- Hong Kong

- /

- Specialty Stores

- /

- SEHK:6033

A Look Into Telecom Digital Holdings' (HKG:6033) Impressive Returns On Capital

To find a multi-bagger stock, what are the underlying trends we should look for in a business? Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. Ergo, when we looked at the ROCE trends at Telecom Digital Holdings (HKG:6033), we liked what we saw.

What Is Return On Capital Employed (ROCE)?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. Analysts use this formula to calculate it for Telecom Digital Holdings:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.32 = HK$139m ÷ (HK$1.4b - HK$961m) (Based on the trailing twelve months to September 2022).

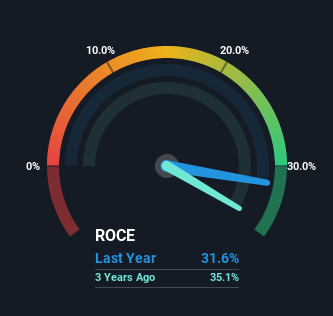

Therefore, Telecom Digital Holdings has an ROCE of 32%. In absolute terms that's a great return and it's even better than the Specialty Retail industry average of 11%.

Check out our latest analysis for Telecom Digital Holdings

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you'd like to look at how Telecom Digital Holdings has performed in the past in other metrics, you can view this free graph of past earnings, revenue and cash flow.

What Can We Tell From Telecom Digital Holdings' ROCE Trend?

Telecom Digital Holdings deserves to be commended in regards to it's returns. The company has consistently earned 32% for the last five years, and the capital employed within the business has risen 49% in that time. Now considering ROCE is an attractive 32%, this combination is actually pretty appealing because it means the business can consistently put money to work and generate these high returns. You'll see this when looking at well operated businesses or favorable business models.

Another point to note, we noticed the company has increased current liabilities over the last five years. This is intriguing because if current liabilities hadn't increased to 69% of total assets, this reported ROCE would probably be less than32% because total capital employed would be higher.The 32% ROCE could be even lower if current liabilities weren't 69% of total assets, because the the formula would show a larger base of total capital employed. So with current liabilities at such high levels, this effectively means the likes of suppliers or short-term creditors are funding a meaningful part of the business, which in some instances can bring some risks.

Our Take On Telecom Digital Holdings' ROCE

In summary, we're delighted to see that Telecom Digital Holdings has been compounding returns by reinvesting at consistently high rates of return, as these are common traits of a multi-bagger. Yet over the last five years the stock has declined 17%, so the decline might provide an opening. That's why we think it'd be worthwhile to look further into this stock given the fundamentals are appealing.

Telecom Digital Holdings does have some risks, we noticed 6 warning signs (and 3 which shouldn't be ignored) we think you should know about.

High returns are a key ingredient to strong performance, so check out our free list ofstocks earning high returns on equity with solid balance sheets.

Valuation is complex, but we're here to simplify it.

Discover if Telecom Digital Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6033

Telecom Digital Holdings

An investment holding company, engages in the telecommunications and related businesses in Hong Kong and the People’s Republic of China.

Moderate risk and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026