- Sweden

- /

- Entertainment

- /

- OM:MTG B

High Growth Tech Stocks To Watch In The None Exchange

Reviewed by Simply Wall St

As global markets navigate the complexities of tariff uncertainties and mixed economic indicators, major indexes like the S&P 500 have shown resilience despite recent declines. In this environment, identifying high-growth tech stocks involves looking for companies that not only demonstrate robust earnings potential but also possess the agility to adapt to shifting market dynamics and regulatory landscapes.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1207 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Modern Times Group MTG (OM:MTG B)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Modern Times Group MTG AB operates through its subsidiaries to offer game franchise services across various regions including Sweden, the United Kingdom, Germany, and several other countries, with a market cap of SEK14.66 billion.

Operations: The company generates revenue primarily from its broadcasting segment, which amounted to SEK6.02 billion. It operates in multiple regions including Europe, Asia, and North America.

Despite a challenging year that saw Modern Times Group MTG AB transitioning from a net income position to a net loss, the company's sales growth narrative remains robust, with revenue climbing to SEK 6.015 billion, up from SEK 5.829 billion previously. This 23% annual revenue growth is significantly ahead of the Swedish market's average. Looking ahead, MTG is poised for a turnaround with earnings expected to surge by approximately 52% annually over the next three years. The firm’s commitment to innovation and market expansion is evident in its aggressive investment in R&D and strategic initiatives aimed at enhancing its competitive edge in the entertainment sector. This strategy underpins MTG's potential for profitability and positions it well for future growth amidst evolving industry dynamics.

- Dive into the specifics of Modern Times Group MTG here with our thorough health report.

Gain insights into Modern Times Group MTG's past trends and performance with our Past report.

Inspur Digital Enterprise Technology (SEHK:596)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Inspur Digital Enterprise Technology Limited is an investment holding company that offers software development, other software services, and cloud services in the People’s Republic of China, with a market cap of HK$6.10 billion.

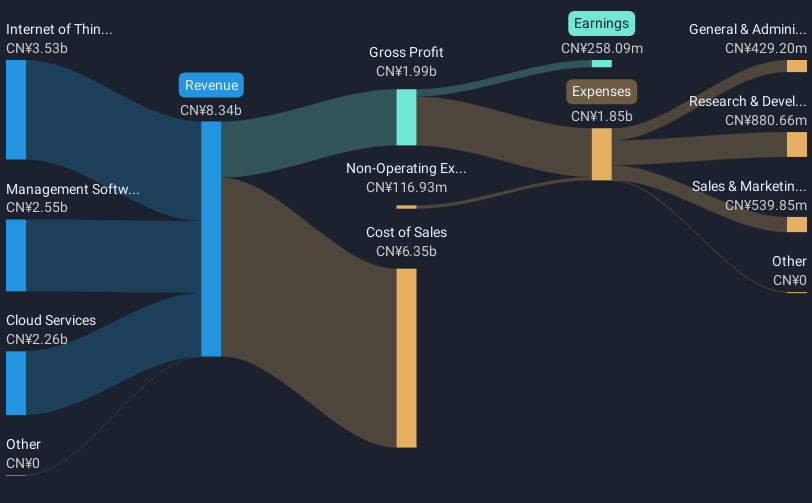

Operations: The company generates revenue through three main segments: Cloud Services (CN¥2.26 billion), Management Software (CN¥2.55 billion), and Internet of Things (IoT) Solutions (CN¥3.53 billion). The IoT Solutions segment is the largest contributor to its revenue streams, highlighting a focus on integrating technology with physical devices in China.

Inspur Digital Enterprise Technology, amidst a dynamic tech landscape, has demonstrated robust growth metrics that underscore its potential in the sector. With a notable 23.3% annual revenue increase and an impressive 38.8% surge in earnings, the company outpaces average industry growth rates significantly. This performance is bolstered by substantial R&D investments, which amounted to $1.2 billion last year, representing a strategic commitment to innovation and future readiness. Moreover, Inspur's focus on cloud computing and AI solutions positions it well within high-demand market segments, promising continued relevance and competitive edge as technologies evolve.

- Get an in-depth perspective on Inspur Digital Enterprise Technology's performance by reading our health report here.

Learn about Inspur Digital Enterprise Technology's historical performance.

Fixstars (TSE:3687)

Simply Wall St Growth Rating: ★★★★☆☆

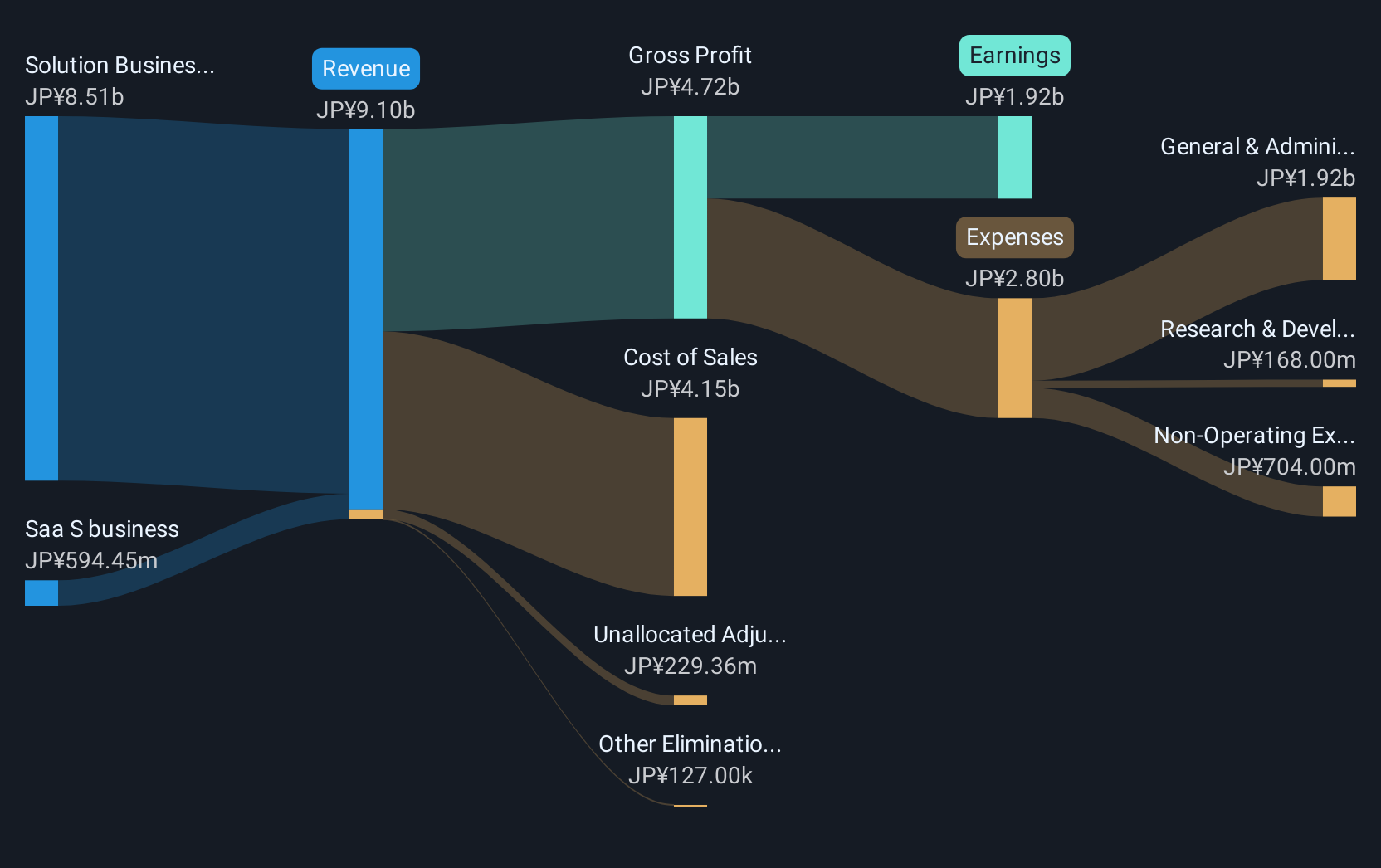

Overview: Fixstars Corporation is a software company with operations in Japan and internationally, and it has a market cap of ¥67.23 billion.

Operations: Fixstars Corporation generates revenue primarily through its software solutions, focusing on high-performance computing and storage optimization. The company's cost structure includes significant investment in research and development to support its technology-driven offerings.

Fixstars Corporation is carving a niche in the high-demand AI sector, recently announcing collaborations and innovations that underscore its growth trajectory. With a 14.7% annual revenue increase and a more impressive 20.5% rise in earnings, the company is outpacing many within its industry. Particularly noteworthy is their strategic R&D spending which reached $320 million last year, accounting for approximately 15% of their total revenue; this investment supports their latest ventures like the AI Data Center project with OPTAGE Inc., aimed at reducing costs for AI training and deployment through innovative liquid-cooled data centers. These initiatives not only enhance Fixstars' offerings but also position it advantageously as industries increasingly rely on powerful computing for AI applications development.

- Click here to discover the nuances of Fixstars with our detailed analytical health report.

Assess Fixstars' past performance with our detailed historical performance reports.

Key Takeaways

- Click through to start exploring the rest of the 1204 High Growth Tech and AI Stocks now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:MTG B

Modern Times Group MTG

Through its subsidiaries, provides game franchise services in Sweden, the United Kingdom, Germany, rest of Europe, Singapore, India, the United States, and New Zealand.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives