- Japan

- /

- Trade Distributors

- /

- TSE:9678

Undiscovered Gems To Watch This November 2024

Reviewed by Simply Wall St

As global markets navigate the complexities of policy changes under the new Trump administration, small-cap stocks have experienced noticeable volatility, with key indices like the Russell 2000 reflecting a decline amidst broader market fluctuations. In this environment, identifying undiscovered gems requires a keen eye for companies that demonstrate resilience and potential growth despite economic uncertainties and shifting regulatory landscapes.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Primadaya Plastisindo | 12.52% | 18.29% | 26.12% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Tethys Petroleum | NA | 29.98% | 44.48% | ★★★★☆☆ |

We'll examine a selection from our screener results.

EEKA Fashion Holdings (SEHK:3709)

Simply Wall St Value Rating: ★★★★★★

Overview: EEKA Fashion Holdings Limited is an investment holding company involved in the design, promotion, marketing, retail, and wholesale of self-owned branded ladies' wear products in the People’s Republic of China with a market cap of HK$6.08 billion.

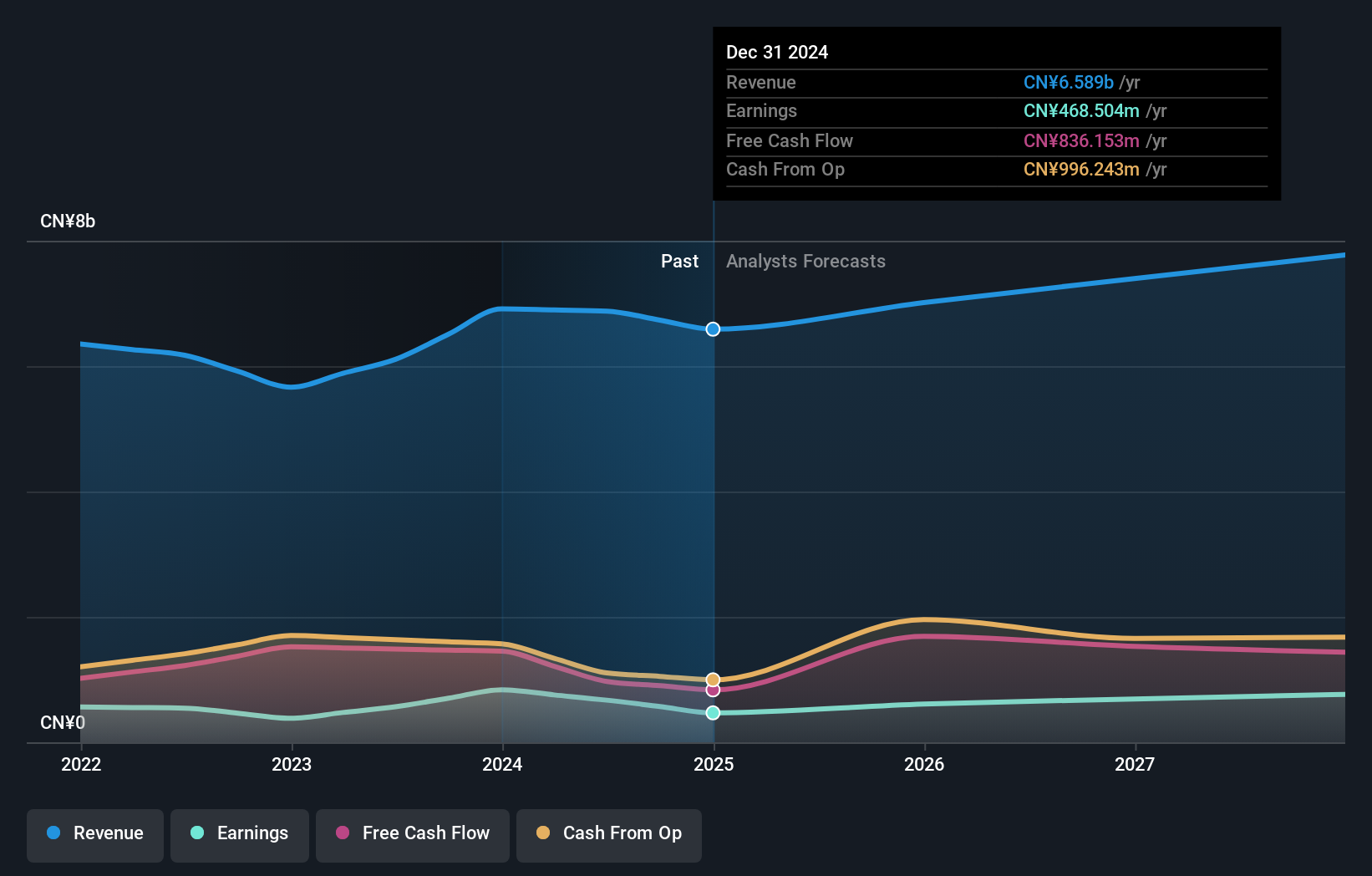

Operations: EEKA Fashion Holdings generates revenue primarily from the retailing and wholesaling of ladies' wear, amounting to CN¥6.88 billion.

EEKA Fashion Holdings, a small player in the fashion industry, has shown robust financial health with its debt-to-equity ratio dropping from 24.8% to 14.3% over five years. The company seems well-positioned with earnings growing by 18.4% last year, outpacing the specialty retail sector's -14.5%. Its EBIT covers interest payments 30 times over, indicating strong profitability and financial stability. Despite shareholder dilution in the past year, EEKA trades at a significant discount of 81.8% below estimated fair value, suggesting potential for value appreciation as it continues to grow earnings projected at 11.41% annually.

- Unlock comprehensive insights into our analysis of EEKA Fashion Holdings stock in this health report.

Gain insights into EEKA Fashion Holdings' past trends and performance with our Past report.

COSCO SHIPPING International (Hong Kong) (SEHK:517)

Simply Wall St Value Rating: ★★★★★★

Overview: COSCO SHIPPING International (Hong Kong) Co., Ltd. is an investment holding company that offers a range of shipping services both in the People’s Republic of China and internationally, with a market capitalization of approximately HK$6.11 billion.

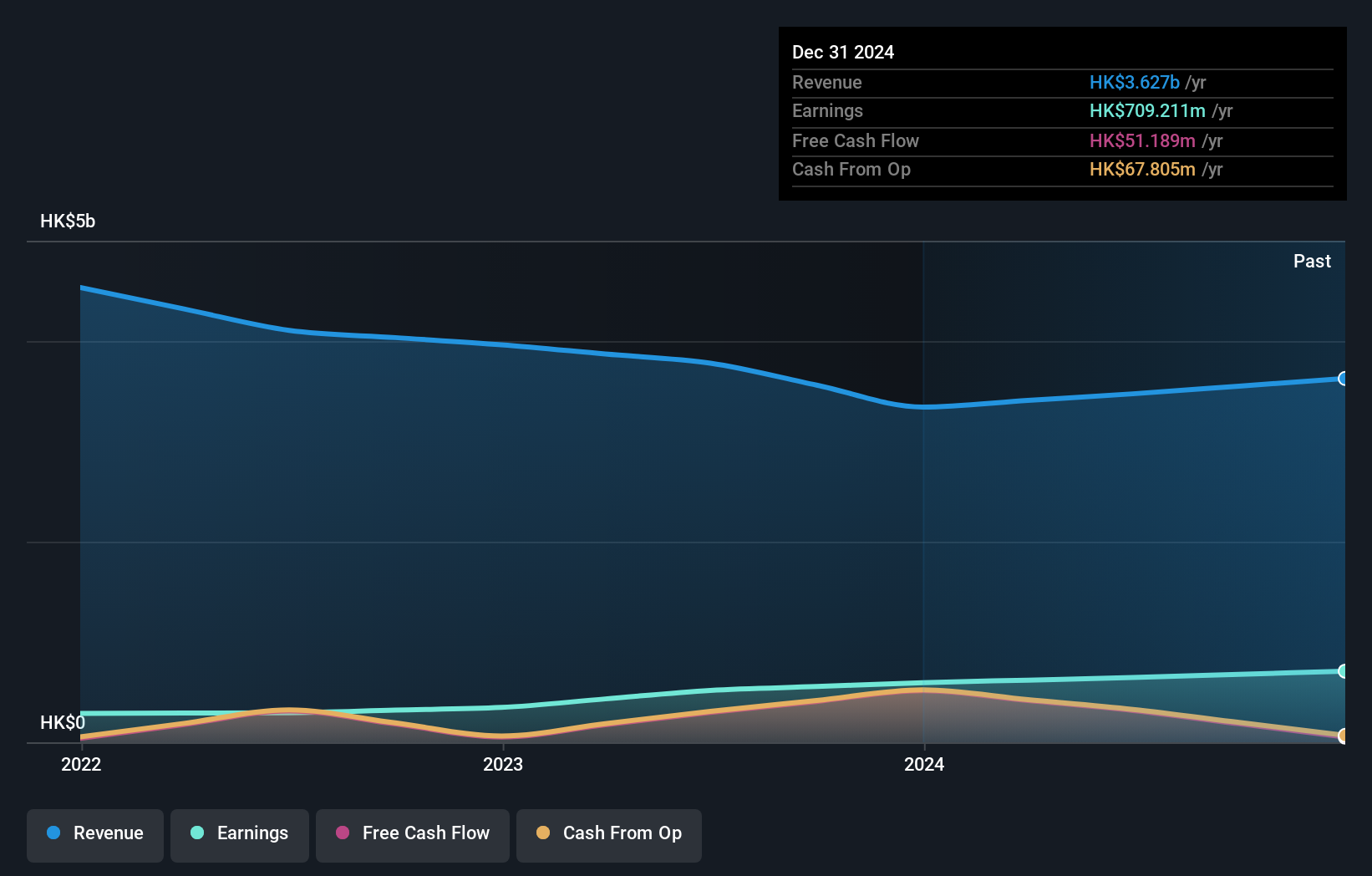

Operations: COSCO SHIPPING International (Hong Kong) generates revenue primarily from marine equipment and spare parts, contributing HK$1.73 billion, and coatings at HK$992.94 million. The company's net profit margin is a key financial indicator to consider when evaluating its performance over time.

COSCO SHIPPING International, a small player in Hong Kong's market, has shown promising financial health with no debt on its books compared to a 0.8 debt-to-equity ratio five years ago. Its earnings growth of 24.8% outpaced the industry average of 6.7%, reflecting strong performance. The company reported net income of HK$388 million for the first half of 2024, up from HK$336 million last year, alongside sales rising to HK$1.75 billion from HK$1.62 billion previously. With a price-to-earnings ratio at 9.5x, slightly below the market average, it seems attractively valued for investors seeking quality earnings and growth potential in this niche sector.

KanamotoLtd (TSE:9678)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kanamoto Co., Ltd. operates in the construction equipment rental industry both domestically in Japan and internationally, with a market cap of ¥98.46 billion.

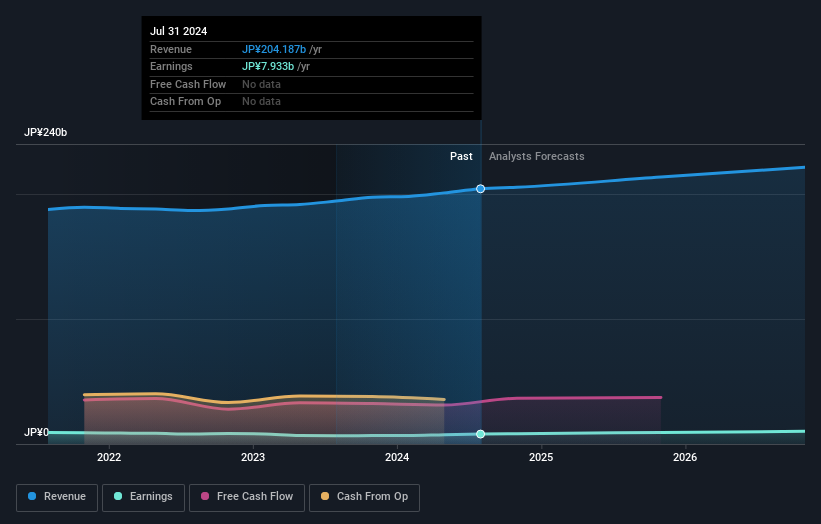

Operations: Kanamoto generates revenue primarily from its construction equipment rental segment, which accounts for ¥182.71 billion. The company has a market cap of ¥98.46 billion.

Kanamoto, a noteworthy player in its sector, has seen its earnings grow by 19.5% over the past year, outpacing the industry average of 1.8%. The firm boasts high-quality earnings and trades at a significant discount of 82% below its estimated fair value. With a net debt to equity ratio of 5.5%, Kanamoto's debt levels are considered satisfactory despite an increase from 25.7% to 42.1% over five years. Recent guidance projects net sales at ¥205 billion and operating profit at ¥14 billion for the fiscal year ending October 2024, suggesting robust financial health and potential growth ahead.

Turning Ideas Into Actions

- Navigate through the entire inventory of 4644 Undiscovered Gems With Strong Fundamentals here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KanamotoLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9678

KanamotoLtd

Engages in the construction equipment rental business in Japan and internationally.

Excellent balance sheet with proven track record and pays a dividend.