More Unpleasant Surprises Could Be In Store For Beijing Fourth Paradigm Technology Co., Ltd.'s (HKG:6682) Shares After Tumbling 27%

Beijing Fourth Paradigm Technology Co., Ltd. (HKG:6682) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 23% share price drop.

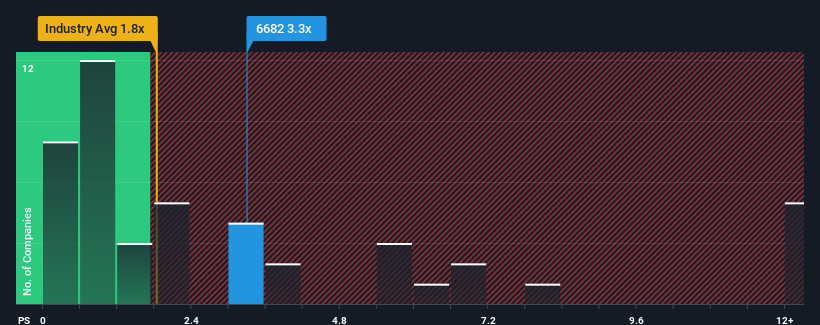

Even after such a large drop in price, you could still be forgiven for thinking Beijing Fourth Paradigm Technology is a stock not worth researching with a price-to-sales ratios (or "P/S") of 3.3x, considering almost half the companies in Hong Kong's Software industry have P/S ratios below 1.8x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

We've discovered 1 warning sign about Beijing Fourth Paradigm Technology. View them for free.See our latest analysis for Beijing Fourth Paradigm Technology

How Has Beijing Fourth Paradigm Technology Performed Recently?

Recent revenue growth for Beijing Fourth Paradigm Technology has been in line with the industry. One possibility is that the P/S ratio is high because investors think this modest revenue performance will accelerate. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Beijing Fourth Paradigm Technology will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Beijing Fourth Paradigm Technology?

The only time you'd be truly comfortable seeing a P/S as high as Beijing Fourth Paradigm Technology's is when the company's growth is on track to outshine the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 25%. Pleasingly, revenue has also lifted 161% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 24% each year during the coming three years according to the three analysts following the company. That's shaping up to be materially lower than the 35% per year growth forecast for the broader industry.

With this information, we find it concerning that Beijing Fourth Paradigm Technology is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Beijing Fourth Paradigm Technology's P/S remain high even after its stock plunged. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Beijing Fourth Paradigm Technology, this doesn't appear to be impacting the P/S in the slightest. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. At these price levels, investors should remain cautious, particularly if things don't improve.

Having said that, be aware Beijing Fourth Paradigm Technology is showing 1 warning sign in our investment analysis, you should know about.

If you're unsure about the strength of Beijing Fourth Paradigm Technology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Fourth Paradigm Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6682

Beijing Fourth Paradigm Technology

An investment holding company, provides platform-centric artificial intelligence (AI) solutions in the People's Republic of China.

Undervalued with high growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026