More Unpleasant Surprises Could Be In Store For Qingdao AInnovation Technology Group Co., Ltd.'s (HKG:2121) Shares After Tumbling 26%

Unfortunately for some shareholders, the Qingdao AInnovation Technology Group Co., Ltd. (HKG:2121) share price has dived 26% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 78% share price decline.

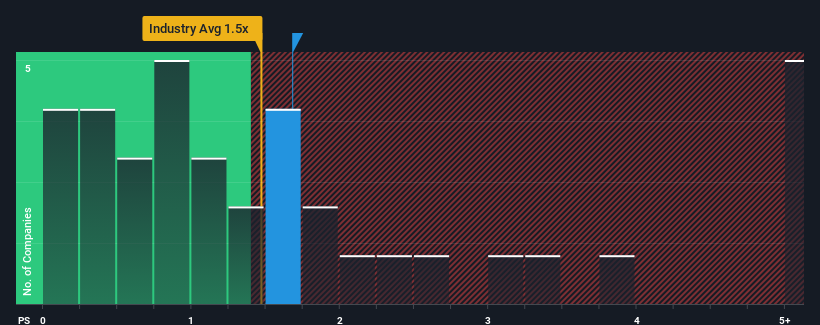

In spite of the heavy fall in price, there still wouldn't be many who think Qingdao AInnovation Technology Group's price-to-sales (or "P/S") ratio of 1.7x is worth a mention when the median P/S in Hong Kong's Software industry is similar at about 1.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Qingdao AInnovation Technology Group

How Qingdao AInnovation Technology Group Has Been Performing

Recent revenue growth for Qingdao AInnovation Technology Group has been in line with the industry. The P/S ratio is probably moderate because investors think this modest revenue performance will continue. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Qingdao AInnovation Technology Group.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Qingdao AInnovation Technology Group would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 12%. The latest three year period has also seen an excellent 279% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 13% per year over the next three years. With the industry predicted to deliver 19% growth each year, the company is positioned for a weaker revenue result.

With this information, we find it interesting that Qingdao AInnovation Technology Group is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Final Word

Following Qingdao AInnovation Technology Group's share price tumble, its P/S is just clinging on to the industry median P/S. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look at the analysts forecasts of Qingdao AInnovation Technology Group's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

Before you settle on your opinion, we've discovered 1 warning sign for Qingdao AInnovation Technology Group that you should be aware of.

If these risks are making you reconsider your opinion on Qingdao AInnovation Technology Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2121

AInnovation Technology Group

Engages in the research, development, and sale of artificial intelligence based software and hardware technology solutions in China.

Flawless balance sheet and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.