- Hong Kong

- /

- Specialty Stores

- /

- SEHK:8222

It's Probably Less Likely That E Lighting Group Holdings Limited's (HKG:8222) CEO Will See A Huge Pay Rise This Year

In the past three years, the share price of E Lighting Group Holdings Limited (HKG:8222) has struggled to grow and now shareholders are sitting on a loss. However, what is unusual is that EPS growth has been positive, suggesting that the share price has diverged from fundamentals. The AGM coming up on the 08 September 2021 could be an opportunity for shareholders to bring these concerns to the board's attention. They could also influence management through voting on resolutions such as executive remuneration. We discuss below why we think shareholders should be cautious of approving a raise for the CEO at the moment.

See our latest analysis for E Lighting Group Holdings

Comparing E Lighting Group Holdings Limited's CEO Compensation With the industry

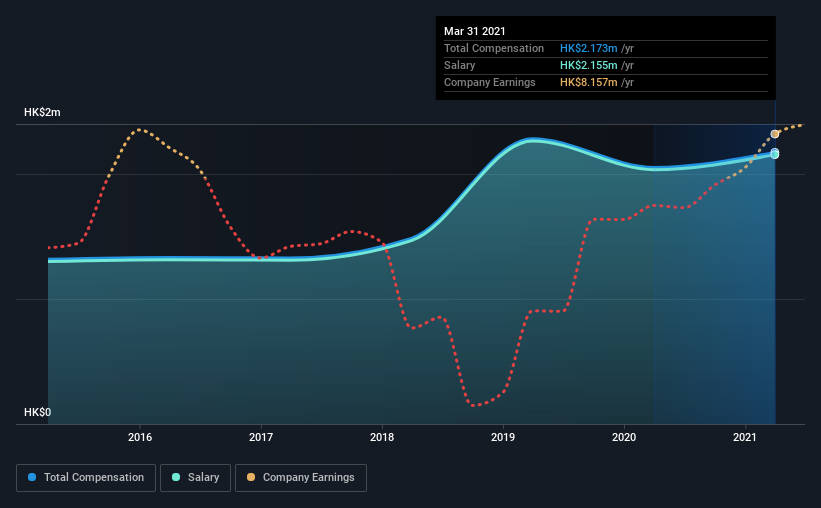

Our data indicates that E Lighting Group Holdings Limited has a market capitalization of HK$28m, and total annual CEO compensation was reported as HK$2.2m for the year to March 2021. That's a modest increase of 5.8% on the prior year. Notably, the salary which is HK$2.16m, represents most of the total compensation being paid.

For comparison, other companies in the industry with market capitalizations below HK$1.6b, reported a median total CEO compensation of HK$1.7m. So it looks like E Lighting Group Holdings compensates Raymond Hui in line with the median for the industry. What's more, Raymond Hui holds HK$13m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | HK$2.2m | HK$2.0m | 99% |

| Other | HK$18k | HK$18k | 1% |

| Total Compensation | HK$2.2m | HK$2.1m | 100% |

Speaking on an industry level, nearly 88% of total compensation represents salary, while the remainder of 12% is other remuneration. E Lighting Group Holdings has gone down a largely traditional route, paying Raymond Hui a high salary, giving it preference over non-salary benefits. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at E Lighting Group Holdings Limited's Growth Numbers

Over the past three years, E Lighting Group Holdings Limited has seen its earnings per share (EPS) grow by 104% per year. It achieved revenue growth of 37% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. The combination of strong revenue growth with medium-term EPS improvement certainly points to the kind of growth we like to see. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has E Lighting Group Holdings Limited Been A Good Investment?

The return of -56% over three years would not have pleased E Lighting Group Holdings Limited shareholders. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

E Lighting Group Holdings pays its CEO a majority of compensation through a salary. Shareholders have not seen their shares grow in value, rather they have seen their shares decline. A huge lag in share price growth when earnings have grown may indicate there could be other issues that are affecting the company at the moment that the market is focused on. Shareholders would be keen to know what's holding the stock back when earnings have grown. The upcoming AGM will be a chance for shareholders to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. In our study, we found 4 warning signs for E Lighting Group Holdings you should be aware of, and 1 of them makes us a bit uncomfortable.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if E Lighting Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:8222

E Lighting Group Holdings

Engages in the retail sale of lighting, designer label furniture, and household products in Hong Kong.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026