- Hong Kong

- /

- Specialty Stores

- /

- SEHK:6909

BetterLife Holding Limited (HKG:6909) Stock Rockets 27% As Investors Are Less Pessimistic Than Expected

BetterLife Holding Limited (HKG:6909) shares have continued their recent momentum with a 27% gain in the last month alone. But the last month did very little to improve the 66% share price decline over the last year.

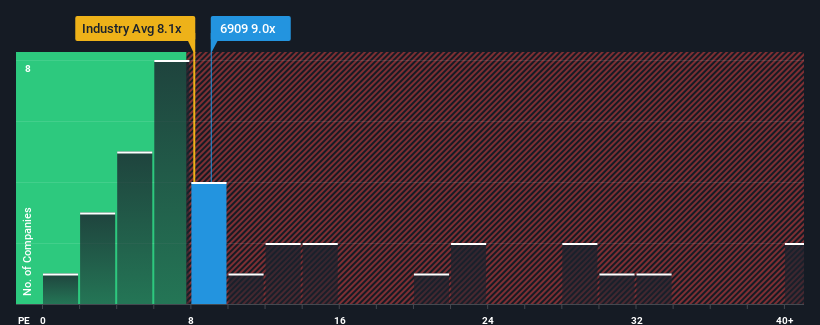

Although its price has surged higher, you could still be forgiven for feeling indifferent about BetterLife Holding's P/E ratio of 9x, since the median price-to-earnings (or "P/E") ratio in Hong Kong is also close to 10x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

As an illustration, earnings have deteriorated at BetterLife Holding over the last year, which is not ideal at all. It might be that many expect the company to put the disappointing earnings performance behind them over the coming period, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for BetterLife Holding

Is There Some Growth For BetterLife Holding?

The only time you'd be comfortable seeing a P/E like BetterLife Holding's is when the company's growth is tracking the market closely.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 67%. The last three years don't look nice either as the company has shrunk EPS by 83% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

In contrast to the company, the rest of the market is expected to grow by 20% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

In light of this, it's somewhat alarming that BetterLife Holding's P/E sits in line with the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh on the share price eventually.

What We Can Learn From BetterLife Holding's P/E?

BetterLife Holding appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that BetterLife Holding currently trades on a higher than expected P/E since its recent earnings have been in decline over the medium-term. Right now we are uncomfortable with the P/E as this earnings performance is unlikely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

Don't forget that there may be other risks. For instance, we've identified 5 warning signs for BetterLife Holding (2 can't be ignored) you should be aware of.

If these risks are making you reconsider your opinion on BetterLife Holding, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if BetterLife Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6909

BetterLife Holding

Provides automobile dealership services with a focus on luxury and ultra-luxury brands in the People’s Republic of China.

Flawless balance sheet with proven track record.