- Philippines

- /

- Banks

- /

- PSE:CBC

Top 3 Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

Amidst global market fluctuations and policy shifts under the new Trump administration, investors are navigating an environment marked by sector volatility and changing interest rate expectations. In such times, dividend stocks can offer a measure of stability and income potential, making them a valuable consideration for portfolios seeking resilience against economic uncertainties.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.16% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.15% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.62% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.23% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.74% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.49% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.37% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.76% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.43% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.78% | ★★★★★☆ |

Click here to see the full list of 1964 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

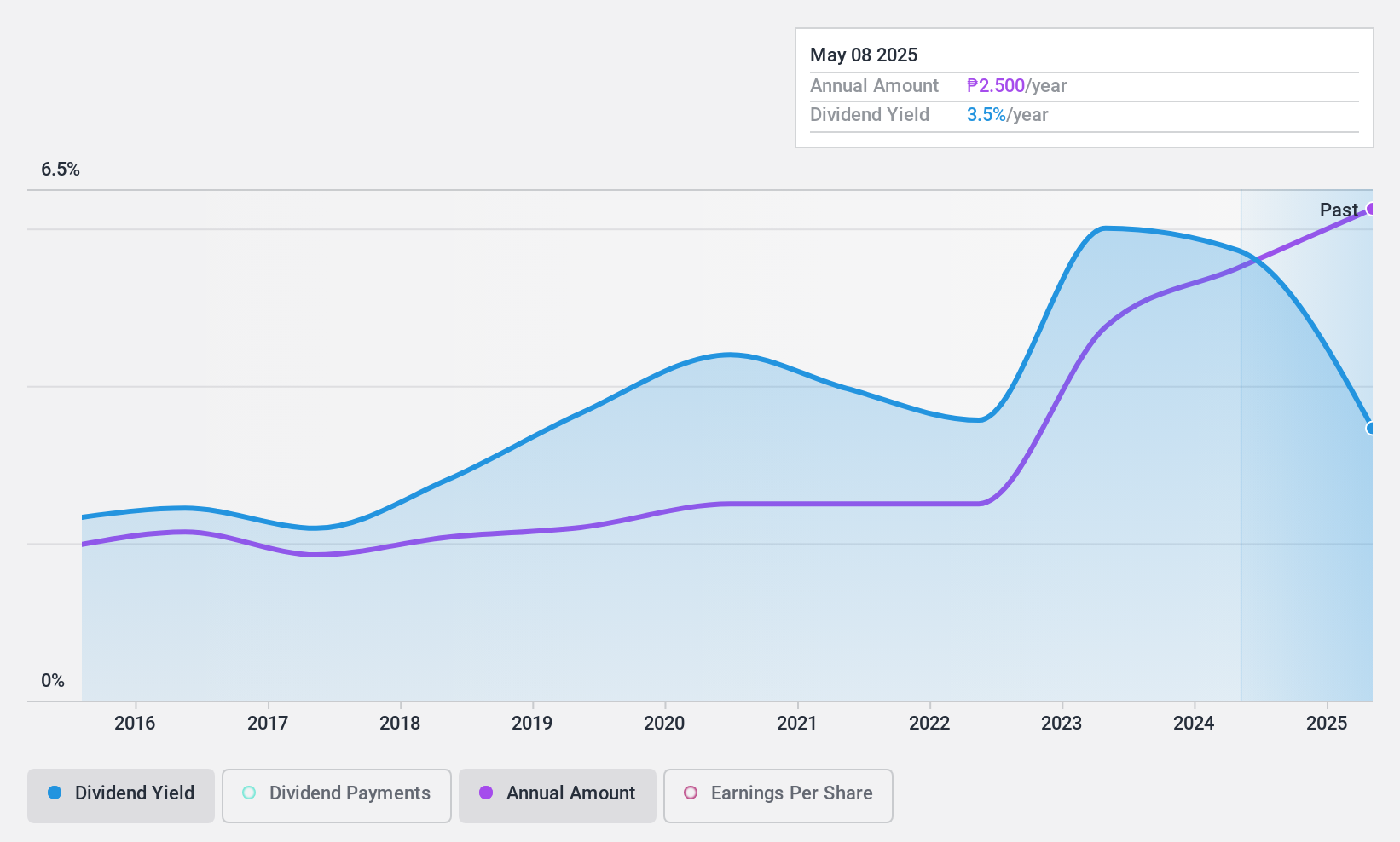

China Banking (PSE:CBC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Banking Corporation offers a range of banking and financial products and services to individuals and businesses in the Philippines, with a market capitalization of ₱154.75 billion.

Operations: China Banking Corporation's revenue segments include ₱23.45 billion from interest income, ₱5.67 billion from trading and securities gains, and ₱3.89 billion from service charges, fees, and commissions.

Dividend Yield: 3.7%

China Banking Corporation's dividend payments have been stable and reliable over the past decade, with a low payout ratio of 14.3%, indicating strong coverage by earnings. However, its dividend yield of 3.75% is below the top tier in the Philippine market. The bank faces challenges with a high level of bad loans at 2.4% and a low allowance for these loans at 91%. Recent executive changes may impact future strategic directions but do not directly affect current dividend stability.

- Click here to discover the nuances of China Banking with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that China Banking is priced lower than what may be justified by its financials.

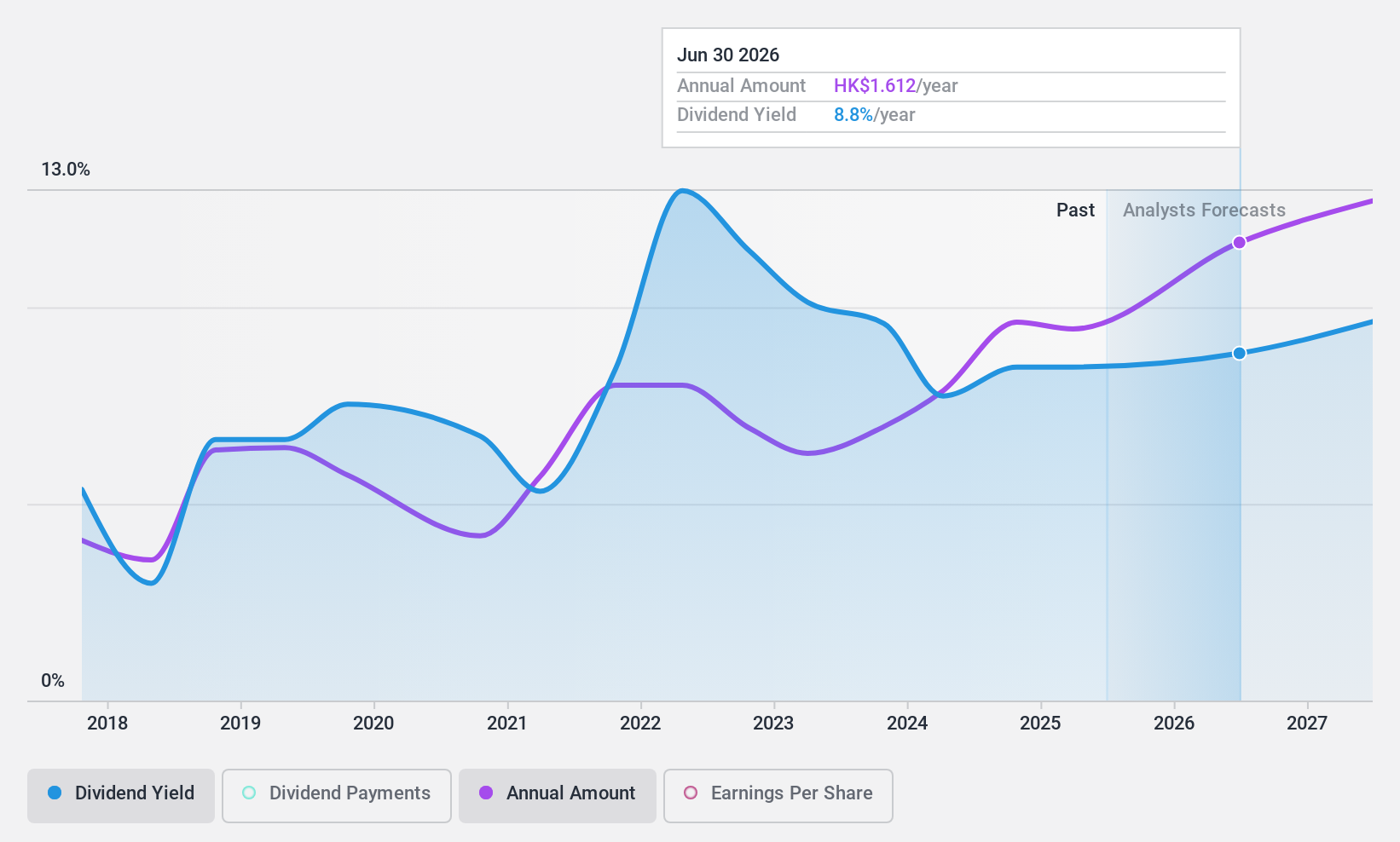

JNBY Design (SEHK:3306)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JNBY Design Limited, along with its subsidiaries, operates in the design, marketing, retail, and sale of fashion apparel, accessories, and household goods both in China and internationally with a market cap of HK$6.96 billion.

Operations: JNBY Design Limited generates revenue from its Mature Brand segment with CN¥2.94 billion, Younger Brands contributing CN¥2.18 billion, and Emerging Brands adding CN¥109.84 million.

Dividend Yield: 9.3%

JNBY Design offers a dividend yield of 9.29%, ranking in the top 25% of Hong Kong's dividend payers. The company maintains a reasonable payout ratio of 73.4%, indicating dividends are covered by earnings, and a cash payout ratio of 42.9% suggests strong cash flow support. However, its seven-year dividend history is marked by volatility and unreliability. Recent approval for a HK$0.86 final dividend per share underscores ongoing shareholder returns despite significant insider selling recently noted.

- Delve into the full analysis dividend report here for a deeper understanding of JNBY Design.

- The analysis detailed in our JNBY Design valuation report hints at an deflated share price compared to its estimated value.

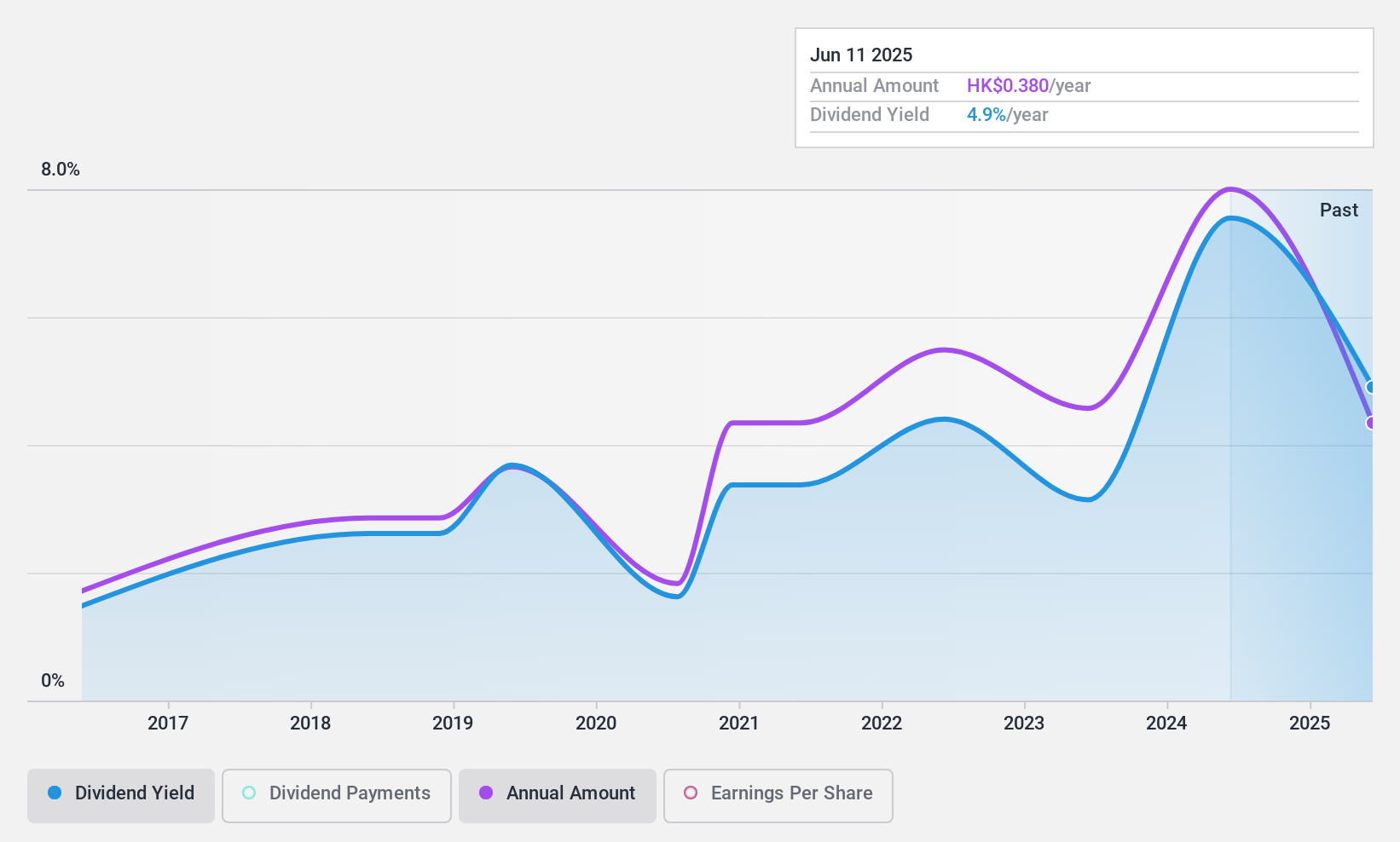

EEKA Fashion Holdings (SEHK:3709)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: EEKA Fashion Holdings Limited is an investment holding company involved in the design, promotion, marketing, retail, and wholesale of self-owned branded ladies’ wear products in China, with a market cap of HK$6.08 billion.

Operations: EEKA Fashion Holdings Limited generates revenue primarily from the retailing and wholesaling of ladies' wear, amounting to CN¥6.88 billion.

Dividend Yield: 7.7%

EEKA Fashion Holdings trades significantly below its estimated fair value and forecasts suggest earnings growth of 11.41% annually. Despite this, the stock's dividend history is marked by volatility over the past decade, indicating unreliability. The dividend yield of 7.7% falls short compared to Hong Kong's top payers, but with a payout ratio of 64.7% and a cash payout ratio of 45.8%, dividends are adequately covered by both earnings and cash flows despite recent shareholder dilution concerns.

- Get an in-depth perspective on EEKA Fashion Holdings' performance by reading our dividend report here.

- According our valuation report, there's an indication that EEKA Fashion Holdings' share price might be on the cheaper side.

Turning Ideas Into Actions

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1961 more companies for you to explore.Click here to unveil our expertly curated list of 1964 Top Dividend Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:CBC

China Banking

Provides various banking and financial products and services to individuals and business in the Philippines.

Good value with adequate balance sheet and pays a dividend.