- Hong Kong

- /

- Semiconductors

- /

- SEHK:522

Why Investors Shouldn't Be Surprised By ASMPT Limited's (HKG:522) 27% Share Price Surge

ASMPT Limited (HKG:522) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 27%.

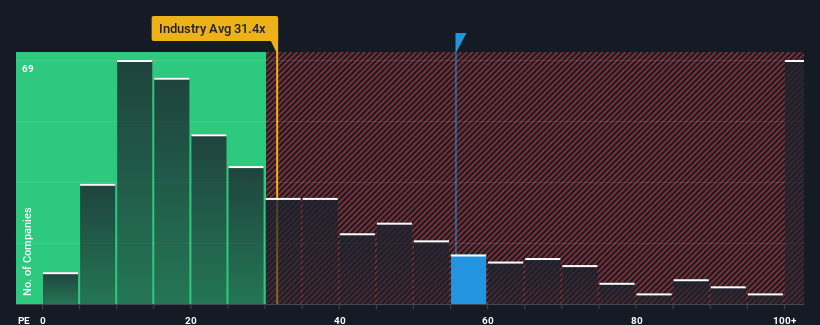

Since its price has surged higher, ASMPT may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 55.6x, since almost half of all companies in Hong Kong have P/E ratios under 8x and even P/E's lower than 4x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

With earnings that are retreating more than the market's of late, ASMPT has been very sluggish. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

Check out our latest analysis for ASMPT

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as ASMPT's is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 73%. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 12% in total. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Looking ahead now, EPS is anticipated to climb by 56% per annum during the coming three years according to the analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 16% per annum, which is noticeably less attractive.

In light of this, it's understandable that ASMPT's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From ASMPT's P/E?

Shares in ASMPT have built up some good momentum lately, which has really inflated its P/E. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of ASMPT's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

You always need to take note of risks, for example - ASMPT has 1 warning sign we think you should be aware of.

If you're unsure about the strength of ASMPT's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:522

ASMPT

An investment holding company, engages in the design, manufacture, and marketing of machines, tools, and materials used in the semiconductor and electronics assembly industries worldwide.

Excellent balance sheet with reasonable growth potential.