- Hong Kong

- /

- Specialty Stores

- /

- SEHK:3813

Pou Sheng International (Holdings) (HKG:3813) Seems To Use Debt Quite Sensibly

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Pou Sheng International (Holdings) Limited (HKG:3813) does use debt in its business. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Pou Sheng International (Holdings)

What Is Pou Sheng International (Holdings)'s Debt?

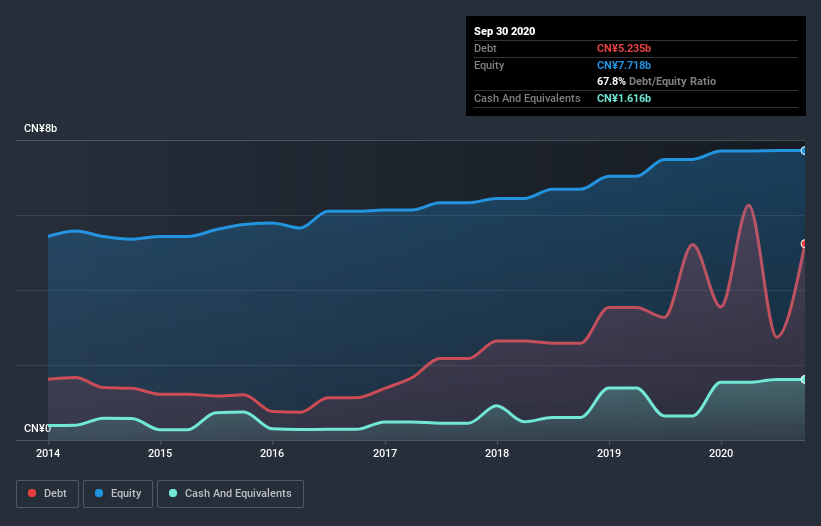

You can click the graphic below for the historical numbers, but it shows that Pou Sheng International (Holdings) had CN¥2.74b of debt in June 2020, down from CN¥5.21b, one year before. However, it also had CN¥1.62b in cash, and so its net debt is CN¥1.13b.

How Healthy Is Pou Sheng International (Holdings)'s Balance Sheet?

According to the last reported balance sheet, Pou Sheng International (Holdings) had liabilities of CN¥6.50b due within 12 months, and liabilities of CN¥1.64b due beyond 12 months. Offsetting this, it had CN¥1.62b in cash and CN¥3.67b in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥2.86b.

This deficit isn't so bad because Pou Sheng International (Holdings) is worth CN¥8.11b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Looking at its net debt to EBITDA of 0.76 and interest cover of 3.6 times, it seems to us that Pou Sheng International (Holdings) is probably using debt in a pretty reasonable way. But the interest payments are certainly sufficient to have us thinking about how affordable its debt is. Importantly, Pou Sheng International (Holdings)'s EBIT fell a jaw-dropping 40% in the last twelve months. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Pou Sheng International (Holdings)'s ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, Pou Sheng International (Holdings) recorded free cash flow worth a fulsome 96% of its EBIT, which is stronger than we'd usually expect. That puts it in a very strong position to pay down debt.

Our View

Based on what we've seen Pou Sheng International (Holdings) is not finding it easy, given its EBIT growth rate, but the other factors we considered give us cause to be optimistic. In particular, we are dazzled with its conversion of EBIT to free cash flow. Looking at all this data makes us feel a little cautious about Pou Sheng International (Holdings)'s debt levels. While we appreciate debt can enhance returns on equity, we'd suggest that shareholders keep close watch on its debt levels, lest they increase. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 1 warning sign for Pou Sheng International (Holdings) that you should be aware of before investing here.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you’re looking to trade Pou Sheng International (Holdings), open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:3813

Pou Sheng International (Holdings)

An investment holding company, engages in distributing and retailing sportswear and footwear in the People’s Republic of China and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives