As global markets show resilience with U.S. indexes nearing record highs and smaller-cap stocks outperforming, investors are keenly observing the dynamics of high-growth sectors like technology amid geopolitical uncertainties and economic indicators such as declining jobless claims. In this environment, identifying promising tech stocks involves considering factors like innovation potential, market demand driven by trends such as artificial intelligence, and a company's ability to navigate economic shifts effectively.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.46% | 109.25% | ★★★★★★ |

| JNTC | 20.52% | 57.26% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| Elliptic Laboratories | 65.73% | 103.55% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.45% | 70.66% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

Click here to see the full list of 1300 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Northern Data (DB:NB2)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Northern Data AG provides high-performance computing infrastructure solutions to businesses and research institutions globally, with a market capitalization of €2.21 billion.

Operations: The company generates revenue primarily through its Peak Mining and Taiga Cloud segments, contributing €156.13 million and €22.13 million respectively. Ardent Data Centers adds another €31.46 million to the revenue stream, while Consolidation reflects a negative impact of -€178.50 million.

Northern Data's strategic pivot from its heritage crypto mining business to a pure-play AI solutions provider is underscored by its recent decision to explore the divestment of Peak Mining. This move aligns with Northern Data's robust growth in its AI Solutions segment, which has recorded a 31.5% revenue increase annually, outpacing the German market's 5.6%. The firm is not just reshaping its business model but also fostering innovation through initiatives like the AI Accelerator program, which supports startups with cutting-edge AI technologies and sustainable practices. With earnings projected to surge by 75.56% annually, Northern Data is positioning itself as a formidable player in the rapidly evolving tech landscape, despite current unprofitability and market volatility challenges.

- Dive into the specifics of Northern Data here with our thorough health report.

Review our historical performance report to gain insights into Northern Data's's past performance.

Persistent Systems (NSEI:PERSISTENT)

Simply Wall St Growth Rating: ★★★★★☆

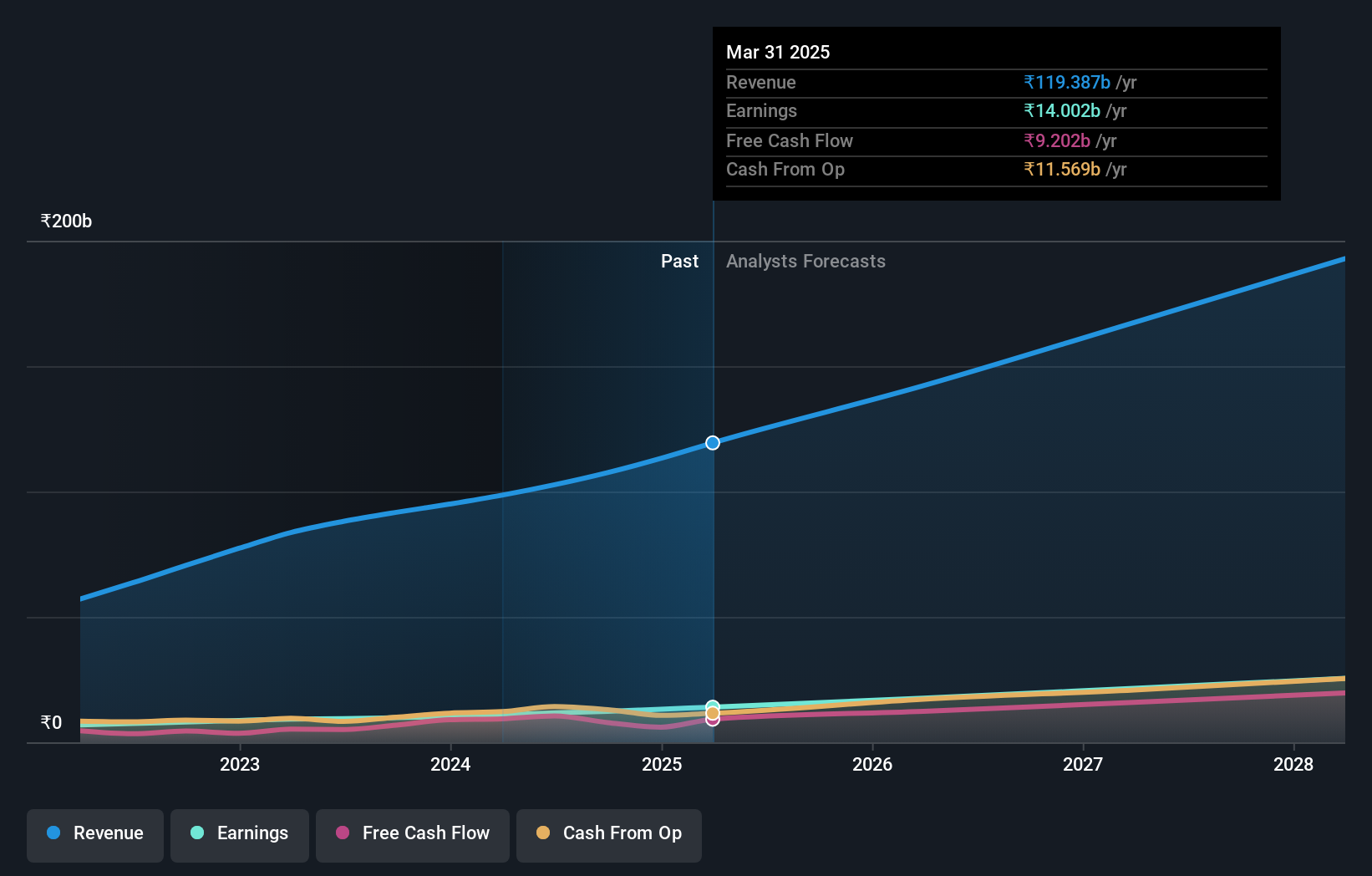

Overview: Persistent Systems Limited is a company that offers software products, services, and technology solutions across India, North America, and globally with a market capitalization of ₹851.47 billion.

Operations: With a focus on diverse sectors, Persistent Systems Limited generates revenue primarily from Software, Hi-Tech and Emerging Industries (₹46.53 billion), followed by Banking, Financial Services and Insurance (BFSI) (₹33.41 billion), and Healthcare & Life Sciences (₹27.29 billion).

Persistent Systems demonstrates a robust trajectory in the tech sector, underscored by a 20.4% forecasted annual earnings growth, outstripping the broader Indian market's 18%. This performance is anchored in significant R&D investments, which are not only enhancing product offerings but also driving financial metrics; for instance, sales surged to INR 28.97 billion this quarter from INR 24.12 billion last year. Moreover, the launch of SASVA 2.0—an AI-driven platform—marks a strategic pivot towards integrating advanced technologies that streamline software development cycles and expand enterprise capabilities, potentially setting new industry standards in innovation and operational efficiency.

- Unlock comprehensive insights into our analysis of Persistent Systems stock in this health report.

Evaluate Persistent Systems' historical performance by accessing our past performance report.

Vobile Group (SEHK:3738)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vobile Group Limited is an investment holding company that offers software as a service for the protection and transaction of digital content assets across the United States, Japan, Mainland China, and other international markets, with a market capitalization of approximately HK$8.26 billion.

Operations: The company generates revenue primarily through its software-as-a-service offerings, which amounted to HK$2.18 billion. Its focus is on the protection and transaction of digital content assets across various international markets.

Vobile Group's recent performance and strategic maneuvers paint a picture of a company striving to capitalize on high-growth opportunities within the tech sector. With revenue up 29% in the latest quarter and monthly recurring revenue increasing by 32%, Vobile is leveraging its market position in China effectively. The initiation of share repurchases signals confidence in enhancing shareholder value, supported by a robust forecast of earnings growth at 63.3% annually, outpacing the Hong Kong market average significantly. This financial trajectory is underpinned by an aggressive R&D strategy, crucial for sustaining innovation and competitive edge in a rapidly evolving industry.

- Take a closer look at Vobile Group's potential here in our health report.

Assess Vobile Group's past performance with our detailed historical performance reports.

Where To Now?

- Access the full spectrum of 1300 High Growth Tech and AI Stocks by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:PERSISTENT

Persistent Systems

Provides software products, services, and technology solutions in India, North America, and internationally.

Outstanding track record with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives