- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:700

High Growth Tech Stocks in Hong Kong for October 2024

Reviewed by Simply Wall St

As global markets navigate through geopolitical tensions and economic fluctuations, Hong Kong's tech sector has shown resilience with the Hang Seng Index climbing 10.2% recently, reflecting optimism amid Beijing's supportive measures. In this dynamic environment, identifying high-growth tech stocks involves looking for companies with innovative capabilities and strong market positioning that can capitalize on current economic conditions and emerging opportunities.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.37% | 25.47% | ★★★★★☆ |

| MedSci Healthcare Holdings | 48.74% | 48.78% | ★★★★★☆ |

| Inspur Digital Enterprise Technology | 25.31% | 39.04% | ★★★★★☆ |

| RemeGen | 26.30% | 52.19% | ★★★★★☆ |

| Akeso | 32.41% | 54.21% | ★★★★★★ |

| Cowell e Holdings | 31.68% | 35.44% | ★★★★★★ |

| Innovent Biologics | 22.24% | 59.39% | ★★★★★☆ |

| Sichuan Kelun-Biotech Biopharmaceutical | 24.70% | 8.53% | ★★★★★☆ |

| Biocytogen Pharmaceuticals (Beijing) | 21.53% | 109.17% | ★★★★★☆ |

| Beijing Airdoc Technology | 37.47% | 93.35% | ★★★★★☆ |

Click here to see the full list of 43 stocks from our SEHK High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

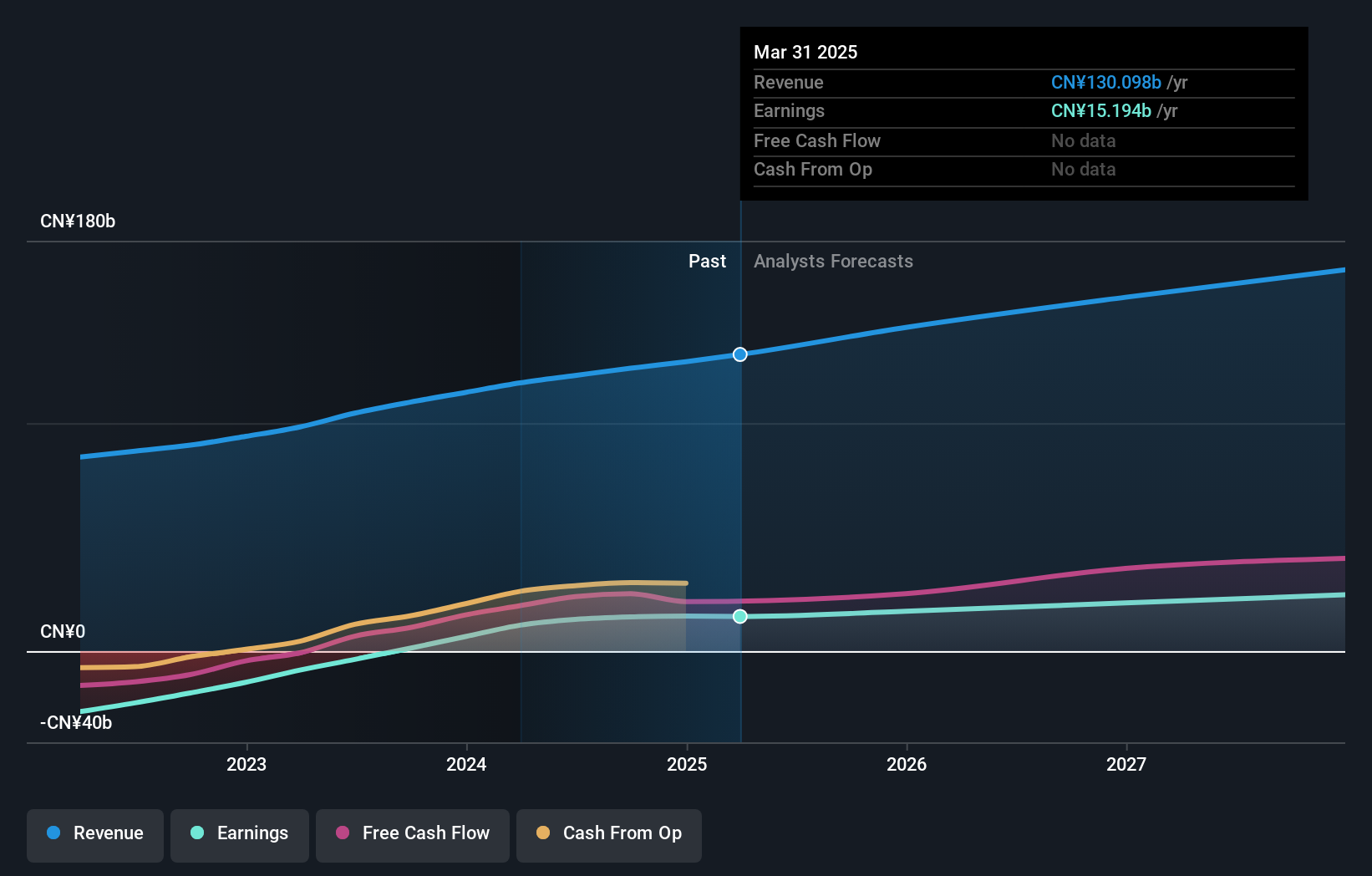

Kuaishou Technology (SEHK:1024)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kuaishou Technology is an investment holding company that offers live streaming, online marketing, and other services in the People’s Republic of China with a market capitalization of approximately HK$264.17 billion.

Operations: The company generates revenue primarily from domestic operations, amounting to CN¥117.32 billion, with a smaller contribution from overseas activities at CN¥3.57 billion.

Kuaishou Technology has demonstrated robust growth, with a notable 18.7% forecast in annual earnings, outpacing the Hong Kong market's average of 12.4%. This surge is mirrored in its revenue growth, expected at 9% annually, again ahead of the market norm of 7.4%. The company's commitment to innovation is evident from its R&D expenses which are strategically reinvested into areas like AI and video technology enhancements. Recent upgrades to their Kling AI platform underscore this focus, aiming to refine user experience and expand globally. These strategic moves not only enhance Kuaishou's product offerings but also solidify its position in a competitive tech landscape, promising continued relevance and potential for sustained growth.

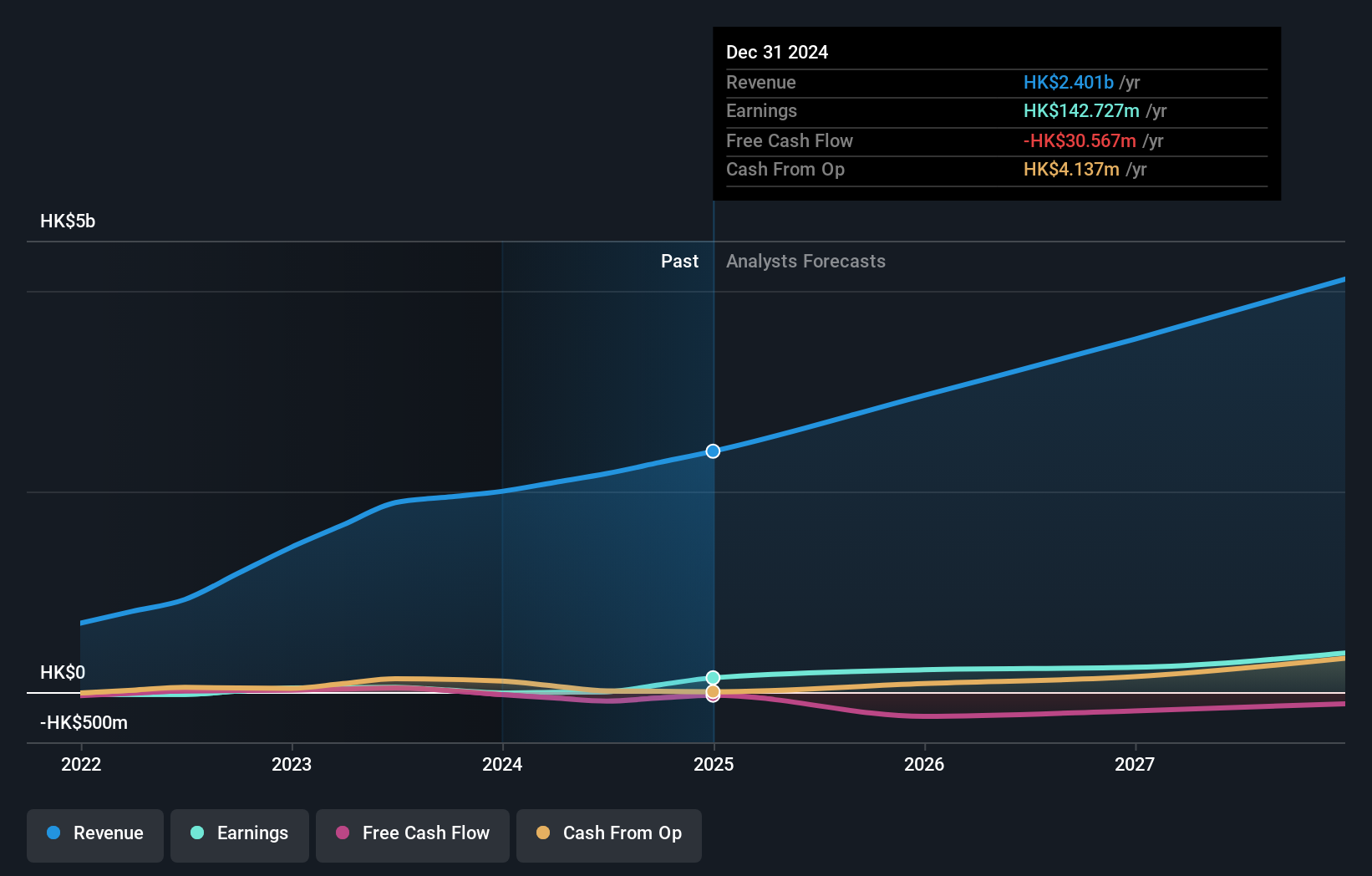

Vobile Group (SEHK:3738)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Vobile Group Limited is an investment holding company that offers software as a service for digital content assets protection and transaction across the United States, Japan, Mainland China, and internationally, with a market cap of approximately HK$6.29 billion.

Operations: The company generates revenue primarily through its SaaS offerings, amounting to HK$2.18 billion.

Vobile Group, amid Hong Kong's bustling tech sector, has shown a promising uptick in performance with recent half-year earnings reporting a revenue increase to HKD 1.18 billion from HKD 1.00 billion year-over-year and net income rising to HKD 41.47 million. This growth is underscored by an aggressive R&D investment strategy, aligning with industry demands for continuous innovation; however, its modest profit margin of 0.2% reflects the high costs associated with these advancements. Despite this, Vobile's projected annual revenue growth at 21.4% outstrips the local market forecast of 7.4%, positioning it as a potential key player in shaping future tech trends within the region.

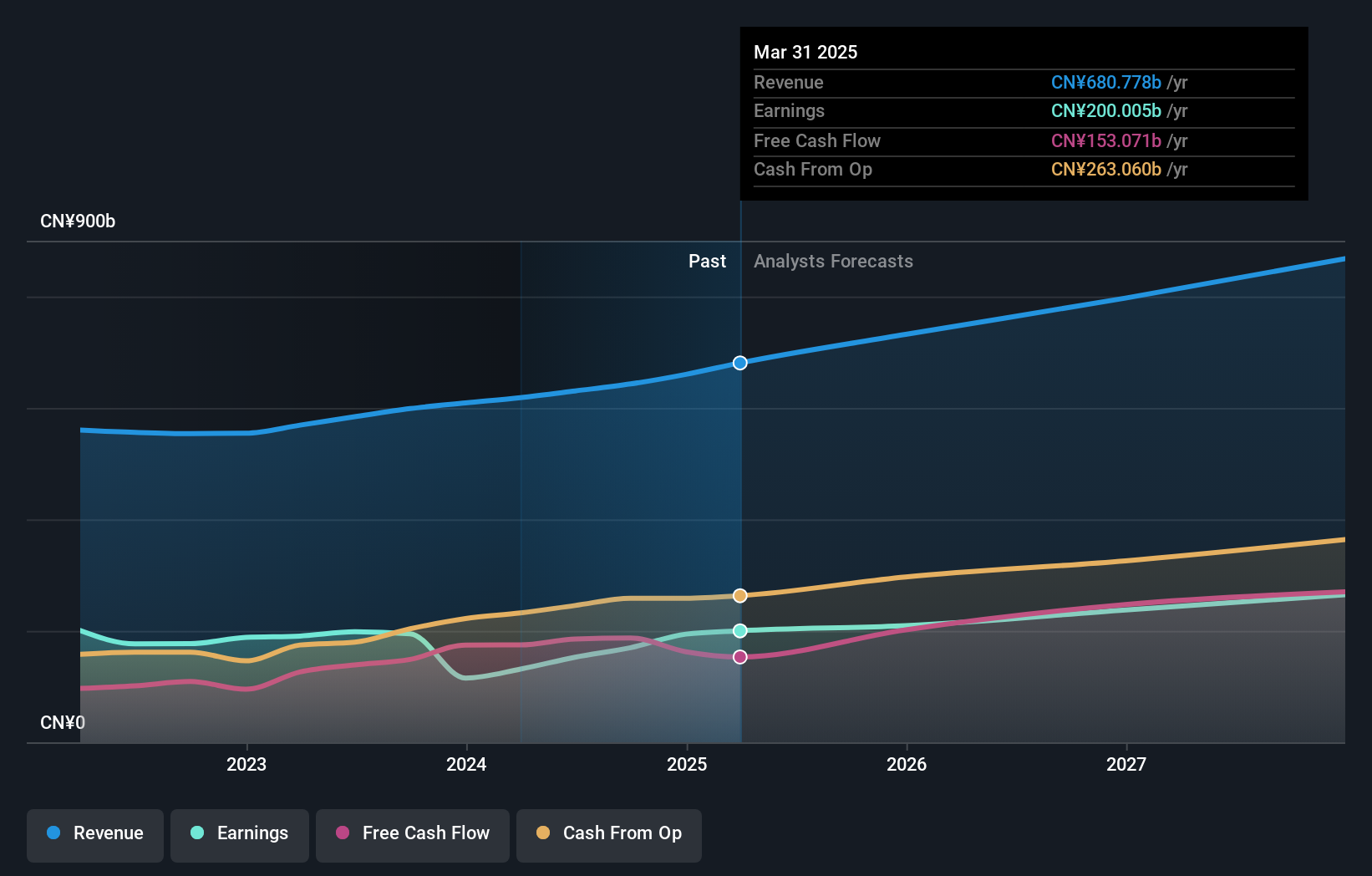

Tencent Holdings (SEHK:700)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tencent Holdings Limited is an investment holding company that provides value-added services, online advertising, fintech, and business services both within the People’s Republic of China and internationally, with a market capitalization of approximately HK$4.40 trillion.

Operations: Tencent Holdings Limited generates significant revenue from its Value-Added Services (VAS), which account for CN¥302.28 billion, followed by Fintech and Business Services at CN¥209.17 billion, and Online Advertising at CN¥111.89 billion. The company's diverse revenue streams highlight its broad engagement in digital services across various sectors both domestically and internationally.

Tencent Holdings, navigating through the competitive tech landscape in Hong Kong, has demonstrated robust financial health with a 12.83% forecast in annual earnings growth and an 8.1% expected revenue increase per year, outpacing the local market's 7.4%. This growth trajectory is supported by substantial R&D investments, which have consistently accounted for a significant portion of revenue, underlining its commitment to innovation and securing its competitive edge in sectors like gaming and cloud services. Recent strategic moves include discussions for a potential buyout of Ubisoft—a testament to Tencent's aggressive expansion strategy despite recent market volatility where Ubisoft’s shares surged by 33% following these talks. These developments suggest not just resilience but also an astute understanding of global tech dynamics that could significantly influence Tencent’s future market positioning.

- Dive into the specifics of Tencent Holdings here with our thorough health report.

Assess Tencent Holdings' past performance with our detailed historical performance reports.

Seize The Opportunity

- Navigate through the entire inventory of 43 SEHK High Growth Tech and AI Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tencent Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:700

Tencent Holdings

An investment holding company, provides value-added services, marketing services, fintech, and business services in Mainland China and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives