Asian Growth Companies With High Insider Ownership For July 2025

Reviewed by Simply Wall St

As of July 2025, Asian markets are navigating a complex landscape shaped by global tariff developments and domestic economic challenges. Despite these headwinds, growth stocks in the region have shown resilience, making companies with high insider ownership particularly intriguing for investors seeking potential opportunities. In this context, insider ownership can serve as a valuable indicator of confidence in a company's long-term prospects, especially when market conditions are uncertain.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 60.6% |

| Vuno (KOSDAQ:A338220) | 15.6% | 109.8% |

| Techwing (KOSDAQ:A089030) | 18.8% | 68% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.3% | 23.5% |

| Oscotec (KOSDAQ:A039200) | 12.7% | 98.7% |

| Novoray (SHSE:688300) | 23.6% | 28.2% |

| M31 Technology (TPEX:6643) | 30.8% | 63.4% |

| Laopu Gold (SEHK:6181) | 35.5% | 42.3% |

| Fulin Precision (SZSE:300432) | 13.6% | 43.7% |

Let's uncover some gems from our specialized screener.

Beijing Fourth Paradigm Technology (SEHK:6682)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing Fourth Paradigm Technology Co., Ltd. is an investment holding company that offers platform-centric artificial intelligence solutions in China, with a market capitalization of HK$27.35 billion.

Operations: The company generates revenue from its Sage AI Platform (CN¥3.68 billion), Sagegpt AIGS Services (CN¥562.50 million), and Shift Intelligent Solutions (CN¥1.02 billion).

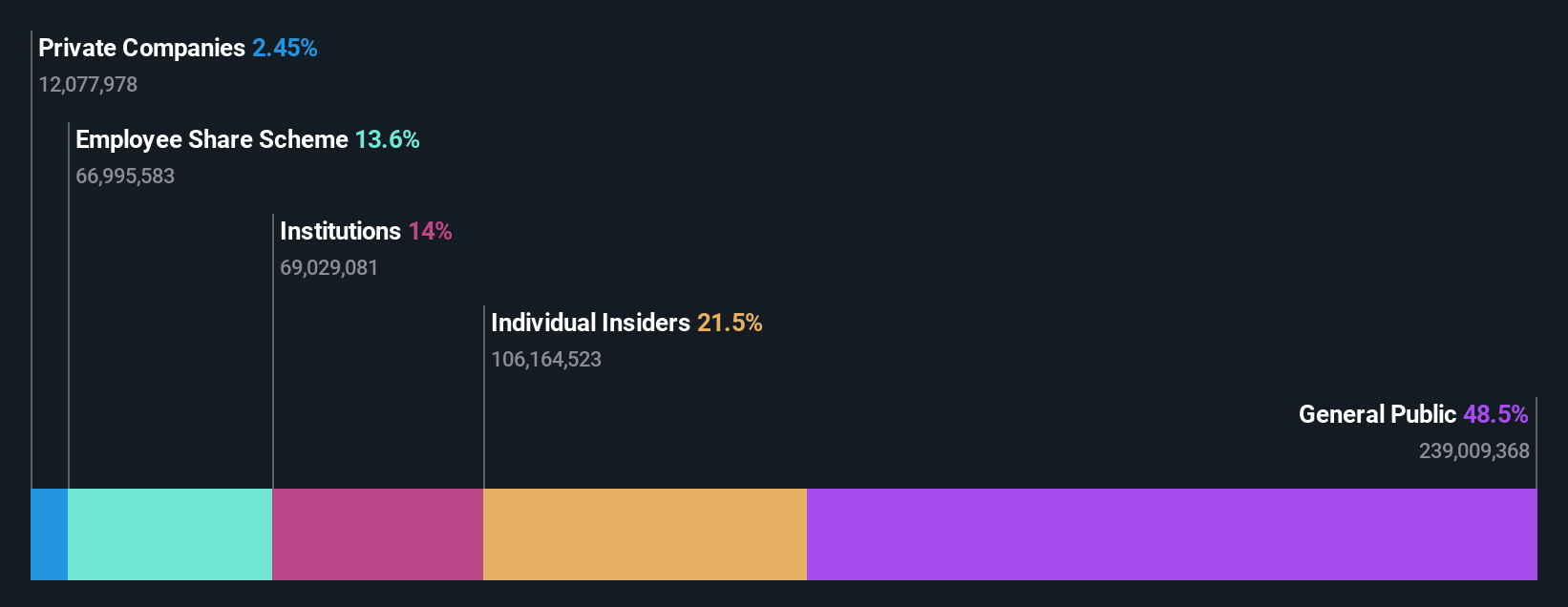

Insider Ownership: 21.5%

Beijing Fourth Paradigm Technology is poised for significant growth, with earnings projected to increase by 96.93% annually and revenue expected to grow at 22.5% per year, outpacing the Hong Kong market. Despite a low forecasted return on equity of 7.4%, the company trades at a substantial discount to its estimated fair value. Recent board changes and auditor appointments reflect strategic shifts, while insider ownership remains stable without significant recent trading activity.

- Navigate through the intricacies of Beijing Fourth Paradigm Technology with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Beijing Fourth Paradigm Technology shares in the market.

RemeGen (SEHK:9995)

Simply Wall St Growth Rating: ★★★★★★

Overview: RemeGen Co., Ltd. is a biopharmaceutical company focused on discovering, developing, and commercializing biologics for autoimmune, oncology, and ophthalmic diseases in Mainland China and the United States, with a market cap of approximately HK$40.54 billion.

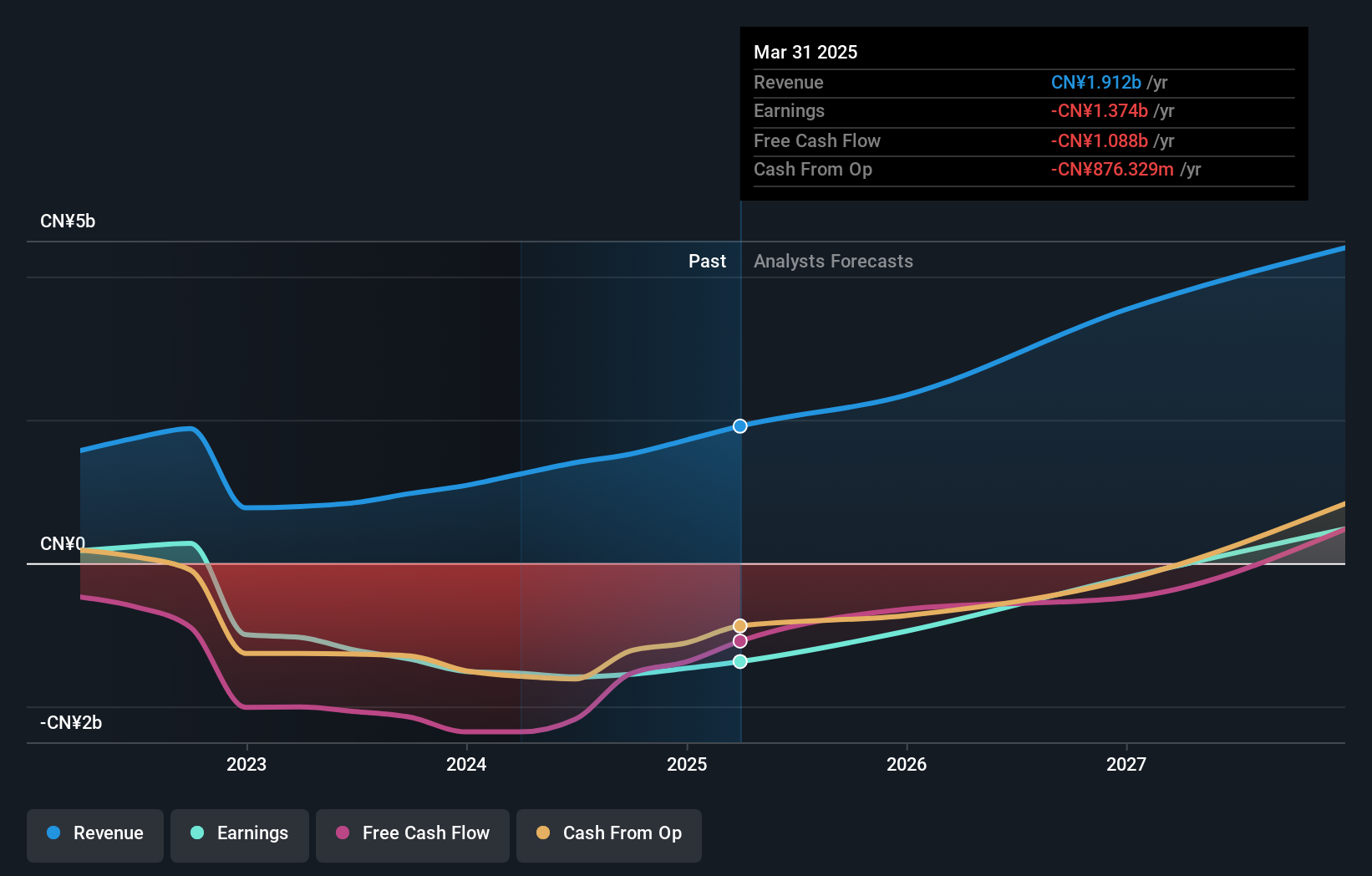

Operations: RemeGen Co., Ltd. generates revenue of approximately CN¥1.91 billion from its biopharmaceutical research, service, production, and sales activities.

Insider Ownership: 11.1%

RemeGen is positioned for robust growth, with revenue expected to increase by 25% annually and earnings projected to grow at a substantial rate of 66.61% per year, surpassing the Hong Kong market. Despite recent share price volatility and no significant insider trading activity, the company remains focused on expanding its innovative drug pipeline. Recent strategic moves include a licensing agreement with Vor Bio worth over US$4 billion in potential milestones and amendments to its corporate bylaws.

- Take a closer look at RemeGen's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of RemeGen shares in the market.

Changsha Jingjia Microelectronics (SZSE:300474)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Changsha Jingjia Microelectronics Co., Ltd. operates in the semiconductor industry, focusing on the design and development of electronic components, with a market cap of CN¥38.85 billion.

Operations: The company's revenue primarily comes from its Computer, Communications and Other Electronic Equipment Manufacturing segment, totaling CN¥460.42 million.

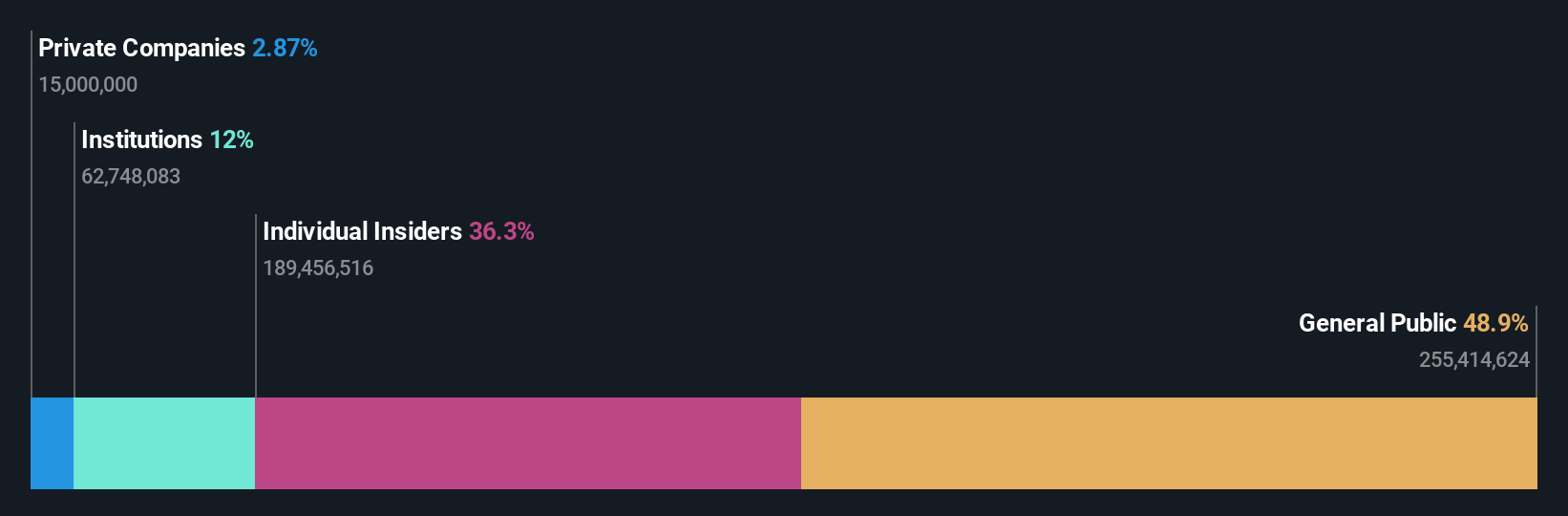

Insider Ownership: 36.3%

Changsha Jingjia Microelectronics is projected to achieve significant growth, with revenue expected to rise by 46.7% annually, outpacing the Chinese market. Earnings are forecasted to grow at 111.85% per year as the company aims for profitability within three years. Despite a challenging financial year with a net loss of CNY 165.12 million in 2024, no recent insider trading activity has been reported, indicating stable insider confidence amidst declining dividends and sales figures.

- Delve into the full analysis future growth report here for a deeper understanding of Changsha Jingjia Microelectronics.

- Upon reviewing our latest valuation report, Changsha Jingjia Microelectronics' share price might be too optimistic.

Make It Happen

- Explore the 597 names from our Fast Growing Asian Companies With High Insider Ownership screener here.

- Interested In Other Possibilities? The latest GPUs need a type of rare earth metal called Neodymium and there are only 27 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9995

RemeGen

A biopharmaceutical company, engages in the discovery, development, and commercialization of biologics for the treatment of autoimmune, oncology, and ophthalmic diseases with unmet medical needs in Mainland China and the United States.

Exceptional growth potential and slightly overvalued.

Market Insights

Community Narratives