- Hong Kong

- /

- Semiconductors

- /

- SEHK:1347

With A 27% Price Drop For Hua Hong Semiconductor Limited (HKG:1347) You'll Still Get What You Pay For

Hua Hong Semiconductor Limited (HKG:1347) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. The recent drop has obliterated the annual return, with the share price now down 9.7% over that longer period.

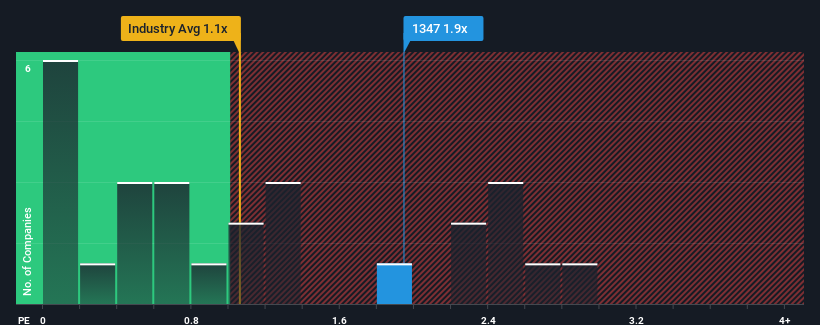

Although its price has dipped substantially, given close to half the companies operating in Hong Kong's Semiconductor industry have price-to-sales ratios (or "P/S") below 1.1x, you may still consider Hua Hong Semiconductor as a stock to potentially avoid with its 1.9x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Hua Hong Semiconductor

What Does Hua Hong Semiconductor's P/S Mean For Shareholders?

Hua Hong Semiconductor hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Hua Hong Semiconductor will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Hua Hong Semiconductor would need to produce impressive growth in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 22%. Even so, admirably revenue has lifted 66% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 19% each year over the next three years. That's shaping up to be materially higher than the 16% per year growth forecast for the broader industry.

With this information, we can see why Hua Hong Semiconductor is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

There's still some elevation in Hua Hong Semiconductor's P/S, even if the same can't be said for its share price recently. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look into Hua Hong Semiconductor shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Hua Hong Semiconductor that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Hua Hong Semiconductor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1347

Hua Hong Semiconductor

An investment holding company, engages in the manufacture and sale of semiconductor products in China, North America, Asia, Europe, and Japan.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives