- Hong Kong

- /

- Semiconductors

- /

- SEHK:1010

Not Many Are Piling Into Balk 1798 Group Limited (HKG:1010) Stock Yet As It Plummets 26%

To the annoyance of some shareholders, Balk 1798 Group Limited (HKG:1010) shares are down a considerable 26% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 50% share price decline.

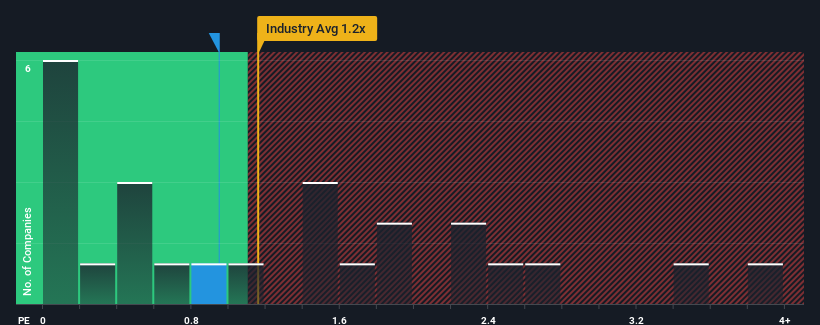

In spite of the heavy fall in price, it's still not a stretch to say that Balk 1798 Group's price-to-sales (or "P/S") ratio of 0.9x right now seems quite "middle-of-the-road" compared to the Semiconductor industry in Hong Kong, where the median P/S ratio is around 1.2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Balk 1798 Group

What Does Balk 1798 Group's Recent Performance Look Like?

Recent times have been quite advantageous for Balk 1798 Group as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to taper off, which has kept the P/S from rising. Those who are bullish on Balk 1798 Group will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Balk 1798 Group will help you shine a light on its historical performance.How Is Balk 1798 Group's Revenue Growth Trending?

Balk 1798 Group's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 152%. Pleasingly, revenue has also lifted 168% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 11% shows it's noticeably more attractive.

With this information, we find it interesting that Balk 1798 Group is trading at a fairly similar P/S compared to the industry. It may be that most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From Balk 1798 Group's P/S?

Following Balk 1798 Group's share price tumble, its P/S is just clinging on to the industry median P/S. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We didn't quite envision Balk 1798 Group's P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Balk 1798 Group (2 are a bit concerning!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Balk 1798 Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1010

Sky Blue 11

An investment holding company, engages in the design, distribution, and trade of integrated circuits and semiconductor parts in the People’s Republic of China, Hong Kong, and Taiwan.

Moderate risk and overvalued.

Market Insights

Community Narratives