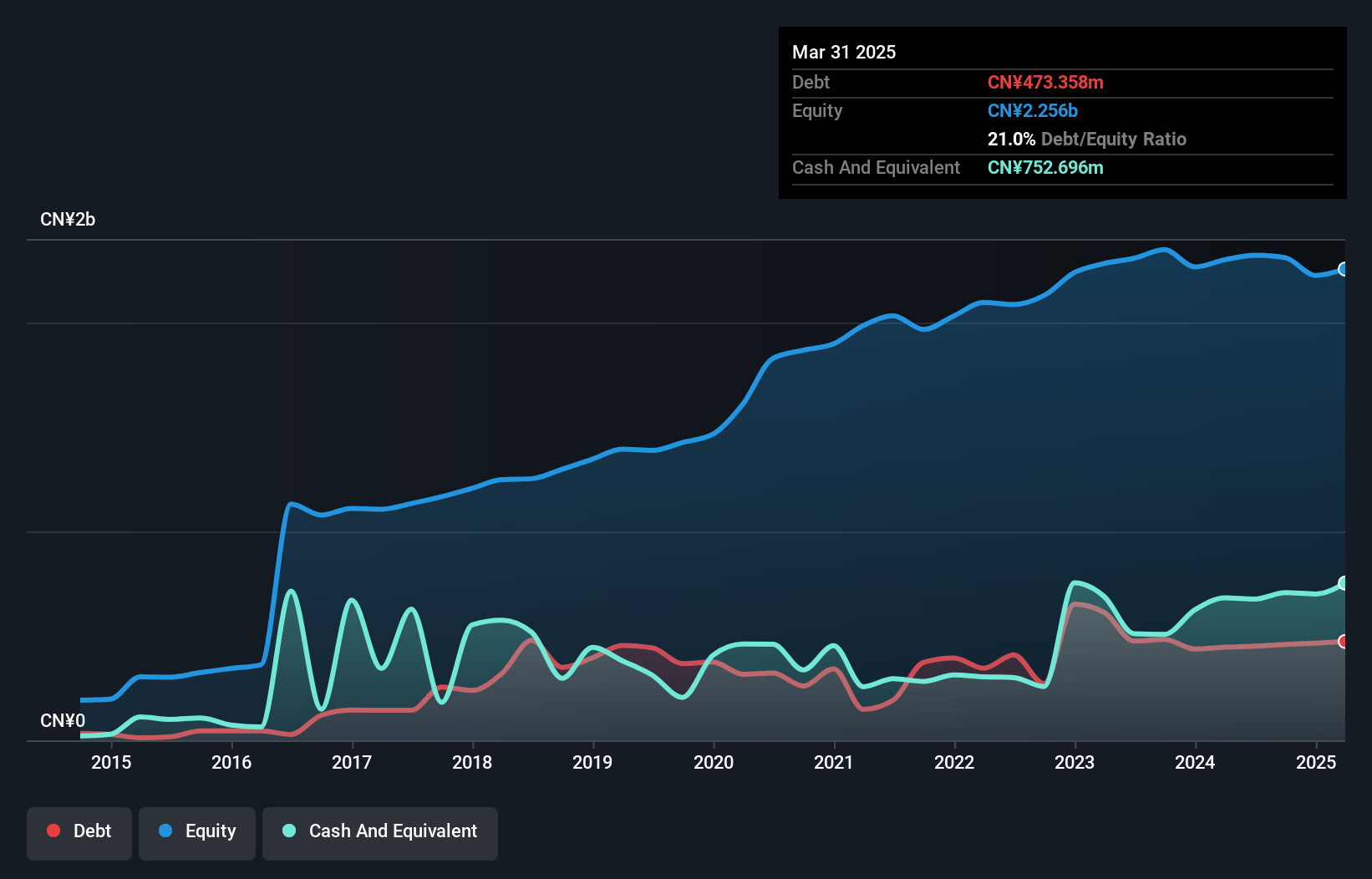

Chongqing Zaisheng Technology, with a market cap of CN¥3.40 billion, faces challenges in profitability and earnings growth. The company's earnings declined by 27.1% annually over the past five years, and recent financials show a drop in net income to CN¥90.88 million from CN¥117.27 million year-on-year for the nine months ending September 2024. Although its debt-to-equity ratio improved to 19.9%, profit margins decreased significantly to 0.8%. Despite these hurdles, Chongqing Zaisheng's short-term assets comfortably cover both short-term and long-term liabilities, indicating some financial resilience amidst volatility concerns.

- Unlock comprehensive insights into our analysis of Chongqing Zaisheng Technology stock in this financial health report.

- Evaluate Chongqing Zaisheng Technology's prospects by accessing our earnings growth report.

JILIN JINGUAN ELECTRICLtd (SZSE:300510)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: JILIN JINGUAN ELECTRIC Co., Ltd operates in the smart grid equipment, energy charging, and energy storage sectors in China with a market cap of CN¥3.44 billion.

Operations: No specific revenue segments have been reported for the company.

Market Cap: CN¥3.44B

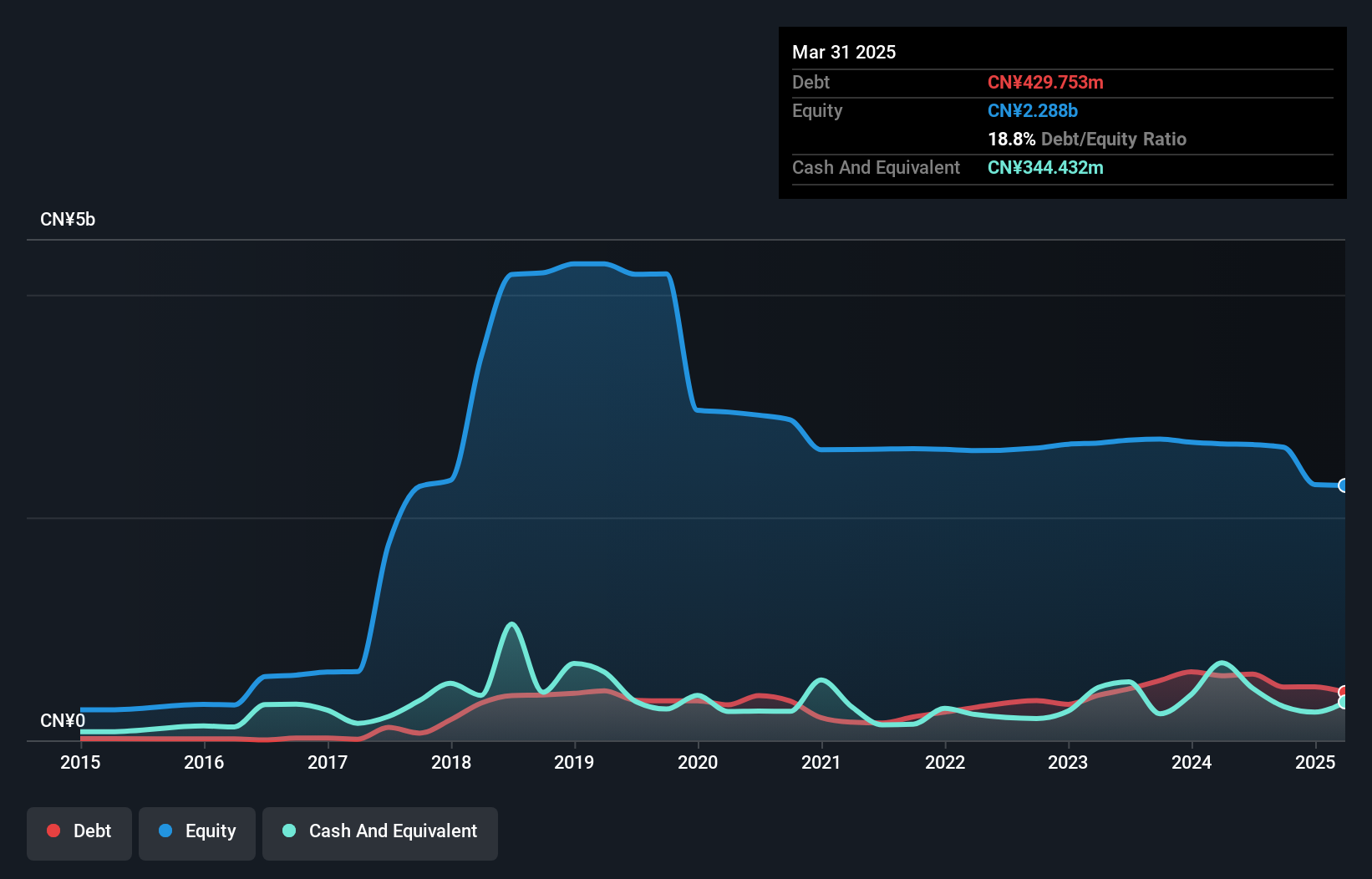

JILIN JINGUAN ELECTRIC Co., Ltd, with a market cap of CN¥3.44 billion, operates in the smart grid equipment sector and has shown resilience despite recent financial challenges. The company reported sales of CN¥850.78 million for the nine months ending September 2024 but incurred a net loss of CN¥16.65 million, reversing from a profit last year. Its short-term assets significantly exceed both short-term and long-term liabilities, providing some financial stability. While unprofitable, it maintains a positive cash runway for over three years without significant shareholder dilution or excessive debt levels.

- Dive into the specifics of JILIN JINGUAN ELECTRICLtd here with our thorough balance sheet health report.

- Evaluate JILIN JINGUAN ELECTRICLtd's historical performance by accessing our past performance report.

Next Steps

- Gain an insight into the universe of 5,705 Penny Stocks by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603601

Chongqing Zaisheng Technology

Researches, manufactures, and markets fiber cotton in China.

Excellent balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives