- Hong Kong

- /

- Professional Services

- /

- SEHK:536

Tradelink Electronic Commerce (HKG:536) Is Increasing Its Dividend To HK$0.028

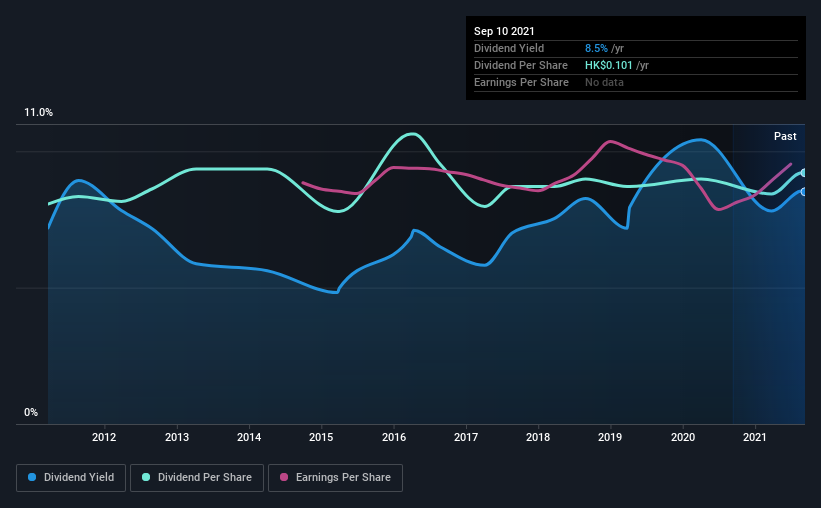

Tradelink Electronic Commerce Limited's (HKG:536) dividend will be increasing to HK$0.028 on 8th of October. This makes the dividend yield 8.5%, which is above the industry average.

View our latest analysis for Tradelink Electronic Commerce

Tradelink Electronic Commerce Doesn't Earn Enough To Cover Its Payments

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Based on the last payment, the company wasn't making enough to cover what it was paying to shareholders. Without profits and cash flows increasing, it would be difficult for the company to continue paying the dividend at this level.

Earnings per share could rise by 0.4% over the next year if things go the same way as they have for the last few years. However, if the dividend continues growing along recent trends, it could start putting pressure on the balance sheet with the payout ratio reaching 98% over the next year.

Dividend Volatility

The company's dividend history has been marked by instability, with at least 1 cut in the last 10 years. The first annual payment during the last 10 years was HK$0.088 in 2011, and the most recent fiscal year payment was HK$0.10. This works out to be a compound annual growth rate (CAGR) of approximately 1.3% a year over that time. The dividend has seen some fluctuations in the past, so even though the dividend was raised this year, we should remember that it has been cut in the past.

Tradelink Electronic Commerce May Find It Hard To Grow The Dividend

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. Tradelink Electronic Commerce hasn't seen much change in its earnings per share over the last five years. So the company has struggled to grow its EPS yet it's still paying out 97% of its earnings. This gives limited room for the company to raise the dividend in the future.

Tradelink Electronic Commerce's Dividend Doesn't Look Sustainable

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. The payments are bit high to be considered sustainable, and the track record isn't the best. We would be a touch cautious of relying on this stock primarily for the dividend income.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Case in point: We've spotted 2 warning signs for Tradelink Electronic Commerce (of which 1 doesn't sit too well with us!) you should know about. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Tradelink Electronic Commerce might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:536

Tradelink Electronic Commerce

Provides government electronic trading services (GETS) for processing official trade-related documents in Hong Kong.

Flawless balance sheet and good value.