- Hong Kong

- /

- Semiconductors

- /

- SEHK:85

China Electronics Huada Technology's(HKG:85) Share Price Is Down 59% Over The Past Five Years.

While not a mind-blowing move, it is good to see that the China Electronics Huada Technology Company Limited (HKG:85) share price has gained 17% in the last three months. But that is little comfort to those holding over the last half decade, sitting on a big loss. In that time the share price has delivered a rude shock to holders, who find themselves down 59% after a long stretch. So we're not so sure if the recent bounce should be celebrated. However, in the best case scenario (far from fait accompli), this improved performance might be sustained.

See our latest analysis for China Electronics Huada Technology

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

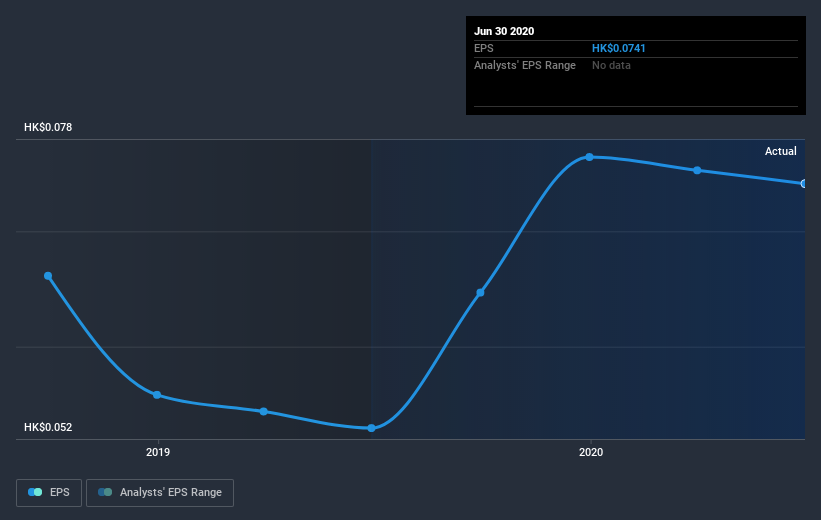

During the five years over which the share price declined, China Electronics Huada Technology's earnings per share (EPS) dropped by 3.0% each year. Readers should note that the share price has fallen faster than the EPS, at a rate of 16% per year, over the period. This implies that the market is more cautious about the business these days. The low P/E ratio of 11.87 further reflects this reticence.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into China Electronics Huada Technology's key metrics by checking this interactive graph of China Electronics Huada Technology's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, China Electronics Huada Technology's TSR for the last 5 years was -54%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

China Electronics Huada Technology provided a TSR of 15% over the last twelve months. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 9% endured over half a decade. It could well be that the business is stabilizing. It's always interesting to track share price performance over the longer term. But to understand China Electronics Huada Technology better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for China Electronics Huada Technology you should be aware of, and 2 of them can't be ignored.

But note: China Electronics Huada Technology may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you’re looking to trade China Electronics Huada Technology, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:85

China Electronics Huada Technology

An investment holding company, engages in the design, development, and sale of integrated circuit chips in the People’s Republic of China.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.