- Hong Kong

- /

- Semiconductors

- /

- SEHK:981

SMIC (SEHK:981) Valuation in Focus After Shares Hit Record Highs on Local DUV Breakthrough

Reviewed by Kshitija Bhandaru

If you’ve been watching Semiconductor Manufacturing International (SEHK:981) lately, you’ll know the action has been hard to ignore. The company’s Hong Kong-listed shares just climbed 6.9%, hitting their highest mark since they first debuted back in 2004. The spark? News broke that SMIC is testing a new deep-ultraviolet (DUV) lithography machine made domestically by a Shanghai-based start-up. This is an ambitious move meant to advance local chipmaking and potentially reduce reliance on overseas technology.

This tested breakthrough arrives as SMIC records its third straight day of gains, making it the third biggest percentage gainer on the Hang Seng Index. Over the past year, momentum has been impressive, with the stock delivering more than triple-digit returns for early holders and a steady build-up in recent months. In the context of longer-term performance, big swings like this can rekindle debate about just how far SMIC could go as global competition over chipmaking heats up.

So is this rally simply catching up to the company’s future potential, or is the market starting to price in projections that may already look stretched? Let’s dig into the valuation puzzle.

Most Popular Narrative: 37% Overvalued

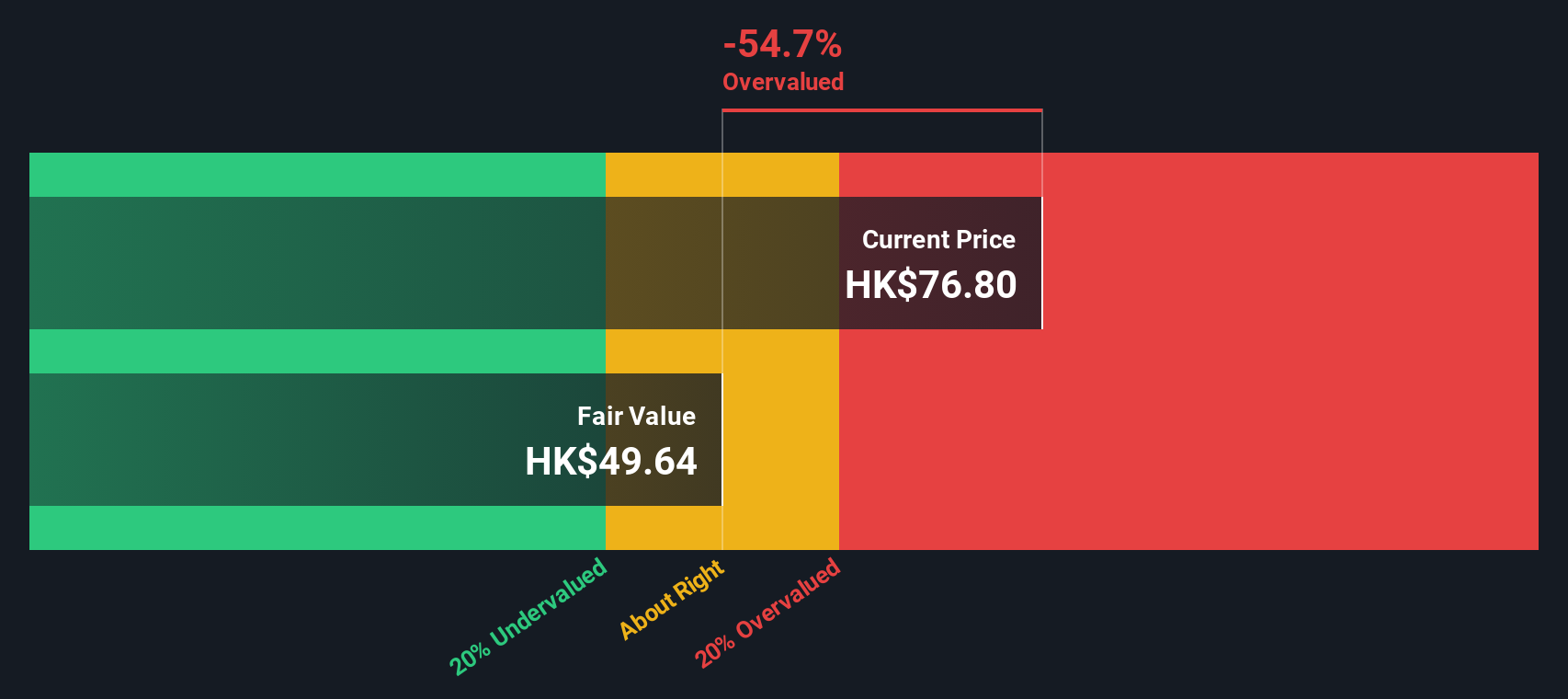

According to the most widely followed narrative, Semiconductor Manufacturing International is currently seen as significantly overvalued compared to underlying fair value assumptions.

“SMIC's aggressive expansion of wafer capacity, particularly in 8-inch and 12-inch nodes, positions the company to capture rising demand from domestic downstream markets such as automotive and analog. This is supported by strong volume growth and high utilization rates, which in turn supports long-term revenue growth and stabilization of gross margins. Deepening partnerships with domestic clients, especially in analog, power management, and CIS, amid global digitalization and rising electronics content in vehicles and edge devices, allows SMIC to win incremental orders and improve fab utilization. This directly lifts shipment volumes and revenues.”

What is really driving this narrative? Massive shifts in earnings potential, margin forecasts, and an unusually high future valuation multiple are at the heart of the calculation. Want to know which financial leap is fueling the bullish case, and whether the implied performance is truly achievable? The numbers behind this target might surprise you.

Result: Fair Value of $50.84 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent margin pressure and reliance on domestic demand could quickly dampen these growth expectations for Semiconductor Manufacturing International if market conditions change.

Find out about the key risks to this Semiconductor Manufacturing International narrative.Another View: What Does Our DCF Model Suggest?

Looking at it from a different angle, our SWS DCF model reaches a similar verdict. It also signals that shares may be priced above intrinsic value. Could both approaches be underestimating potential risks or rewards?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Semiconductor Manufacturing International for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Semiconductor Manufacturing International Narrative

If you have a different perspective, or want to dig into the numbers on your own terms, you can easily assemble your own view in just a few minutes. Do it your way.

A great starting point for your Semiconductor Manufacturing International research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Your next big opportunity could be closer than you think. With the right tools, you can uncover stocks primed for growth, income, or innovation. See what you’re missing. Opportunities move fast, and smart investors stay ahead.

- Spot value opportunities before the crowd by tracking undervalued stocks based on cash flows for companies trading below their true potential.

- Tap into the AI revolution by following AI penny stocks featuring businesses pushing boundaries in artificial intelligence.

- Capture steady income and resilience in your portfolio through dividend stocks with yields > 3% for top dividend payers with yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:981

Semiconductor Manufacturing International

An investment holding company, engages in the manufacture, testing, and sale of integrated circuits wafer and various compound semiconductors in the United States, China, and Eurasia.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives