- Hong Kong

- /

- Semiconductors

- /

- SEHK:981

Investors in Semiconductor Manufacturing International (HKG:981) have made a decent return of 87% over the past five years

While Semiconductor Manufacturing International Corporation (HKG:981) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 11% in the last quarter. On the bright side the returns have been quite good over the last half decade. Its return of 87% has certainly bested the market return! Unfortunately not all shareholders will have held it for the long term, so spare a thought for those caught in the 25% decline over the last twelve months.

Now it's worth having a look at the company's fundamentals too, because that will help us determine if the long term shareholder return has matched the performance of the underlying business.

However if you'd rather see where the opportunities and risks are within 981's industry, you can check out our analysis on the HK Semiconductor industry.

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

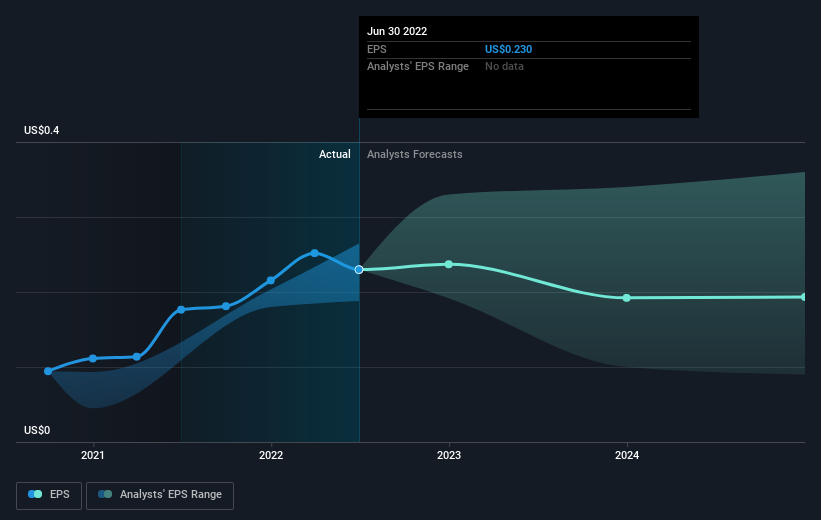

Over half a decade, Semiconductor Manufacturing International managed to grow its earnings per share at 26% a year. The EPS growth is more impressive than the yearly share price gain of 13% over the same period. So it seems the market isn't so enthusiastic about the stock these days. The reasonably low P/E ratio of 9.13 also suggests market apprehension.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that Semiconductor Manufacturing International has improved its bottom line over the last three years, but what does the future have in store? If you are thinking of buying or selling Semiconductor Manufacturing International stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

While the broader market lost about 22% in the twelve months, Semiconductor Manufacturing International shareholders did even worse, losing 25%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. On the bright side, long term shareholders have made money, with a gain of 13% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand Semiconductor Manufacturing International better, we need to consider many other factors. To that end, you should learn about the 2 warning signs we've spotted with Semiconductor Manufacturing International (including 1 which is potentially serious) .

But note: Semiconductor Manufacturing International may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:981

Semiconductor Manufacturing International

An investment holding company, engages in the manufacture, testing, and sale of integrated circuits wafer and various compound semiconductors in the United States, China, and Eurasia.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives