Shareholders May Not Be So Generous With Vobile Group Limited's (HKG:3738) CEO Compensation And Here's Why

Key Insights

- Vobile Group will host its Annual General Meeting on 28th of June

- CEO Bernard Wang's total compensation includes salary of HK$4.30m

- Total compensation is 218% above industry average

- Over the past three years, Vobile Group's EPS fell by 35% and over the past three years, the total loss to shareholders 86%

Shareholders of Vobile Group Limited (HKG:3738) will have been dismayed by the negative share price return over the last three years. Per share earnings growth is also lacking, despite revenue growth. Shareholders will have a chance to take their concerns to the board at the next AGM on 28th of June and vote on resolutions including executive compensation, which studies show may have an impact on company performance. Here's why we think shareholders should hold off on a raise for the CEO at the moment.

Check out our latest analysis for Vobile Group

Comparing Vobile Group Limited's CEO Compensation With The Industry

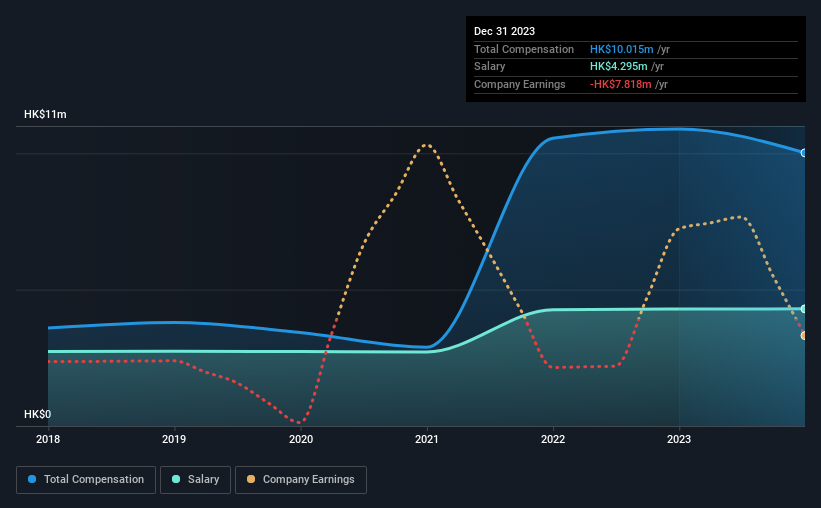

Our data indicates that Vobile Group Limited has a market capitalization of HK$2.6b, and total annual CEO compensation was reported as HK$10m for the year to December 2023. That's a notable decrease of 8.1% on last year. While we always look at total compensation first, our analysis shows that the salary component is less, at HK$4.3m.

In comparison with other companies in the Hong Kong Software industry with market capitalizations ranging from HK$1.6b to HK$6.2b, the reported median CEO total compensation was HK$3.1m. This suggests that Bernard Wang is paid more than the median for the industry. Furthermore, Bernard Wang directly owns HK$356m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | HK$4.3m | HK$4.3m | 43% |

| Other | HK$5.7m | HK$6.6m | 57% |

| Total Compensation | HK$10m | HK$11m | 100% |

Talking in terms of the industry, salary represented approximately 56% of total compensation out of all the companies we analyzed, while other remuneration made up 44% of the pie. It's interesting to note that Vobile Group allocates a smaller portion of compensation to salary in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at Vobile Group Limited's Growth Numbers

Over the last three years, Vobile Group Limited has shrunk its earnings per share by 35% per year. In the last year, its revenue is up 39%.

Investors would be a bit wary of companies that have lower EPS On the other hand, the strong revenue growth suggests the business is growing. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Vobile Group Limited Been A Good Investment?

With a total shareholder return of -86% over three years, Vobile Group Limited shareholders would by and large be disappointed. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

The loss to shareholders over the past three years is certainly concerning and possibly has something to do with the fact that the company's earnings haven't grown. In the upcoming AGM, shareholders will get the opportunity to discuss any issues with the board, including those related to CEO remuneration and assess if the board's plan is in line with their expectations.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 1 warning sign for Vobile Group that investors should think about before committing capital to this stock.

Switching gears from Vobile Group, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3738

Vobile Group

An investment holding company, provides software as a service for digital content asset protection and transaction in the United States, Mainland China, and internationally.

High growth potential with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion