- Hong Kong

- /

- Specialty Stores

- /

- SEHK:3709

EEKA Fashion Holdings And 2 Other Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets experience a surge, with U.S. stock indexes nearing record highs and European indices reaching fresh peaks, investors are navigating an environment marked by heightened inflation and interest rate expectations. In such dynamic times, dividend stocks like EEKA Fashion Holdings offer a compelling option for those seeking steady income streams amidst market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.92% | ★★★★★★ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.33% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.51% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.32% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 3.99% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.23% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.97% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.36% | ★★★★★★ |

Click here to see the full list of 1974 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

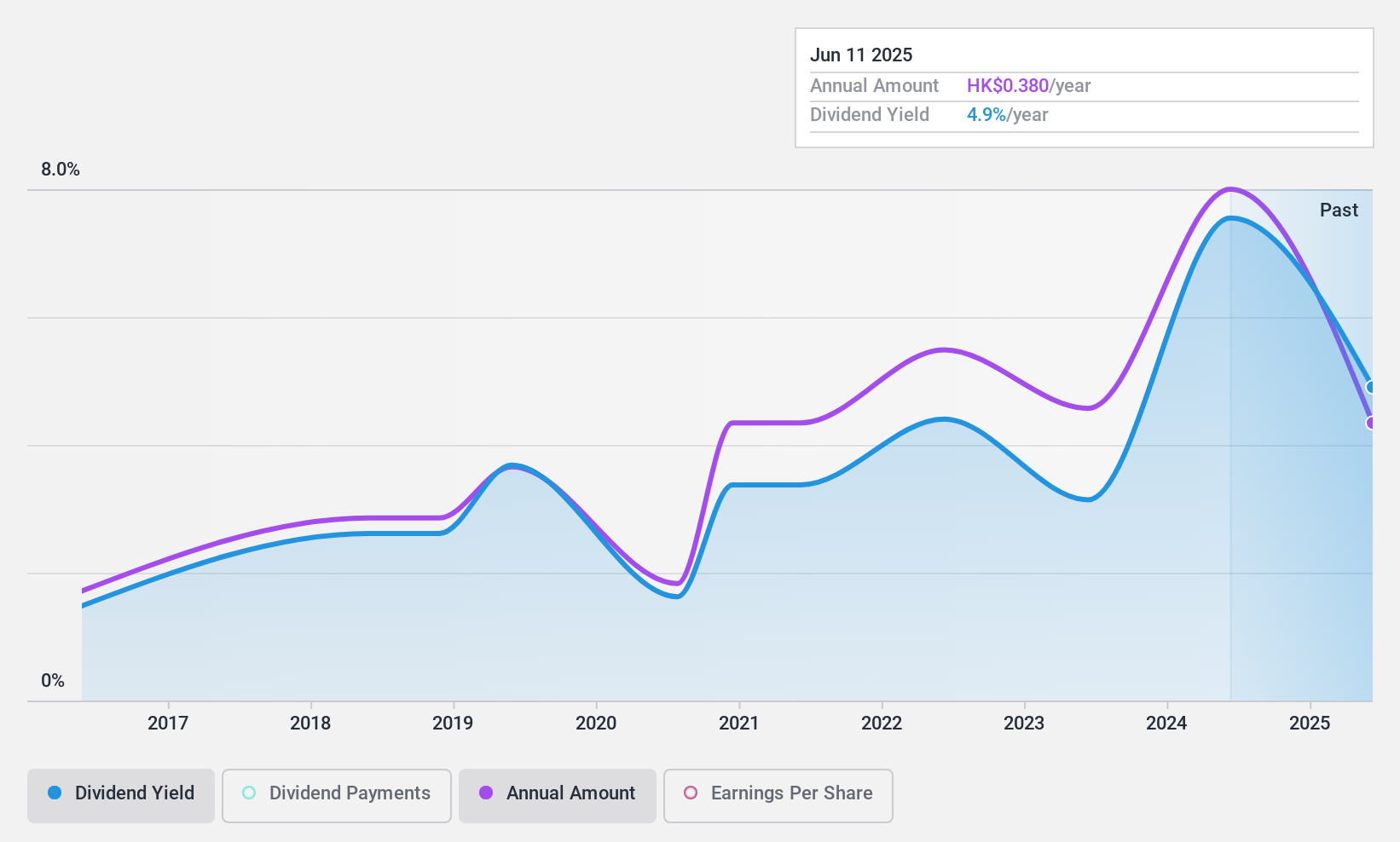

EEKA Fashion Holdings (SEHK:3709)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: EEKA Fashion Holdings Limited is involved in the design, promotion, marketing, retail, and wholesale of its own branded ladies' wear products in China with a market cap of HK$6.02 billion.

Operations: EEKA Fashion Holdings Limited generates revenue of CN¥6.88 billion from the retailing and wholesaling of its branded ladies' wear products in China.

Dividend Yield: 7.9%

EEKA Fashion Holdings offers a dividend yield in the top 25% of Hong Kong payers, with dividends covered by earnings (64.7% payout ratio) and cash flows (45.8%). However, its dividend history is unstable and volatile over the past decade. Despite trading at a significant discount to estimated fair value, recent guidance indicates potential challenges with expected decreases in revenue and net profit due to increased brand investment and declining sales.

- Take a closer look at EEKA Fashion Holdings' potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that EEKA Fashion Holdings is priced lower than what may be justified by its financials.

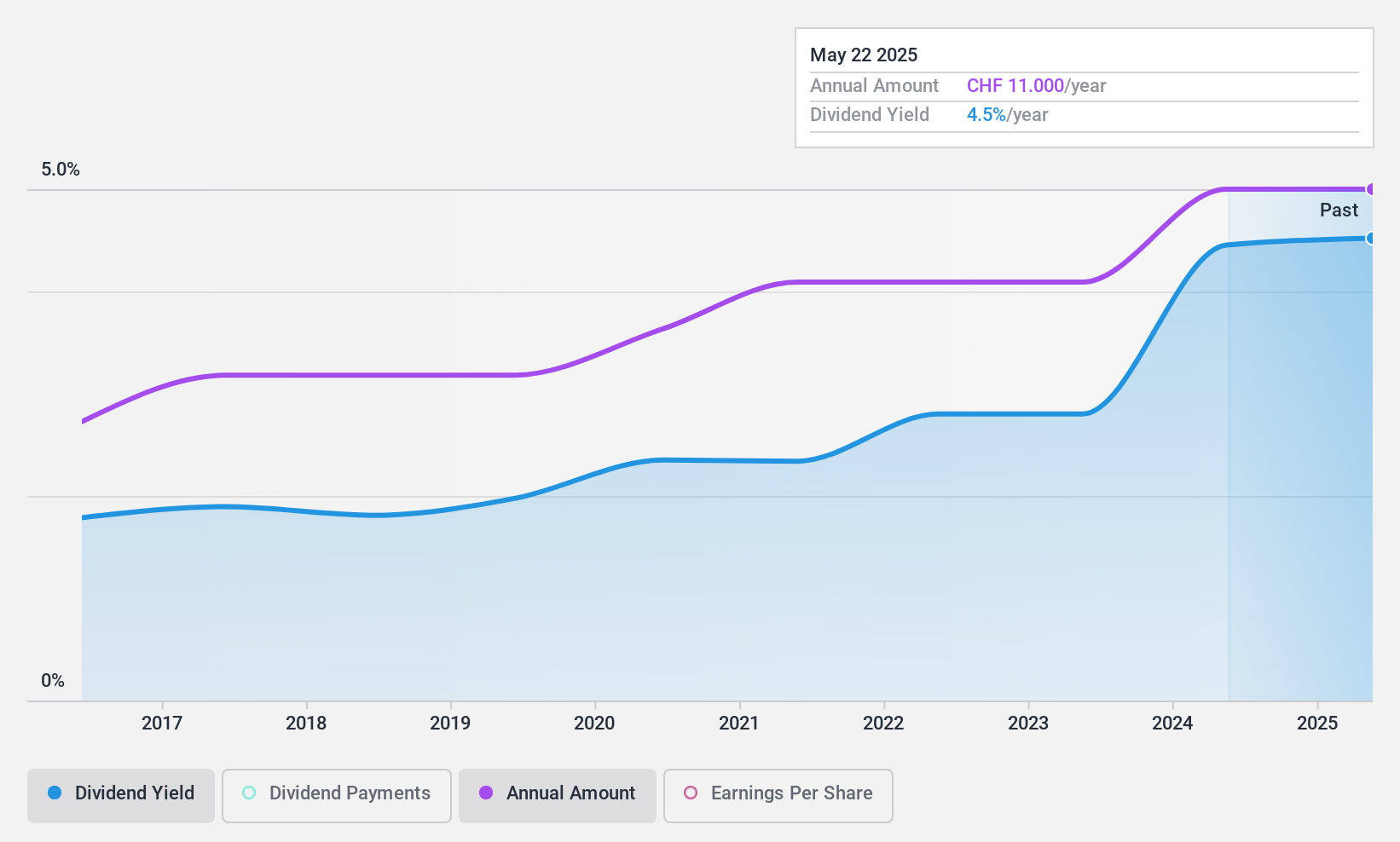

Groupe Minoteries (SWX:GMI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Groupe Minoteries SA processes and markets grain, plant, and food raw materials mainly in Switzerland with a market cap of CHF90.42 million.

Operations: Groupe Minoteries SA generates revenue of CHF147.61 million from its food processing segment.

Dividend Yield: 4%

Groupe Minoteries trades significantly below its estimated fair value, offering potential for capital appreciation. Its dividend payments have grown over the past decade and are well-covered by earnings (58.1% payout ratio) and cash flows (30.3% cash payout ratio). However, the dividends have been volatile, with occasional drops exceeding 20%, and its yield of 4.01% is slightly below the top quartile in Switzerland's market at 4.11%.

- Navigate through the intricacies of Groupe Minoteries with our comprehensive dividend report here.

- The analysis detailed in our Groupe Minoteries valuation report hints at an deflated share price compared to its estimated value.

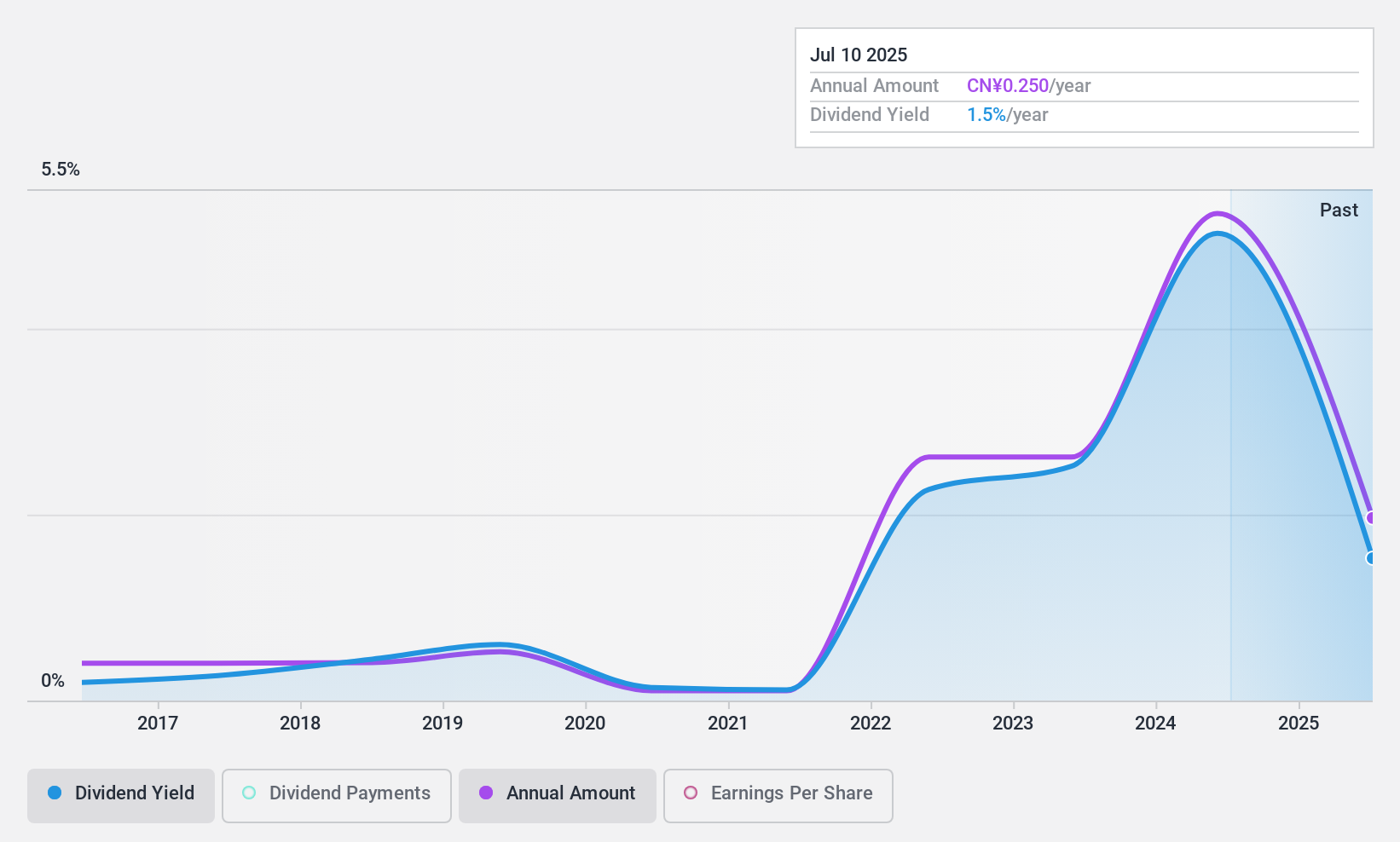

Boai NKY Medical Holdings (SZSE:300109)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Boai NKY Medical Holdings Ltd. operates in the fine chemical and medical care sectors both in China and internationally, with a market cap of CN¥7.32 billion.

Operations: Boai NKY Medical Holdings Ltd. generates revenue through its operations in the fine chemical and medical care sectors, serving both domestic and international markets.

Dividend Yield: 4.4%

Boai NKY Medical Holdings offers a dividend yield of 4.41%, placing it in the top quartile of CN market payers. However, its dividend payments have been volatile over the past decade with significant drops, and a high cash payout ratio of 258.4% indicates they are not well-covered by cash flows. Despite being covered by earnings with a 77% payout ratio, the overall sustainability is questionable due to these factors and recent share price volatility.

- Unlock comprehensive insights into our analysis of Boai NKY Medical Holdings stock in this dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Boai NKY Medical Holdings shares in the market.

Key Takeaways

- Investigate our full lineup of 1974 Top Dividend Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EEKA Fashion Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3709

EEKA Fashion Holdings

An investment holding company, engages in the design, promotion, marketing, retail, and wholesale of self-owned branded ladies’ wear products in the People’s Republic of China.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives