- Hong Kong

- /

- Specialty Stores

- /

- SEHK:9992

Pop Mart (SEHK:9992) Valuation Check After Recent Share Price Pullback

Reviewed by Simply Wall St

Pop Mart International Group (SEHK:9992) has quietly turned into a high volatility ride, with the share price sliding about 5% in the past day and roughly 31% over the past 3 months, despite strong double digit revenue and profit growth.

See our latest analysis for Pop Mart International Group.

Zooming out, the stock is still up strongly over the past year in total shareholder return terms, but the recent 1 month and 3 month share price pullback suggests momentum is cooling as investors reassess how much growth is already priced in at HK$190.3.

If Pop Mart’s swings have you rethinking risk and reward, it could be a good time to broaden your radar and discover fast growing stocks with high insider ownership.

With sentiment softening but revenue and earnings still growing at a mid twenties clip, investors now face the key question: is Pop Mart trading at a rare discount to its growth potential, or has the market already priced in the future upside?

Price-to-Earnings of 33.9x: Is it justified?

At HK$190.3, Pop Mart trades on a 33.9x price-to-earnings multiple, a clear premium that suggests the market is paying up for growth.

The price-to-earnings, or P/E ratio, compares the current share price to the company’s earnings per share and is a common way to gauge how much investors are willing to pay for each unit of profit. For a fast growing specialty retailer with strong brand power and high quality earnings, investors often focus on this metric to judge whether current profits and expected future profits warrant a higher tag.

Right now, Pop Mart’s 33.9x P/E looks stretched against multiple benchmarks, hinting that the market is baking in very strong profit growth and sustained high returns on equity. Versus our estimated fair P/E of 27.1x, the current multiple sits notably higher, implying the share price may already be running ahead of what our fair ratio work suggests could be a more balanced level over time.

The gap is even starker when compared with the Hong Kong Specialty Retail industry average of just 12x, and also with the broader peer group average of 16.9x. That means investors are paying roughly double the sector norm for Pop Mart’s earnings and well above the fair ratio our model indicates, a sign the stock carries a substantial growth and quality premium that will need to be justified by future execution.

Explore the SWS fair ratio for Pop Mart International Group

Result: Price-to-Earnings of 33.9x (OVERVALUED)

However, investors face key risks, including a sharp slowdown in consumer spending in China and rising competition in designer toys, which could pressure volumes and margins.

Find out about the key risks to this Pop Mart International Group narrative.

Another View: DCF Signals Undervaluation

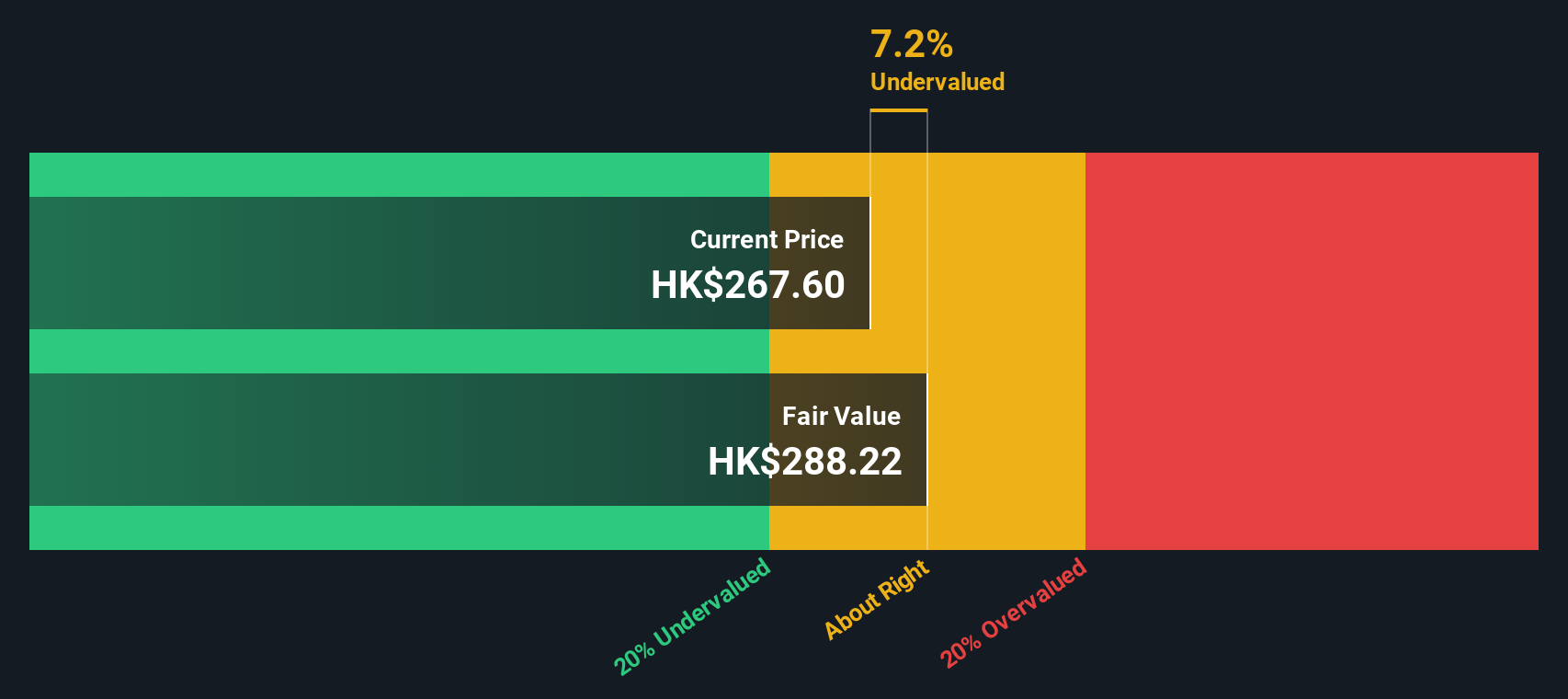

Our DCF model offers a different angle, suggesting Pop Mart’s fair value sits around HK$282.73, roughly 33% above the current HK$190.3 share price. While the 33.9x P/E appears rich, the cash flow view hints at upside, leaving investors to ask which lens will prove right.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Pop Mart International Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 900 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Pop Mart International Group Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Pop Mart International Group.

Looking for more investment ideas?

Before Pop Mart’s story moves on without you, consider scanning other opportunities that match your strategy and risk profile to help inform your next move.

- Look for potential mispricings early by targeting companies flagged as these 900 undervalued stocks based on cash flows, where current expectations may trail their long term cash flow strength.

- Focus on powerful secular trends by considering innovation driven opportunities like these 27 AI penny stocks that could reshape entire industries over the next decade.

- Support your income stream with cash returns from these 15 dividend stocks with yields > 3% while still keeping an eye on quality and balance sheet resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9992

Pop Mart International Group

An investment holding company, engages in the design, development, and sale of pop toys in the People’s Republic of China, Hong Kong, Macao, Taiwan, and internationally.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026