- Hong Kong

- /

- Semiconductors

- /

- SEHK:6865

Flat Glass Group (SEHK:6865) One-Off Loss Undercuts Bullish Growth Narrative Despite Strong Forecasts

Reviewed by Simply Wall St

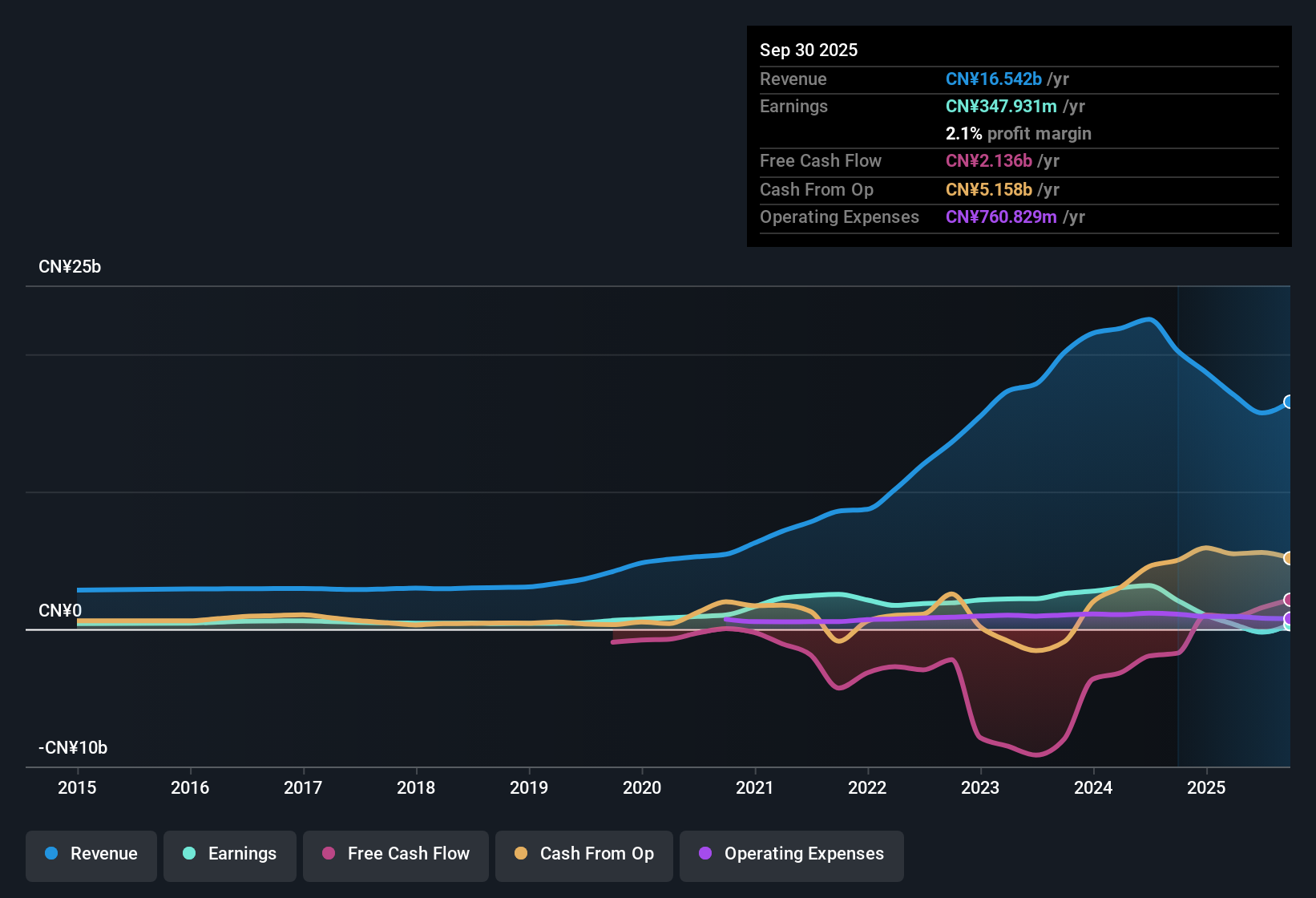

Flat Glass Group (SEHK:6865) delivered a mixed set of results in its latest filing, with earnings forecast to grow a brisk 69.92% per year and revenues expected to rise 17% per year, well ahead of the broader Hong Kong market. Net profit margins, however, have come under pressure, sliding to 2.1% from last year’s 10.3%, and the company recognized a one-off loss of CN¥290.4 million for the period ending September 30, 2025. Over the last five years, earnings have declined by 10.1% per year. This sets the stage for investors to closely watch whether rapid growth forecasts can offset current margin weakness.

See our full analysis for Flat Glass Group.The next section puts these headline figures side by side with the most widely discussed narratives around Flat Glass Group, revealing where the market’s expectations are met and where surprises emerge.

Curious how numbers become stories that shape markets? Explore Community Narratives

One-Off Loss of CN¥290.4 Million Raises Quality Questions

- The company recognized a one-off loss totaling CN¥290.4 million for the September 30, 2025 period. This loss weighed heavily on current period results and distorted the underlying earnings picture.

- While forecasts project significant earnings and revenue growth, this sizeable loss challenges the claim that Flat Glass Group’s near-term fundamentals are clean and repeatable.

- A one-off of this magnitude raises doubts about earnings durability, especially since net profit margins fell steeply to 2.1% compared to 10.3% the prior year.

- Despite growth optimism, investor focus shifts toward how much of future profitability is sustainable versus temporarily boosted by adjustments or non-core items.

Five-Year Earnings Slide Contrasts with Growth Story

- Over the last five years, Flat Glass Group’s earnings have declined by 10.1% each year on average. This shows a persistent downtrend at odds with the rapid growth forecast.

- The prevailing market view emphasizes strong future expansion driven by solar energy demand and new capacity investments, but

- The long-term earnings decline challenges the idea that past profitability is a reliable base for the bullish growth thesis.

- Investors must weigh whether investment in new projects and market tailwinds will be enough to reverse this established earnings shrinkage.

Trading at a Marked Premium to Industry Peers

- Flat Glass Group’s price-to-earnings ratio is 74.4x, which significantly exceeds both the industry average of 39.6x and peer average of 71.8x. The current share price stands at 12.15.

- The prevailing market view is that shares are priced for strong upside, but

- With a P/E multiple far above sector norms and trading above the analyst fair value estimate of 11.29, investors are paying a premium for expected growth.

- This premium suggests expectations are high, so any further margin pressure or earnings disappointments could heighten valuation risk going forward.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Flat Glass Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Flat Glass Group’s falling margins, persistent earnings decline, and premium valuation raise concerns about the sustainability and reliability of its future growth.

If seeing these red flags has you thinking twice, redirect your attention to stable growth stocks screener (2120 results), where companies consistently deliver healthier revenue and earnings without the same volatility or valuation risk.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6865

Flat Glass Group

Engages in the manufacture and sale of glass products in the People's Republic of China, the rest of Asia, Europe, North America, and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives