What Kind Of Investors Own Most Of Asiainfo Technologies Limited (HKG:1675)?

The big shareholder groups in Asiainfo Technologies Limited (HKG:1675) have power over the company. Institutions will often hold stock in bigger companies, and we expect to see insiders owning a noticeable percentage of the smaller ones. I generally like to see some degree of insider ownership, even if only a little. As Nassim Nicholas Taleb said, 'Don’t tell me what you think, tell me what you have in your portfolio.

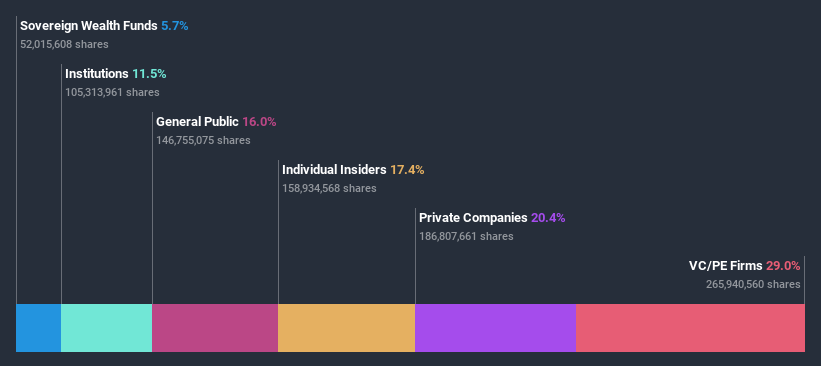

Asiainfo Technologies isn't enormous, but it's not particularly small either. It has a market capitalization of HK$9.7b, which means it would generally expect to see some institutions on the share registry. Taking a look at our data on the ownership groups (below), it seems that institutions are noticeable on the share registry. Let's take a closer look to see what the different types of shareholders can tell us about Asiainfo Technologies.

View our latest analysis for Asiainfo Technologies

What Does The Institutional Ownership Tell Us About Asiainfo Technologies?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

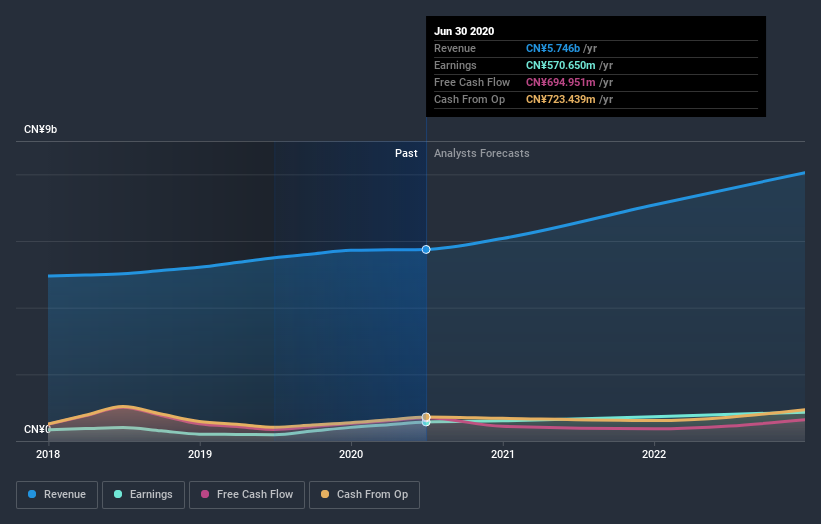

Asiainfo Technologies already has institutions on the share registry. Indeed, they own a respectable stake in the company. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at Asiainfo Technologies' earnings history below. Of course, the future is what really matters.

Asiainfo Technologies is not owned by hedge funds. The company's largest shareholder is CITIC Capital Partners Management Ltd., with ownership of 23%. For context, the second largest shareholder holds about 20% of the shares outstanding, followed by an ownership of 9.8% by the third-largest shareholder. Suning Tian, who is the third-largest shareholder, also happens to hold the title of Chairman of the Board. Furthermore, CEO Nianshu Gao is the owner of 0.5% of the company's shares.

After doing some more digging, we found that the top 3 shareholders collectively control more than half of the company's shares, implying that they have considerable power to influence the company's decisions.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. While there is some analyst coverage, the company is probably not widely covered. So it could gain more attention, down the track.

Insider Ownership Of Asiainfo Technologies

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our most recent data indicates that insiders own a reasonable proportion of Asiainfo Technologies Limited. Insiders own HK$1.7b worth of shares in the HK$9.7b company. That's quite meaningful. Most would be pleased to see the board is investing alongside them. You may wish to access this free chart showing recent trading by insiders.

General Public Ownership

The general public holds a 16% stake in Asiainfo Technologies. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Private Equity Ownership

Private equity firms hold a 29% stake in Asiainfo Technologies. This suggests they can be influential in key policy decisions. Sometimes we see private equity stick around for the long term, but generally speaking they have a shorter investment horizon and -- as the name suggests -- don't invest in public companies much. After some time they may look to sell and redeploy capital elsewhere.

Private Company Ownership

Our data indicates that Private Companies hold 20%, of the company's shares. It might be worth looking deeper into this. If related parties, such as insiders, have an interest in one of these private companies, that should be disclosed in the annual report. Private companies may also have a strategic interest in the company.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Asiainfo Technologies better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for Asiainfo Technologies you should be aware of.

If you would prefer discover what analysts are predicting in terms of future growth, do not miss this free report on analyst forecasts.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you decide to trade Asiainfo Technologies, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1675

AsiaInfo Technologies

An investment holding company, offers telecom software products and related services in the People’s Republic of China.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion