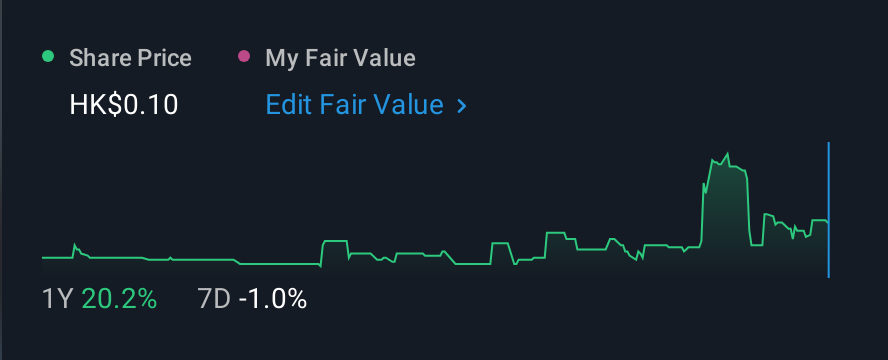

Global Link Communications Holdings Limited (HKG:8060) Surges 38% Yet Its Low P/S Is No Reason For Excitement

The Global Link Communications Holdings Limited (HKG:8060) share price has done very well over the last month, posting an excellent gain of 38%. The last 30 days bring the annual gain to a very sharp 45%.

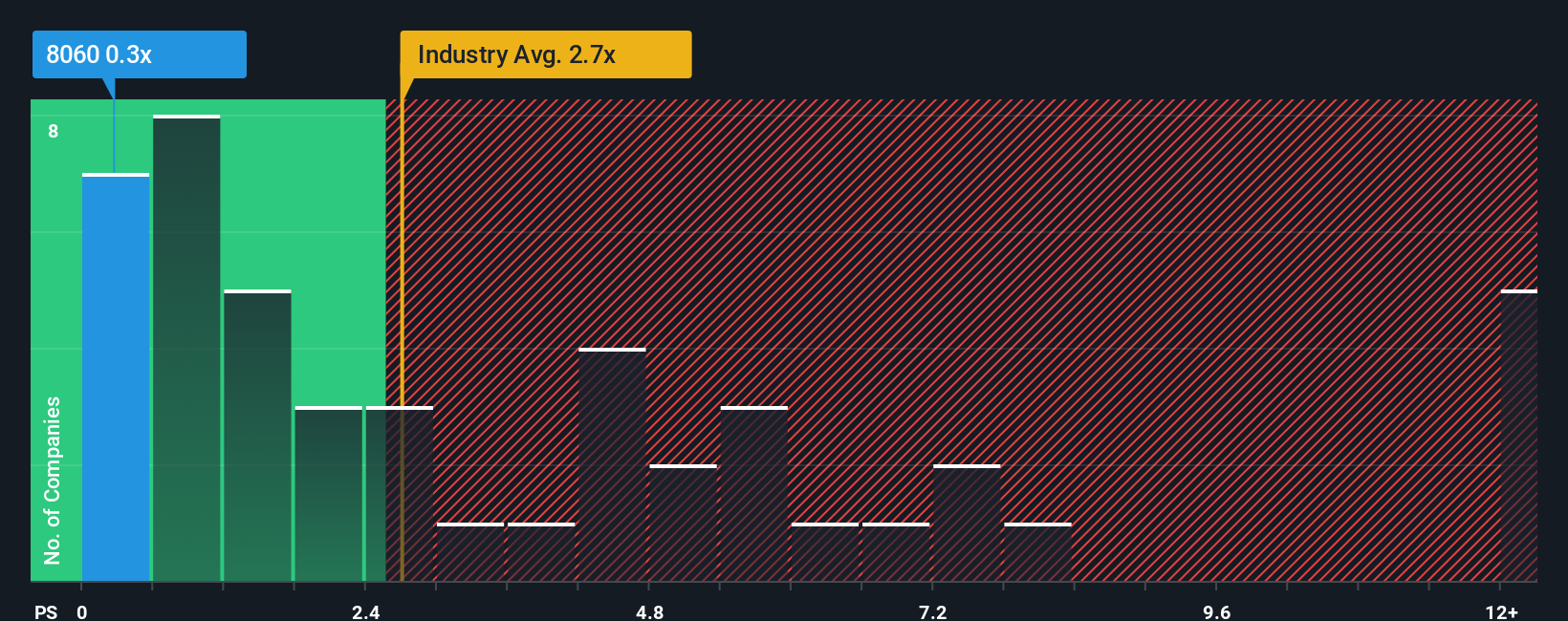

In spite of the firm bounce in price, Global Link Communications Holdings' price-to-sales (or "P/S") ratio of 0.3x might still make it look like a strong buy right now compared to the wider Software industry in Hong Kong, where around half of the companies have P/S ratios above 2.7x and even P/S above 6x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for Global Link Communications Holdings

How Global Link Communications Holdings Has Been Performing

The revenue growth achieved at Global Link Communications Holdings over the last year would be more than acceptable for most companies. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Global Link Communications Holdings will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Global Link Communications Holdings?

The only time you'd be truly comfortable seeing a P/S as depressed as Global Link Communications Holdings' is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered a decent 11% gain to the company's revenues. Still, lamentably revenue has fallen 17% in aggregate from three years ago, which is disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to grow by 29% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this in mind, we understand why Global Link Communications Holdings' P/S is lower than most of its industry peers. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

The Final Word

Even after such a strong price move, Global Link Communications Holdings' P/S still trails the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Global Link Communications Holdings revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Given the current circumstances, it seems unlikely that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

You should always think about risks. Case in point, we've spotted 1 warning sign for Global Link Communications Holdings you should be aware of.

If you're unsure about the strength of Global Link Communications Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8060

Global Link Communications Holdings

An investment holding company, engages in the development, production, sale, service, and operation of train information system solutions in the People’s Republic of China and Hong Kong.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.