Are Xinhua Winshare Publishing and Media's (HKG:811) Statutory Earnings A Good Reflection Of Its Earnings Potential?

As a general rule, we think profitable companies are less risky than companies that lose money. That said, the current statutory profit is not always a good guide to a company's underlying profitability. Today we'll focus on whether this year's statutory profits are a good guide to understanding Xinhua Winshare Publishing and Media (HKG:811).

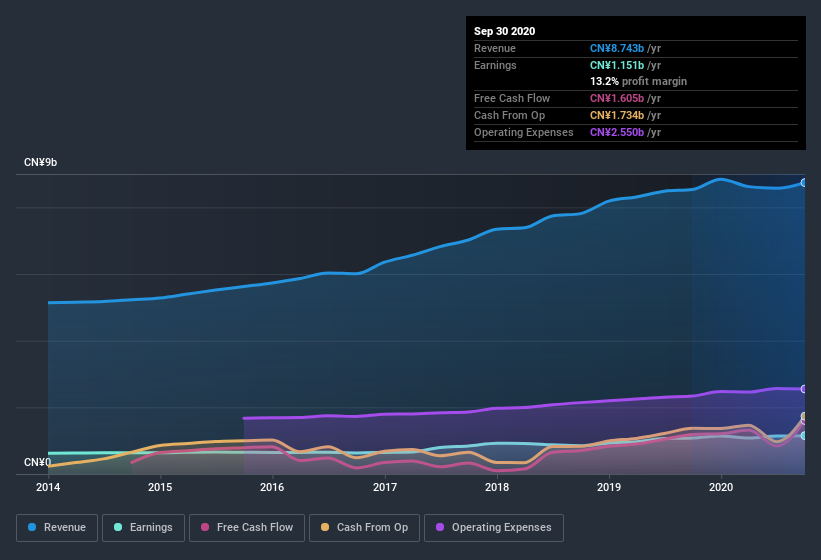

While Xinhua Winshare Publishing and Media was able to generate revenue of CN¥8.74b in the last twelve months, we think its profit result of CN¥1.15b was more important. One positive is that it has grown both its profit and its revenue, over the last few years.

View our latest analysis for Xinhua Winshare Publishing and Media

Of course, it is only sensible to look beyond the statutory profits and question how well those numbers represent the sustainable earnings power of the business. So today we'll look at what Xinhua Winshare Publishing and Media's cashflow and unusual items tell us about the quality of its earnings. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Xinhua Winshare Publishing and Media.

A Closer Look At Xinhua Winshare Publishing and Media's Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. This ratio tells us how much of a company's profit is not backed by free cashflow.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

Xinhua Winshare Publishing and Media has an accrual ratio of -0.11 for the year to September 2020. Therefore, its statutory earnings were quite a lot less than its free cashflow. In fact, it had free cash flow of CN¥1.6b in the last year, which was a lot more than its statutory profit of CN¥1.15b. Xinhua Winshare Publishing and Media's free cash flow improved over the last year, which is generally good to see. Having said that, there is more to the story. We can see that unusual items have impacted its statutory profit, and therefore the accrual ratio.

How Do Unusual Items Influence Profit?

While the accrual ratio might bode well, we also note that Xinhua Winshare Publishing and Media's profit was boosted by unusual items worth CN¥133m in the last twelve months. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. And that's as you'd expect, given these boosts are described as 'unusual'. If Xinhua Winshare Publishing and Media doesn't see that contribution repeat, then all else being equal we'd expect its profit to drop over the current year.

Our Take On Xinhua Winshare Publishing and Media's Profit Performance

In conclusion, Xinhua Winshare Publishing and Media's accrual ratio suggests its statutory earnings are of good quality, but on the other hand the profits were boosted by unusual items. Based on these factors, it's hard to tell if Xinhua Winshare Publishing and Media's profits are a reasonable reflection of its underlying profitability. If you'd like to know more about Xinhua Winshare Publishing and Media as a business, it's important to be aware of any risks it's facing. For example - Xinhua Winshare Publishing and Media has 1 warning sign we think you should be aware of.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

When trading Xinhua Winshare Publishing and Media or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:811

Xinhua Winshare Publishing and Media

Xinhua Winshare Publishing and Media Co., Ltd.

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.