- Hong Kong

- /

- Specialty Stores

- /

- SEHK:3709

Will Weakness in EEKA Fashion Holdings Limited's (HKG:3709) Stock Prove Temporary Given Strong Fundamentals?

It is hard to get excited after looking at EEKA Fashion Holdings' (HKG:3709) recent performance, when its stock has declined 38% over the past three months. However, stock prices are usually driven by a company’s financial performance over the long term, which in this case looks quite promising. Specifically, we decided to study EEKA Fashion Holdings' ROE in this article.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

See our latest analysis for EEKA Fashion Holdings

How Is ROE Calculated?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for EEKA Fashion Holdings is:

11% = CN¥367m ÷ CN¥3.3b (Based on the trailing twelve months to June 2020).

The 'return' is the yearly profit. One way to conceptualize this is that for each HK$1 of shareholders' capital it has, the company made HK$0.11 in profit.

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

EEKA Fashion Holdings' Earnings Growth And 11% ROE

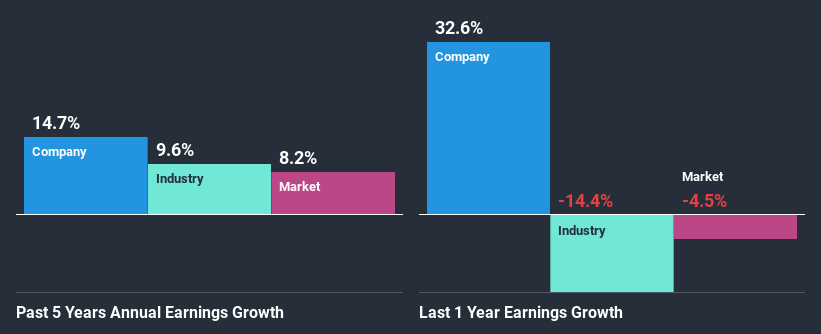

To begin with, EEKA Fashion Holdings seems to have a respectable ROE. And on comparing with the industry, we found that the the average industry ROE is similar at 9.5%. This certainly adds some context to EEKA Fashion Holdings' moderate 15% net income growth seen over the past five years.

As a next step, we compared EEKA Fashion Holdings' net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 9.6%.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). This then helps them determine if the stock is placed for a bright or bleak future. Is EEKA Fashion Holdings fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is EEKA Fashion Holdings Making Efficient Use Of Its Profits?

EEKA Fashion Holdings has a three-year median payout ratio of 38%, which implies that it retains the remaining 62% of its profits. This suggests that its dividend is well covered, and given the decent growth seen by the company, it looks like management is reinvesting its earnings efficiently.

Besides, EEKA Fashion Holdings has been paying dividends over a period of six years. This shows that the company is committed to sharing profits with its shareholders.

Conclusion

On the whole, we feel that EEKA Fashion Holdings' performance has been quite good. Specifically, we like that the company is reinvesting a huge chunk of its profits at a high rate of return. This of course has caused the company to see substantial growth in its earnings. Having said that, looking at the current analyst estimates, we found that the company's earnings are expected to gain momentum. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

If you’re looking to trade EEKA Fashion Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if EEKA Fashion Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:3709

EEKA Fashion Holdings

An investment holding company, engages in the design, promotion, marketing, retail, and wholesale of self-owned branded ladies’ wear products in the People’s Republic of China.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives