Asian Market Insights: SenseTime Group And 2 Other Noteworthy Penny Stocks

Reviewed by Simply Wall St

The Asian markets have been navigating a complex landscape, with significant developments such as the Bank of Japan raising its benchmark interest rate to the highest level in 30 years. Against this backdrop, penny stocks—though an older term—remain a relevant area for investment, particularly among smaller or newer companies that might offer unique growth opportunities. In light of current market conditions, we explore several penny stocks that exhibit financial strength and potential for long-term success.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| YKGI (Catalist:YK9) | SGD0.145 | SGD61.07M | ✅ 2 ⚠️ 4 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.48 | HK$915.41M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.57 | HK$2.13B | ✅ 4 ⚠️ 1 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.102 | SGD53.4M | ✅ 2 ⚠️ 4 View Analysis > |

| Halcyon Technology (SET:HTECH) | THB2.90 | THB870M | ✅ 2 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.47 | SGD13.66B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$0.76 | HK$2.03B | ✅ 3 ⚠️ 2 View Analysis > |

| NagaCorp (SEHK:3918) | HK$4.79 | HK$21.19B | ✅ 5 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.97 | NZ$138.07M | ✅ 2 ⚠️ 5 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.60 | HK$53.4B | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 978 stocks from our Asian Penny Stocks screener.

We'll examine a selection from our screener results.

SenseTime Group (SEHK:20)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SenseTime Group Inc. is an investment holding company that focuses on researching, developing, and selling artificial intelligence software platforms across Mainland China, Northeast Asia, Southeast Asia, and internationally with a market cap of approximately HK$81.99 billion.

Operations: The company's revenue primarily comes from its Software & Programming segment, which generated CN¥4.39 billion.

Market Cap: HK$81.99B

SenseTime Group, an AI software company, has a market cap of approximately HK$81.99 billion and generated CN¥4.39 billion in revenue from its Software & Programming segment. Despite being unprofitable with a negative return on equity of -14.77%, the company has shown financial improvement by turning negative shareholder equity positive over five years and reducing losses by 29.8% annually during this period. It possesses more cash than debt and covers both short-term and long-term liabilities with its assets, maintaining a stable weekly volatility of 7%. The management team is experienced with an average tenure of 9.2 years.

- Unlock comprehensive insights into our analysis of SenseTime Group stock in this financial health report.

- Gain insights into SenseTime Group's future direction by reviewing our growth report.

Sinopec Shanghai Petrochemical (SEHK:338)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sinopec Shanghai Petrochemical Company Limited, along with its subsidiaries, engages in the manufacturing and sale of petroleum and chemical products in China, with a market cap of HK$25.71 billion.

Operations: Sinopec Shanghai Petrochemical does not report specific revenue segments.

Market Cap: HK$25.71B

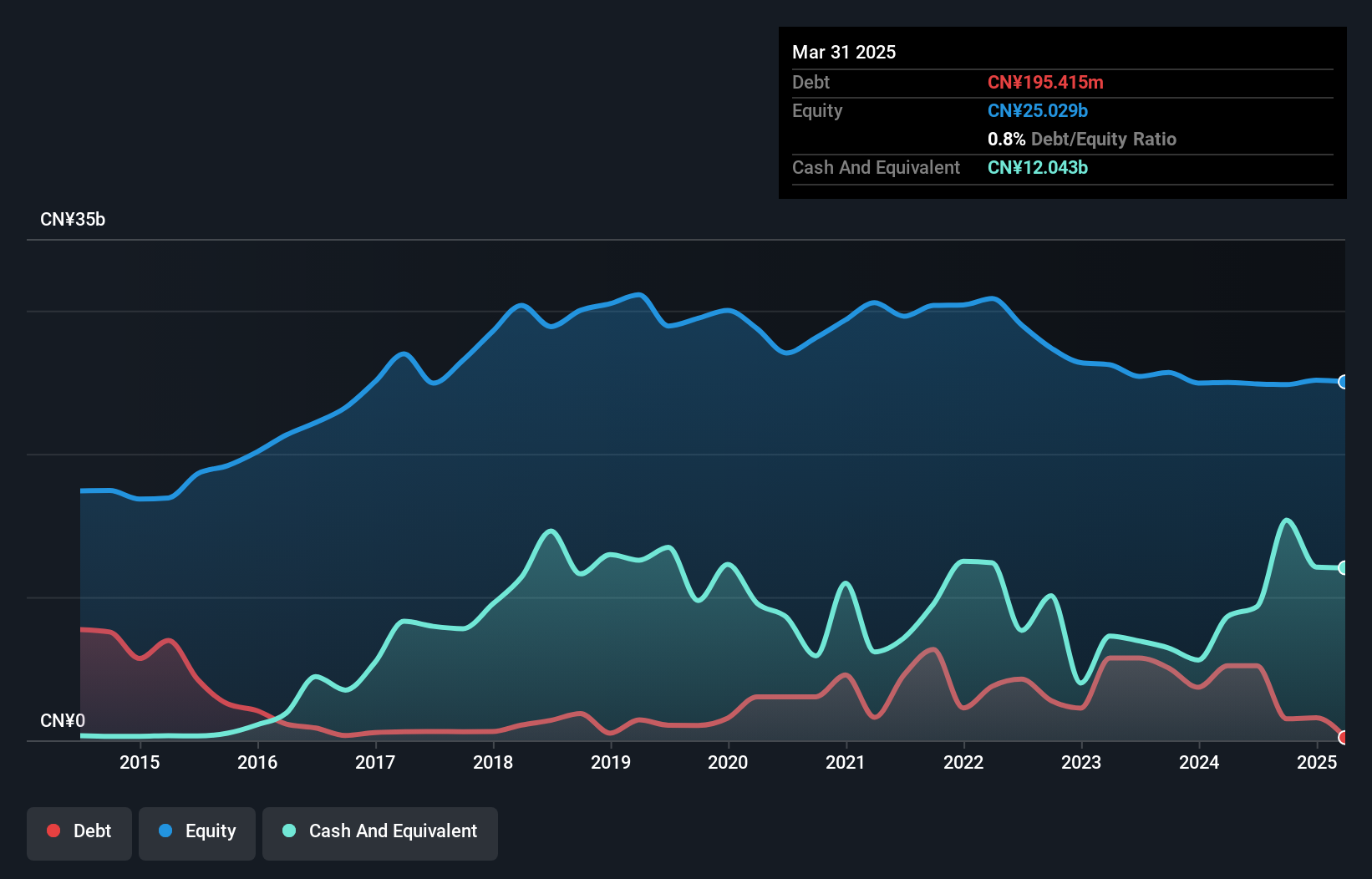

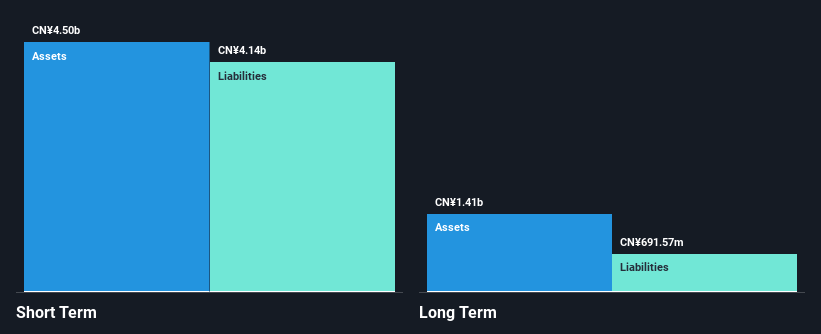

Sinopec Shanghai Petrochemical, with a market cap of HK$25.71 billion, remains unprofitable despite stable weekly volatility and a robust asset position covering both short-term and long-term liabilities. The company has more cash than debt, indicating sound financial management. Recent activities include an Entrustment Contract with Baling New Materials for personnel secondment services worth RMB 52.72 million, highlighting strategic collaborations within the industry. However, earnings have declined significantly over the past year, with net losses reported at CN¥431.53 million for the nine months ending September 2025 compared to a profit in the previous year.

- Get an in-depth perspective on Sinopec Shanghai Petrochemical's performance by reading our balance sheet health report here.

- Evaluate Sinopec Shanghai Petrochemical's prospects by accessing our earnings growth report.

Youzan Technology (SEHK:8083)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Youzan Technology Limited is an investment holding company that offers online and offline e-commerce solutions in China, Japan, and Canada, with a market cap of HK$4.52 billion.

Operations: The company generates revenue from its operations in Japan, amounting to CN¥0.61 million.

Market Cap: HK$4.52B

Youzan Technology, with a market cap of HK$4.52 billion, is currently pre-revenue and unprofitable but shows potential through its strong asset position, where short-term assets (CN¥4.7 billion) exceed both short-term and long-term liabilities. The company maintains a positive cash flow runway for over three years despite higher volatility than most Hong Kong stocks. Its seasoned management and board provide stability as they navigate towards profitability, reducing losses by 32% annually over five years. Trading significantly below estimated fair value suggests potential upside if earnings forecasts of 108.62% growth per year materialize without shareholder dilution concerns.

- Dive into the specifics of Youzan Technology here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Youzan Technology's future.

Taking Advantage

- Access the full spectrum of 978 Asian Penny Stocks by clicking on this link.

- Interested In Other Possibilities? These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:338

Sinopec Shanghai Petrochemical

Manufactures and sells petroleum and chemical products in the People’s Republic of China.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion