- Hong Kong

- /

- Specialty Stores

- /

- SEHK:6110

Topsports International Holdings (SEHK:6110) Eyes Growth with New Brand Partnerships and Strong Dividends

Reviewed by Simply Wall St

Topsports International Holdings (SEHK:6110) Continues to Demonstrate Market Resilience

Topsports International Holdings continues to demonstrate its market resilience through a well-integrated omnichannel strategy, enhancing consumer engagement and financial strength with a high dividend yield of 14.97%. Recent developments include strategic partnerships with brands like Norda and Mitchell & Ness, aimed at expanding their market presence in various sports subcategories. The company report will cover key areas such as financial performance, strategic gaps, future growth prospects, and regulatory challenges.

Core Advantages Driving Sustained Success for Topsports International Holdings

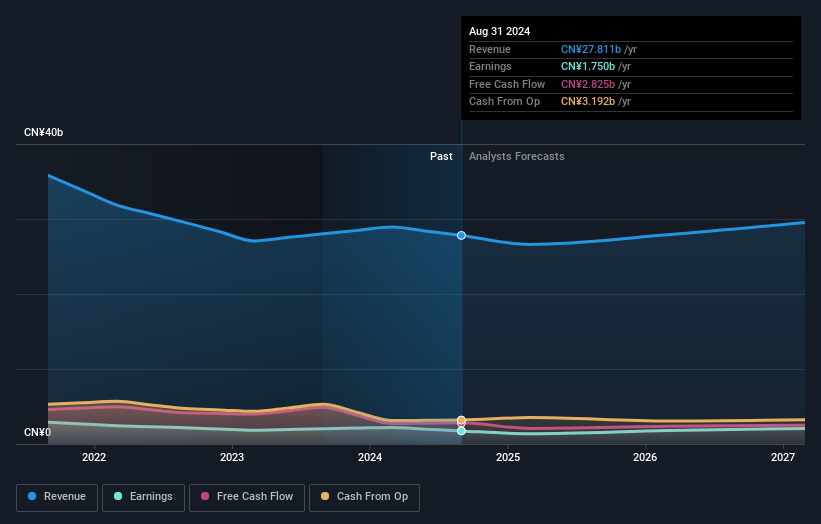

Topsports International Holdings has effectively leveraged its omnichannel strategy to integrate online and offline channels, as highlighted by CEO Wu Yu. This integration has enhanced consumer engagement and acquisition, adapting to evolving consumer preferences. The company's cash generation capability, as noted by Rebecca Zhang, Head of Capital Markets, underscores its financial health, with cash reserves of RMB 400 million and a high dividend payout ratio of 99.9%. This financial strength is complemented by a high dividend yield of 14.97%, placing it among the top dividend payers in the Hong Kong market. Moreover, the company's earnings are forecasted to grow at 10.97% annually, indicating strong future prospects. The stock's trading below its estimated fair value suggests it may be undervalued, further reinforcing its market position.

Strategic Gaps That Could Affect Topsports International Holdings

The company faces challenges such as declining past earnings, which have decreased by 5.3% annually over the past five years. This decline is coupled with a current return on equity of 18.4%, which is lower than the industry standard. Additionally, Topsports has experienced a 7.9% drop in revenue to CNY 13.05 billion, with a corresponding 3.6% decrease in gross profit margin, as reported by Rebecca Zhang. These financial challenges are exacerbated by unreliable dividend payments over the past five years, potentially impacting investor confidence. The pressure on brick-and-mortar stores, due to changing consumer behavior towards online shopping, further complicates the company's operational environment.

Future Prospects for Topsports International Holdings in the Market

The company is actively expanding its presence in various sports subcategories, as noted by Wu Yu, which presents significant growth opportunities. Strategic partnerships with new brands like Norda and Mitchell & Ness are expected to enhance product offerings and tap into new market segments. Furthermore, government measures aimed at stimulating consumption could positively impact the market, creating opportunities for increased consumer spending. These initiatives could bolster Topsports' market position and capitalize on emerging opportunities, driving performance and market share growth.

Regulatory Challenges Facing Topsports International Holdings

The consumer market's uncertainty poses a risk to future sales and revenue growth, a concern voiced by Wu Yu. High industry inventory levels, coupled with competitive pressures, could affect pricing strategies and profitability. Additionally, economic headwinds and shifts in consumer behavior towards online shopping present threats to traditional retail operations, as noted by industry executives. These external factors could impact Topsports' ability to maintain its market share and necessitate strategic adjustments to navigate these challenges effectively.

Conclusion

Topsports International Holdings' successful integration of online and offline channels has significantly improved consumer engagement, aligning with changing consumer preferences and setting the stage for sustained growth. The company faces challenges such as declining past earnings and pressures on traditional retail operations, but its strong cash reserves and high dividend payout underscore its financial resilience. With strategic expansions and partnerships, Topsports is well-positioned to capitalize on emerging market opportunities, potentially enhancing future earnings growth forecasted at 10.97% annually. Importantly, the current market price suggests the stock is trading below its fair value, offering an attractive entry point for investors looking to benefit from the company's promising growth trajectory.

Key Takeaways

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

```Valuation is complex, but we're here to simplify it.

Discover if Topsports International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6110

Topsports International Holdings

An investment holding company, engages in the trading of sportswear products in the People’s Republic of China.

Flawless balance sheet, undervalued and pays a dividend.