China e-Wallet Payment Group Limited's (HKG:802) 25% Dip In Price Shows Sentiment Is Matching Revenues

Unfortunately for some shareholders, the China e-Wallet Payment Group Limited (HKG:802) share price has dived 25% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 74% loss during that time.

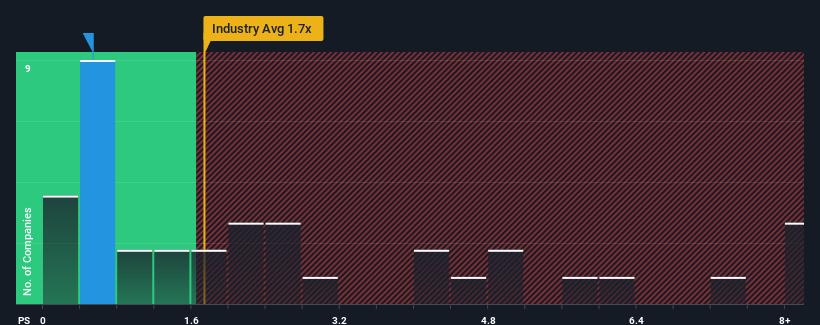

Since its price has dipped substantially, China e-Wallet Payment Group's price-to-sales (or "P/S") ratio of 0.5x might make it look like a buy right now compared to the Software industry in Hong Kong, where around half of the companies have P/S ratios above 1.7x and even P/S above 5x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for China e-Wallet Payment Group

How Has China e-Wallet Payment Group Performed Recently?

For instance, China e-Wallet Payment Group's receding revenue in recent times would have to be some food for thought. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for China e-Wallet Payment Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is China e-Wallet Payment Group's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as China e-Wallet Payment Group's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 13%. The last three years don't look nice either as the company has shrunk revenue by 5.1% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to grow by 30% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

In light of this, it's understandable that China e-Wallet Payment Group's P/S would sit below the majority of other companies. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What Does China e-Wallet Payment Group's P/S Mean For Investors?

China e-Wallet Payment Group's P/S has taken a dip along with its share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of China e-Wallet Payment Group revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 1 warning sign for China e-Wallet Payment Group you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:802

China e-Wallet Payment Group

An investment holding company, primarily engages in the internet and mobile’s application, and related accessories business in Hong Kong and the People’s Republic of China.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives