- Hong Kong

- /

- Retail Distributors

- /

- SEHK:8126

Here's Why I Think G.A. Holdings (HKG:8126) Is An Interesting Stock

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like G.A. Holdings (HKG:8126). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for G.A. Holdings

How Fast Is G.A. Holdings Growing?

As one of my mentors once told me, share price follows earnings per share (EPS). That makes EPS growth an attractive quality for any company. I, for one, am blown away by the fact that G.A. Holdings has grown EPS by 47% per year, over the last three years. That sort of growth never lasts long, but like a shooting star it is well worth watching when it happens.

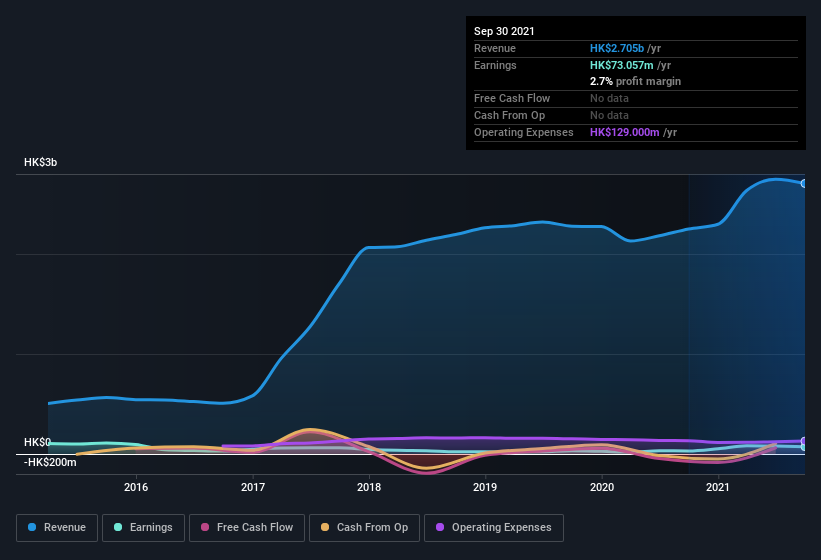

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). While we note G.A. Holdings's EBIT margins were flat over the last year, revenue grew by a solid 20% to HK$2.7b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

G.A. Holdings isn't a huge company, given its market capitalization of HK$141m. That makes it extra important to check on its balance sheet strength.

Are G.A. Holdings Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The good news for G.A. Holdings shareholders is that no insiders reported selling shares in the last year. So it's definitely nice that Executive Director Guo Qiang Xue bought HK$48k worth of shares at an average price of around HK$0.28.

I do like that insiders have been buying shares in G.A. Holdings, but there is more evidence of shareholder friendly management. I refer to the very reasonable level of CEO pay. I discovered that the median total compensation for the CEOs of companies like G.A. Holdings with market caps under HK$1.6b is about HK$1.8m.

G.A. Holdings offered total compensation worth HK$1.5m to its CEO in the year to . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add G.A. Holdings To Your Watchlist?

G.A. Holdings's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. Better yet, we can observe insider buying and the chief executive pay looks reasonable. The strong EPS growth suggests G.A. Holdings may be at an inflection point. For those chasing fast growth, then, I'd suggest to stock merits monitoring. What about risks? Every company has them, and we've spotted 2 warning signs for G.A. Holdings you should know about.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of G.A. Holdings, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8126

G.A. Holdings

An investment holding company, engages in the sale of motor vehicles and provision of car-related technical services in Hong Kong and the People’s Republic of China.

Moderate and slightly overvalued.

Market Insights

Community Narratives