Asian Growth Companies With High Insider Ownership In November 2025

Reviewed by Simply Wall St

As global markets face volatility, particularly in the technology sector, Asian markets have shown resilience with Chinese indices reaching new highs amid easing trade tensions. In this environment, growth companies with high insider ownership can be appealing as they often indicate strong confidence from those who know the business best and may offer stability amidst broader market fluctuations.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| M31 Technology (TPEX:6643) | 26.3% | 117.3% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 56.2% |

We'll examine a selection from our screener results.

Beijing Fourth Paradigm Technology (SEHK:6682)

Simply Wall St Growth Rating: ★★★★★☆

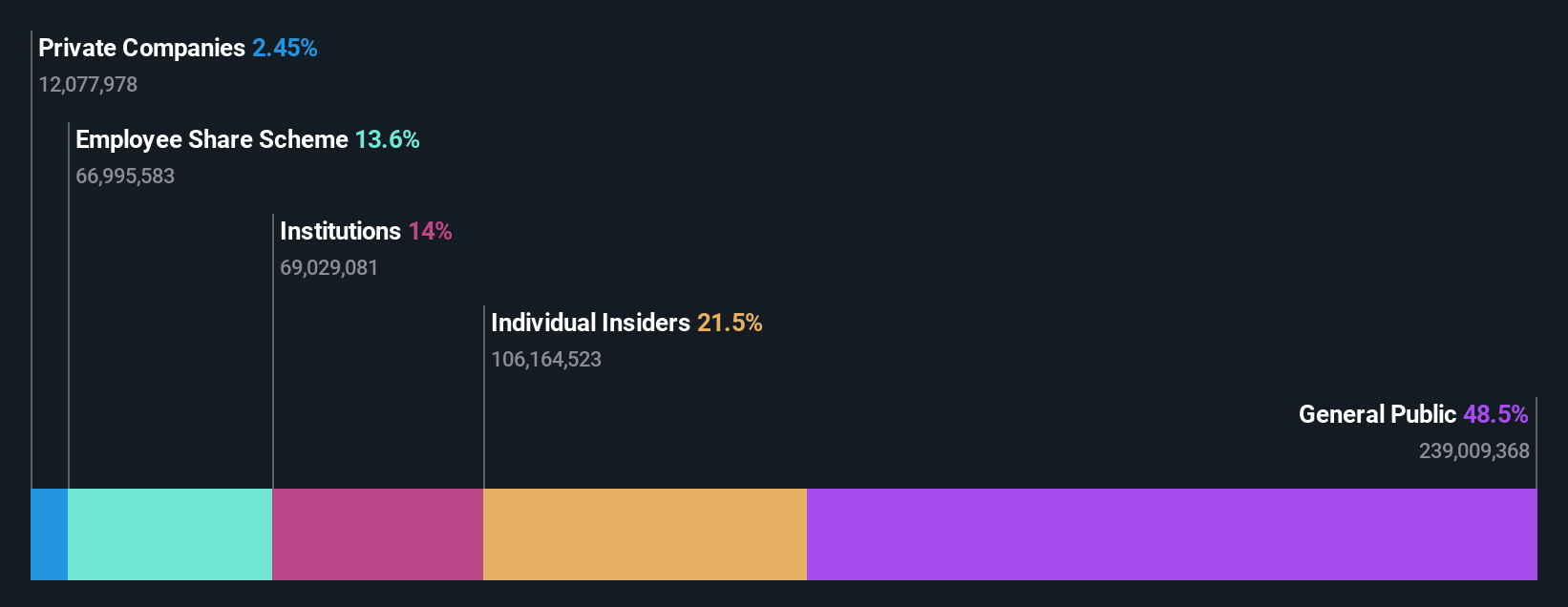

Overview: Beijing Fourth Paradigm Technology Co., Ltd. is an investment holding company offering platform-centric artificial intelligence solutions in China, with a market cap of HK$27.53 billion.

Operations: The company's revenue is primarily derived from three segments: Sagegpt Aigs Services (CN¥505.70 million), 4ParadigmSage AI Platform (CN¥4.57 billion), and Shift Intelligent Solutions (CN¥940.30 million).

Insider Ownership: 20.5%

Earnings Growth Forecast: 110.3% p.a.

Beijing Fourth Paradigm Technology has shown significant revenue growth, with a 26.7% annual forecast surpassing the Hong Kong market's average. Recent partnerships, like its strategic alliance with Solowin Holdings for blockchain compliance solutions, highlight its innovative edge. Despite a net loss reduction to CNY 66.97 million and a follow-on equity offering raising HK$1.31 billion, insider ownership remains high without substantial recent buying or selling activity reported in the last three months.

- Click here and access our complete growth analysis report to understand the dynamics of Beijing Fourth Paradigm Technology.

- Our comprehensive valuation report raises the possibility that Beijing Fourth Paradigm Technology is priced lower than what may be justified by its financials.

InnoCare Pharma (SEHK:9969)

Simply Wall St Growth Rating: ★★★★★☆

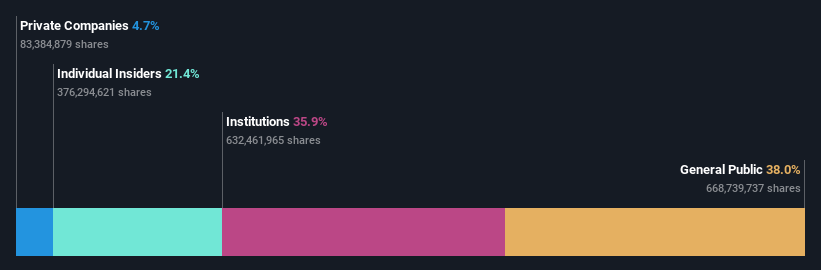

Overview: InnoCare Pharma Limited is a biopharmaceutical company focused on discovering, developing, and commercializing drugs for cancer and autoimmune diseases in China, with a market cap of HK$28.93 billion.

Operations: The company generates revenue primarily from its pharmaceuticals segment, amounting to CN¥1.32 billion.

Insider Ownership: 21.7%

Earnings Growth Forecast: 99.6% p.a.

InnoCare Pharma is poised for substantial growth, with revenue expected to increase by 22.8% annually, outpacing the Hong Kong market. Despite a recent net loss of CNY 64.41 million, the company has reduced its losses significantly from last year and continues to innovate in oncology treatments like ICP-B794 and zurletrectinib. While insider ownership remains high, there has been significant insider selling recently. The stock trades at a discount of 28.7% below its estimated fair value.

- Click here to discover the nuances of InnoCare Pharma with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of InnoCare Pharma shares in the market.

freee K.K (TSE:4478)

Simply Wall St Growth Rating: ★★★★★☆

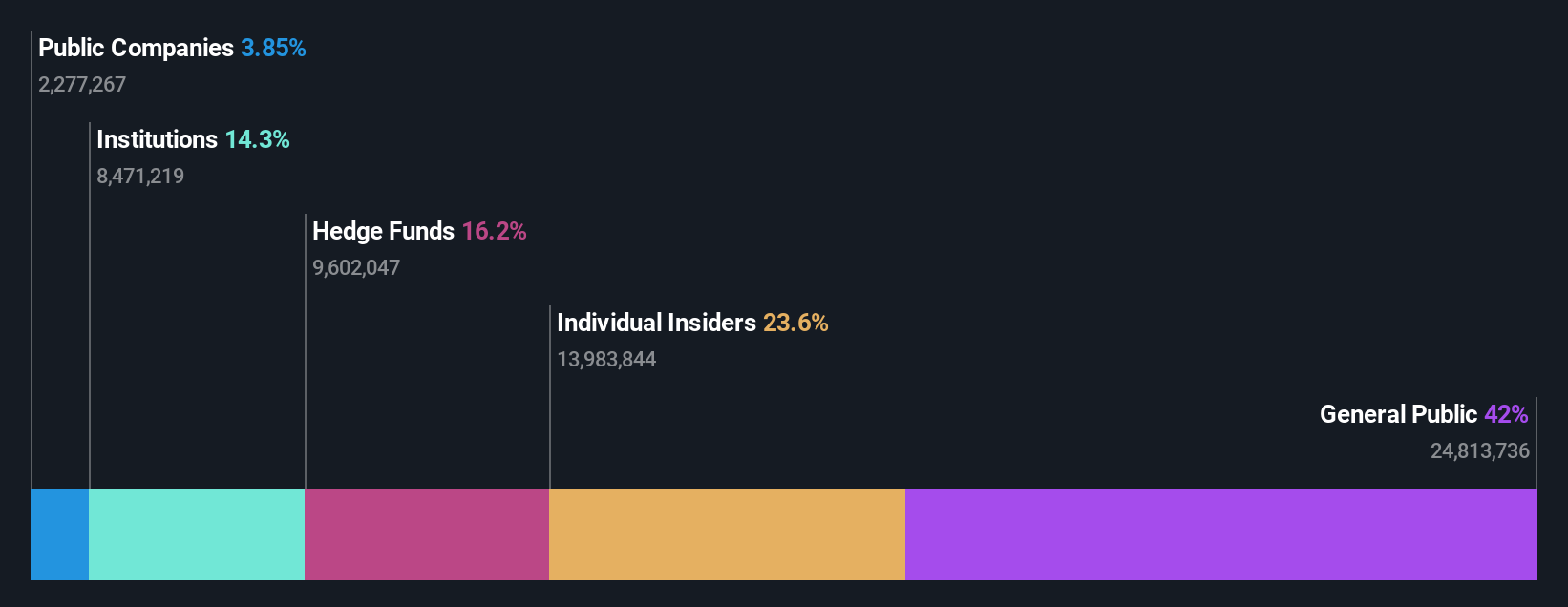

Overview: freee K.K. provides cloud-based accounting and HR software solutions in Japan, with a market cap of ¥214.37 billion.

Operations: The company generates revenue through its Platform Business segment, which accounted for ¥33.27 billion.

Insider Ownership: 25.4%

Earnings Growth Forecast: 38.4% p.a.

freee K.K. is experiencing significant growth, with earnings expected to increase by 38.41% annually, surpassing the Japanese market's growth rate. Although its revenue is projected to grow at 17% per year, this lags behind its earnings expansion. The company recently became profitable and trades at a substantial discount of 46.5% below its estimated fair value. Recent board meetings have focused on share issuance and compensation plans, while net sales for fiscal year 2026 are forecasted to rise by up to 25%.

- Click to explore a detailed breakdown of our findings in freee K.K's earnings growth report.

- Upon reviewing our latest valuation report, freee K.K's share price might be too pessimistic.

Turning Ideas Into Actions

- Access the full spectrum of 627 Fast Growing Asian Companies With High Insider Ownership by clicking on this link.

- Searching for a Fresh Perspective? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Fourth Paradigm Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6682

Beijing Fourth Paradigm Technology

An investment holding company, provides platform-centric artificial intelligence (AI) solutions in the People's Republic of China.

High growth potential and good value.

Market Insights

Community Narratives