- Hong Kong

- /

- Trade Distributors

- /

- SEHK:1094

Many Still Looking Away From Cherish Sunshine International Limited (HKG:1094)

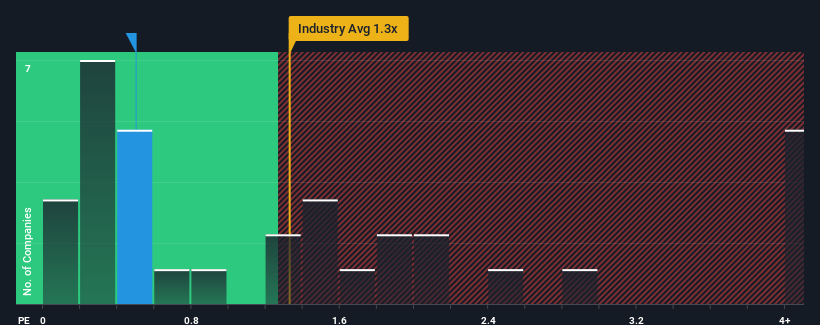

Cherish Sunshine International Limited's (HKG:1094) price-to-sales (or "P/S") ratio of 0.5x may look like a pretty appealing investment opportunity when you consider close to half the companies in the IT industry in Hong Kong have P/S ratios greater than 1.3x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Cherish Sunshine International

How Cherish Sunshine International Has Been Performing

Recent times have been quite advantageous for Cherish Sunshine International as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to dwindle, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for Cherish Sunshine International, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Cherish Sunshine International's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Cherish Sunshine International's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 111% gain to the company's top line. This great performance means it was also able to deliver immense revenue growth over the last three years. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

This is in contrast to the rest of the industry, which is expected to grow by 14% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it odd that Cherish Sunshine International is trading at a P/S lower than the industry. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Cherish Sunshine International revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

Plus, you should also learn about these 3 warning signs we've spotted with Cherish Sunshine International (including 1 which doesn't sit too well with us).

If you're unsure about the strength of Cherish Sunshine International's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1094

Cherish Sunshine International

An investment holding company, trades in various products in the People’s Republic of China.

Excellent balance sheet and good value.

Market Insights

Community Narratives