- Hong Kong

- /

- Semiconductors

- /

- SEHK:1385

While shareholders of Shanghai Fudan Microelectronics Group (HKG:1385) are in the black over 5 years, those who bought a week ago aren't so fortunate

It hasn't been the best quarter for Shanghai Fudan Microelectronics Group Company Limited (HKG:1385) shareholders, since the share price has fallen 30% in that time. But that scarcely detracts from the really solid long term returns generated by the company over five years. It's fair to say most would be happy with 114% the gain in that time. So while it's never fun to see a share price fall, it's important to look at a longer time horizon. The more important question is whether the stock is too cheap or too expensive today. Unfortunately not all shareholders will have held it for five years, so spare a thought for those caught in the 41% decline over the last three years: that's a long time to wait for profits.

Since the long term performance has been good but there's been a recent pullback of 7.4%, let's check if the fundamentals match the share price.

Check out our latest analysis for Shanghai Fudan Microelectronics Group

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

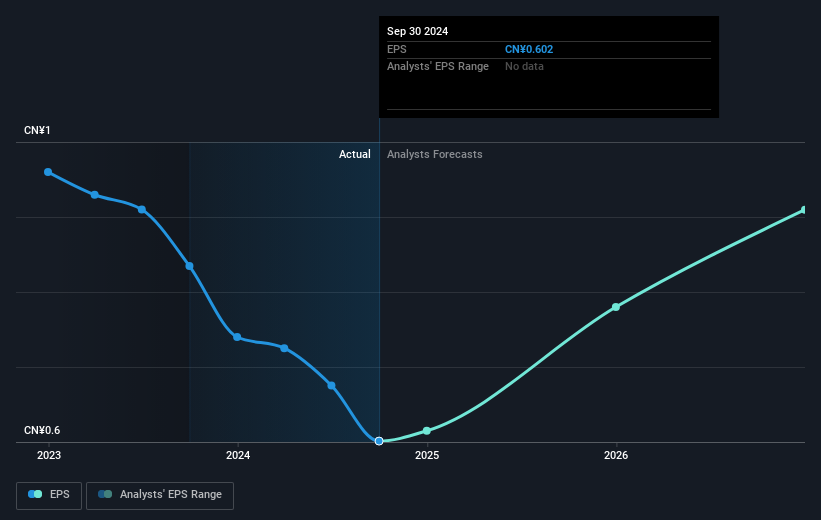

During the last half decade, Shanghai Fudan Microelectronics Group became profitable. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here. Given that the company made a profit three years ago, but not five years ago, it is worth looking at the share price returns over the last three years, too. We can see that the Shanghai Fudan Microelectronics Group share price is down 41% in the last three years. Meanwhile, EPS is up 0.8% per year. It would appear there's a real mismatch between the increasing EPS and the share price, which has declined -16% a year for three years.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Dive deeper into Shanghai Fudan Microelectronics Group's key metrics by checking this interactive graph of Shanghai Fudan Microelectronics Group's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Shanghai Fudan Microelectronics Group, it has a TSR of 118% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Shanghai Fudan Microelectronics Group shareholders gained a total return of 10% during the year. But that return falls short of the market. It's probably a good sign that the company has an even better long term track record, having provided shareholders with an annual TSR of 17% over five years. Maybe the share price is just taking a breather while the business executes on its growth strategy. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Shanghai Fudan Microelectronics Group has 3 warning signs we think you should be aware of.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1385

Shanghai Fudan Microelectronics Group

Engages in the design, development, and sale of integrated circuit products and total solutions in Mainland China and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion