Amidst global market fluctuations, the Asian tech sector remains a focal point for investors, with China's stock markets showing resilience as hopes for economic stimulus persist. In this environment, identifying high-growth tech stocks involves evaluating companies that can navigate trade tensions and leverage technological advancements to sustain growth.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 30.19% | 29.63% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.44% | 23.48% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.31% | 28.63% | ★★★★★★ |

| PharmaResearch | 26.50% | 29.34% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| Marketingforce Management | 26.39% | 112.30% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.53% | 96.08% | ★★★★★★ |

| JNTC | 55.45% | 94.52% | ★★★★★★ |

Below we spotlight a couple of our favorites from our exclusive screener.

Robosense Technology (SEHK:2498)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Robosense Technology Co., Ltd is an investment holding company that offers LiDAR and perception solutions across China, the United States, and other international markets, with a market cap of HK$15.32 billion.

Operations: The company focuses on providing LiDAR and perception solutions, with a significant portion of its revenue, CN¥1.62 billion, derived from the Industrial Automation & Controls segment.

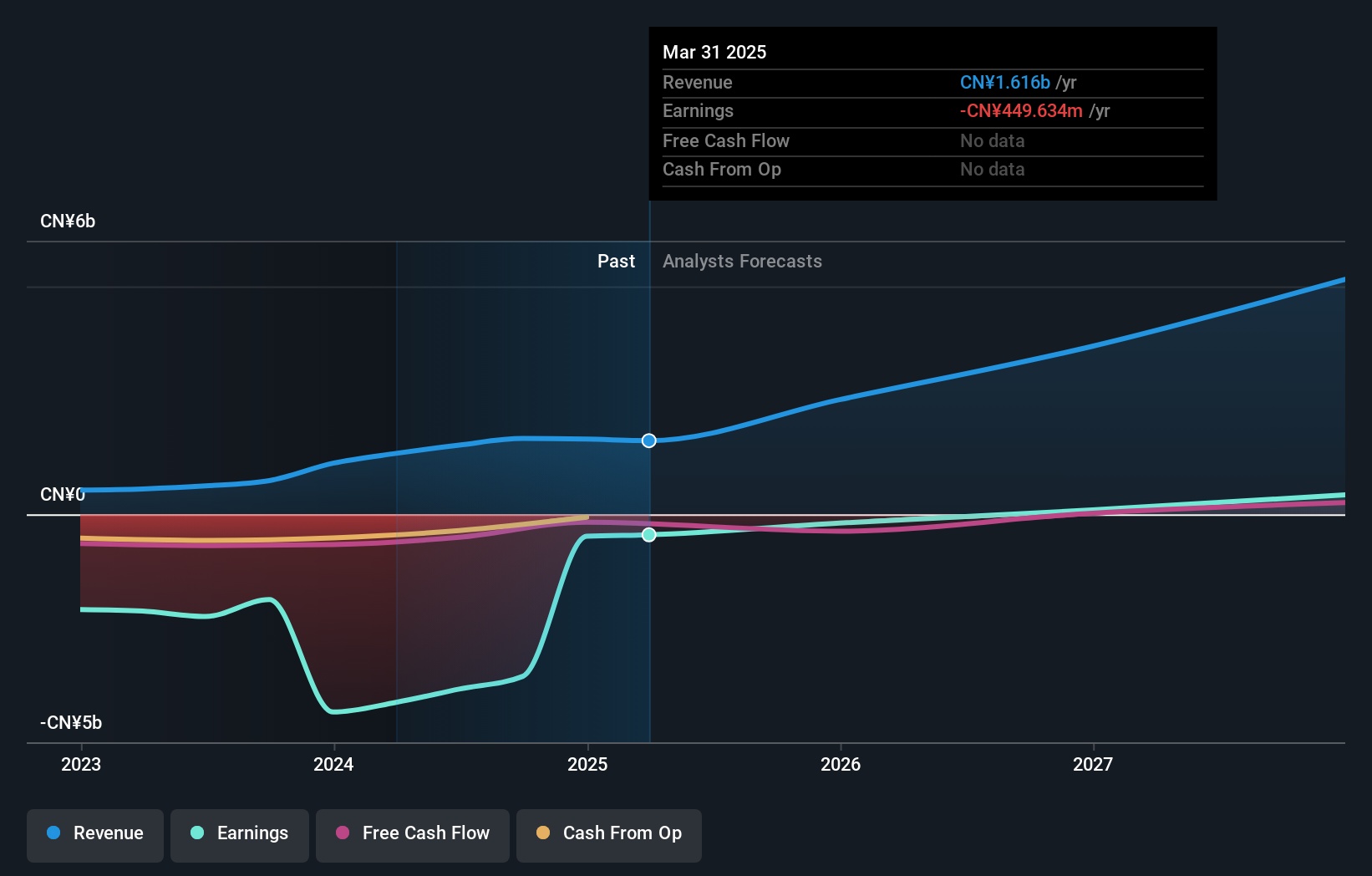

Robosense Technology, a trailblazer in digital LiDAR systems, has demonstrated robust growth with its revenue forecast to surge by 28.9% annually. Despite current unprofitability, earnings are expected to grow impressively at 69.12% per year over the next three years, signaling potential future profitability. The company's commitment to innovation is evident in its R&D investments which have significantly contributed to developing advanced products like the EMX LiDAR; this focus on high-performance technology catering to automotive intelligence needs positions Robosense well within the rapidly evolving tech landscape of Asia. Moreover, their recent strategic product launches and partnerships underscore their capability in capturing substantial market share and addressing diverse industry requirements effectively.

- Navigate through the intricacies of Robosense Technology with our comprehensive health report here.

Evaluate Robosense Technology's historical performance by accessing our past performance report.

Kingdee International Software Group (SEHK:268)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kingdee International Software Group Company Limited is an investment holding company that operates in the enterprise resource planning sector, with a market capitalization of approximately HK$55.15 billion.

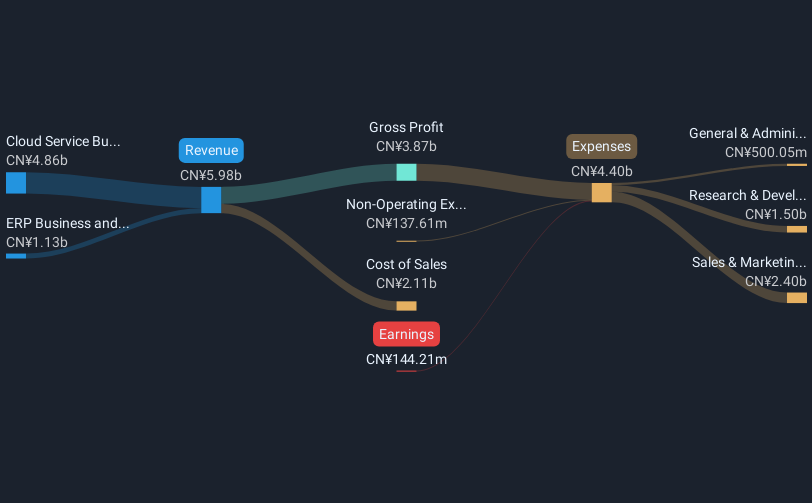

Operations: Kingdee focuses on enterprise resource planning and cloud services, generating CN¥1.15 billion and CN¥5.11 billion in revenue respectively. The company's business model emphasizes a strong shift towards cloud services as a significant revenue driver.

Kingdee International Software Group, a prominent name in the Asian tech landscape, is navigating its growth trajectory with notable strategies. The company's revenue is projected to grow at 13.6% annually, slightly lagging behind the high-growth benchmarks of some peers but still outpacing Hong Kong's average market growth of 8.1%. With a significant emphasis on R&D, Kingdee invests robustly to innovate and stay competitive; this commitment is reflected in their R&D expenses which are crucial for their strategic positioning in software solutions. Additionally, the firm is poised to turn profitable within three years with an expected earnings surge of 41.56% annually, showcasing potential for substantial financial improvement and market impact.

- Click here and access our complete health analysis report to understand the dynamics of Kingdee International Software Group.

Learn about Kingdee International Software Group's historical performance.

WuXi Xinje ElectricLtd (SHSE:603416)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: WuXi Xinje Electric Co., Ltd. focuses on developing, producing, and selling industrial automation products both in China and internationally, with a market cap of approximately CN¥9.28 billion.

Operations: Xinje Electric generates revenue primarily from the instrument industry, amounting to CN¥1.76 billion. The company's focus on industrial automation products positions it in both domestic and international markets.

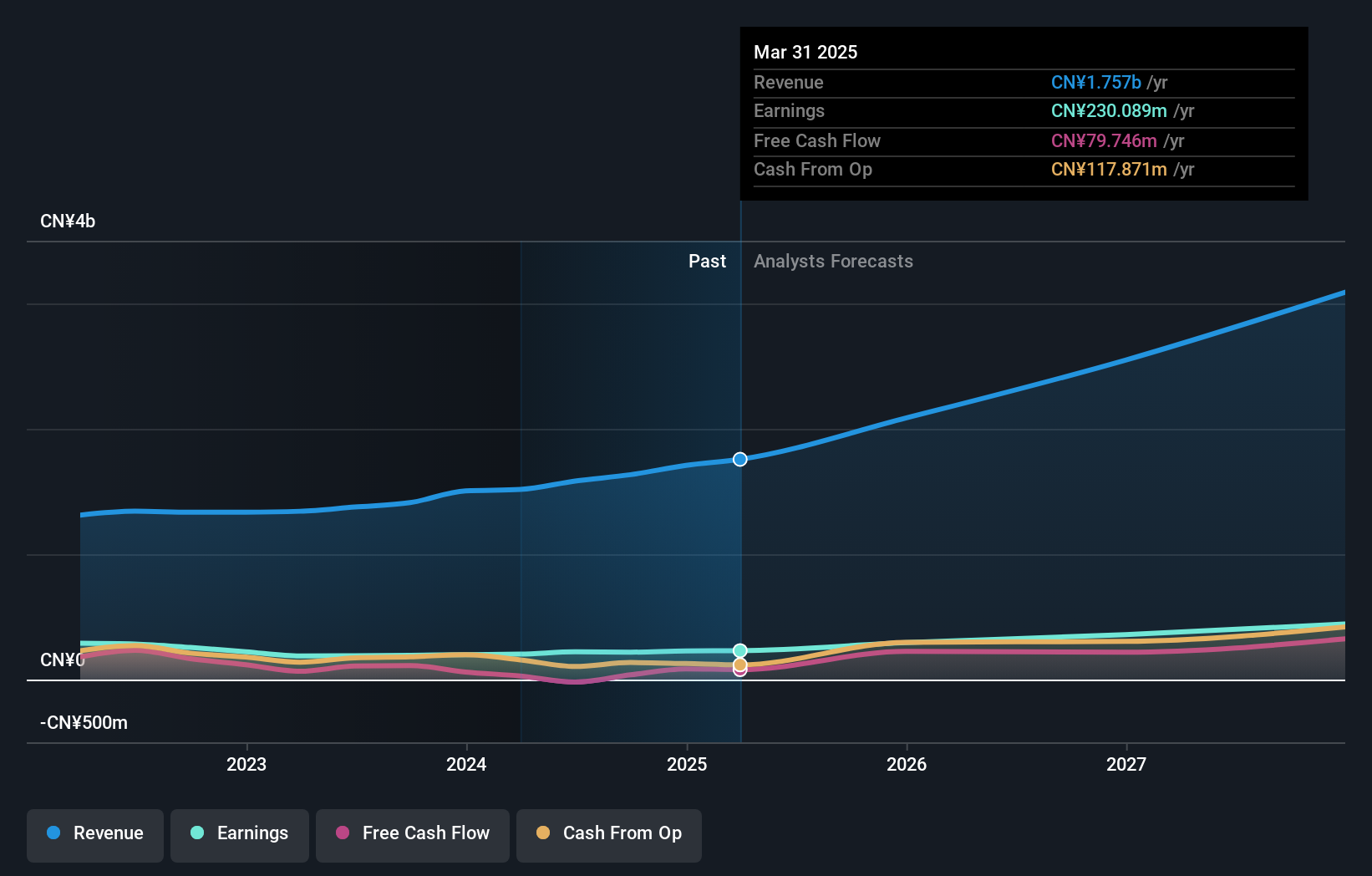

WuXi Xinje Electric Co., Ltd. is shaping its trajectory in the high-tech sector with a robust focus on innovation, reflected in its R&D spending which aligns with its revenue growth of 20.3% annually. This strategic emphasis has led to a notable increase in earnings, up by 22.8% per year, showcasing the company's ability to scale effectively amidst competitive pressures. Recent dividends and private placements underscore financial confidence, further buoyed by Q1 revenue rising to CNY 388.3 million from CNY 339.86 million year-over-year, indicating sustained demand for their electronic solutions in an evolving market landscape.

- Dive into the specifics of WuXi Xinje ElectricLtd here with our thorough health report.

Gain insights into WuXi Xinje ElectricLtd's past trends and performance with our Past report.

Turning Ideas Into Actions

- Discover the full array of 478 Asian High Growth Tech and AI Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kingdee International Software Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:268

Kingdee International Software Group

An investment holding company, engages in the enterprise resource planning business.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives