As the Asian markets navigate a landscape marked by U.S.-China trade tensions and deflationary pressures in China, investors are closely monitoring how these economic factors impact high-growth tech sectors. In such a dynamic environment, strong fundamentals, innovative capabilities, and adaptability to changing market conditions are key attributes that can make a tech stock worth watching.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Accton Technology | 24.08% | 28.54% | ★★★★★★ |

| Giant Network Group | 31.77% | 34.18% | ★★★★★★ |

| Fositek | 35.21% | 46.95% | ★★★★★★ |

| Eoptolink Technology | 38.08% | 35.42% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| Zhongji Innolight | 28.99% | 31.11% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| Foxconn Industrial Internet | 28.55% | 27.95% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

We'll examine a selection from our screener results.

Cafe24 (KOSDAQ:A042000)

Simply Wall St Growth Rating: ★★★★★☆

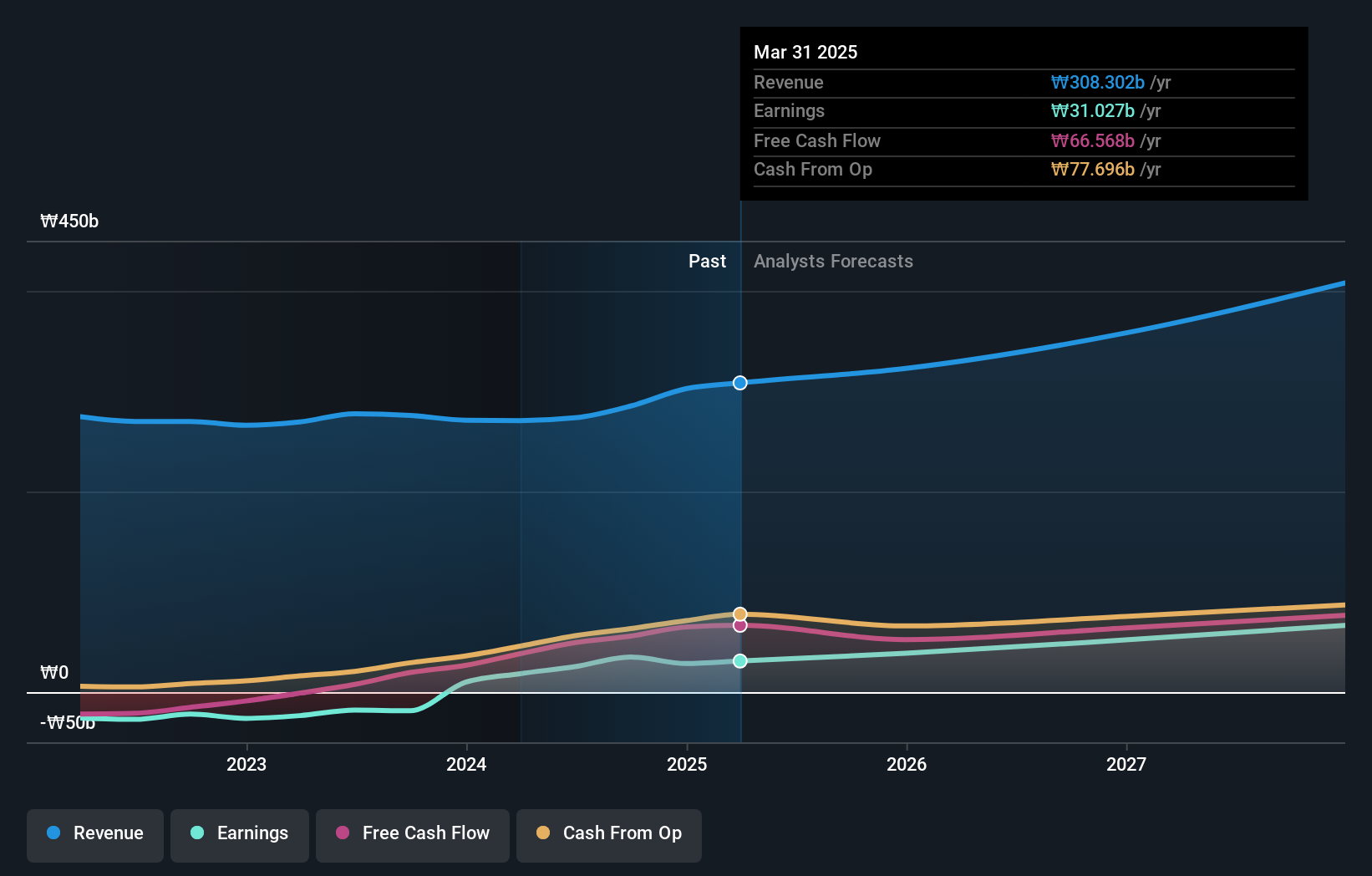

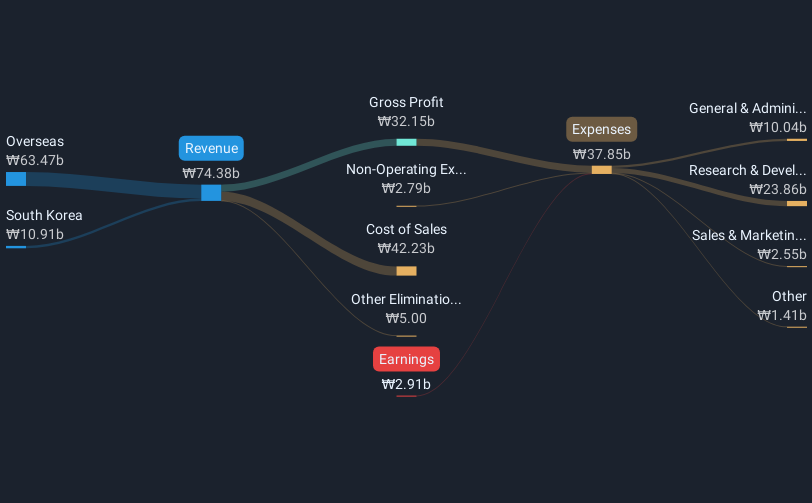

Overview: Cafe24 Corp. operates a global e-commerce platform with a market capitalization of approximately ₩884.92 billion.

Operations: Cafe24 Corp. generates revenue primarily through its Internet Business Solution segment, which accounts for ₩250.28 billion, followed by Transit and Clothes segments contributing ₩42.57 billion and ₩29.43 billion respectively.

Cafe24, a dynamic player in Asia's tech landscape, is outpacing its regional counterparts with an impressive 38.1% earnings growth over the past year, significantly higher than the IT industry's average of 6.9%. This growth trajectory is underpinned by robust forecasts indicating annual earnings and revenue increases of 31.7% and 12.6%, respectively—figures that eclipse broader market expectations. The company's commitment to innovation is evident in its substantial R&D investments, aligning with broader industry shifts towards scalable digital solutions. With a forward-looking approach marked by strategic client relationships and high-quality earnings, Cafe24 is well-positioned to capitalize on emerging tech trends in Asia.

- Click here to discover the nuances of Cafe24 with our detailed analytical health report.

Review our historical performance report to gain insights into Cafe24's's past performance.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc. is a biotechnology company specializing in the development of long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market cap of ₩23.69 trillion.

Operations: The company generates revenue primarily from its biotechnology segment, amounting to approximately ₩158.06 billion.

Alteogen's recent European Commission approval for EYLUXVI®, a biosimilar for Eylea, marks a significant stride in its biosimilar portfolio, enhancing its presence in the lucrative biopharmaceutical market. This approval, stemming from robust Phase 3 trials across multiple countries, underscores Alteogen's commitment to expanding treatment options in ophthalmology. Financially, Alteogen is poised for substantial growth with projected annual revenue and earnings increases of 56.3% and 65.1%, respectively—outpacing broader market expectations significantly. These figures reflect not only Alteogen’s strong R&D capabilities but also its strategic foresight in addressing high-demand medical needs, positioning it well within Asia’s high-growth tech landscape.

- Navigate through the intricacies of ALTEOGEN with our comprehensive health report here.

Explore historical data to track ALTEOGEN's performance over time in our Past section.

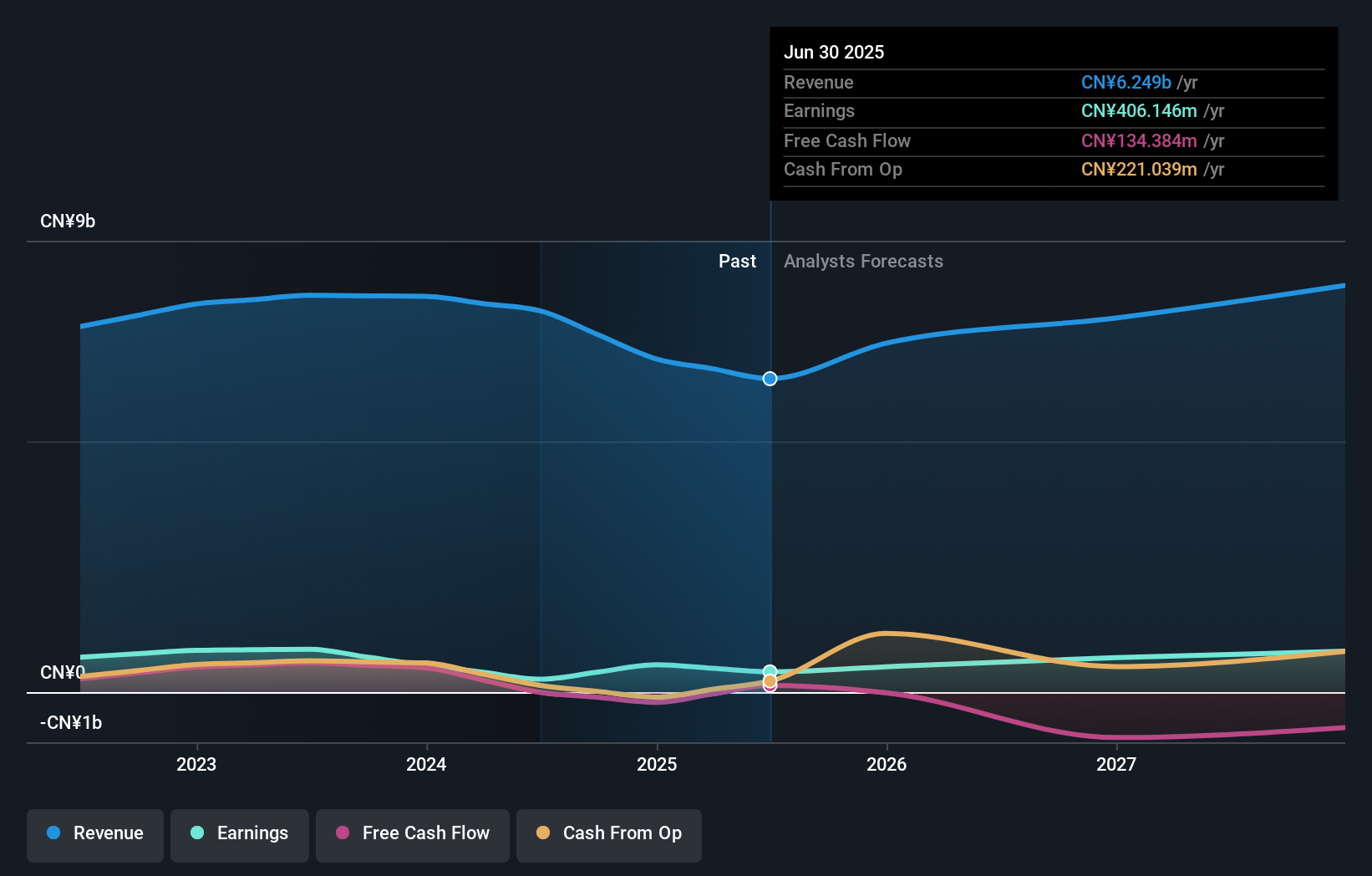

AsiaInfo Technologies (SEHK:1675)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AsiaInfo Technologies Limited is an investment holding company that provides telecom software products and related services in the People’s Republic of China, with a market capitalization of HK$8.25 billion.

Operations: The company generates revenue primarily from its communications software segment, totaling CN¥6.25 billion.

AsiaInfo Technologies' recent strategic alliance with Alibaba Cloud marks a pivotal advancement in its AI and cloud computing capabilities, emphasizing its role in delivering large-scale AI applications. Despite facing a net loss of CNY 198.26 million for the first half of 2025, the company is poised for recovery with expected earnings growth of 21.5% annually. This partnership could significantly enhance AsiaInfo's market position by integrating cutting-edge AI technologies into diverse sectors, potentially accelerating revenue growth beyond the current rate of 9.7% per year.

Seize The Opportunity

- Explore the 187 names from our Asian High Growth Tech and AI Stocks screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1675

AsiaInfo Technologies

An investment holding company, offers telecom software products and related services in the People’s Republic of China.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives