- Saudi Arabia

- /

- Metals and Mining

- /

- SASE:9553

3 Promising Penny Stocks With Market Caps Over US$20M

Reviewed by Simply Wall St

As global markets navigate a period of monetary policy adjustments, with the Nasdaq hitting record highs while other indices show mixed results, investors are eyeing opportunities in various market segments. Penny stocks, though often perceived as relics from past market eras, continue to offer intriguing possibilities for those interested in smaller or newer companies. These stocks can provide a mix of affordability and growth potential when backed by strong financials, making them an appealing option for those seeking value in today's complex economic landscape.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.76 | A$139.45M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.415 | MYR1.15B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.89 | MYR295.43M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.85 | HK$539.57M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.97 | HK$43.72B | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.49 | £67.51M | ★★★★☆☆ |

| Tristel (AIM:TSTL) | £3.885 | £180.04M | ★★★★★★ |

| CSE Global (SGX:544) | SGD0.46 | SGD324.93M | ★★★★★☆ |

Click here to see the full list of 5,763 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Molan Steel (SASE:9553)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Molan Steel Company produces and supplies steel products to the construction and steel fabrication industries in Saudi Arabia and internationally, with a market cap of SAR99.22 million.

Operations: The company generates revenue from its wholesale miscellaneous segment, amounting to SAR85.58 million.

Market Cap: SAR99.22M

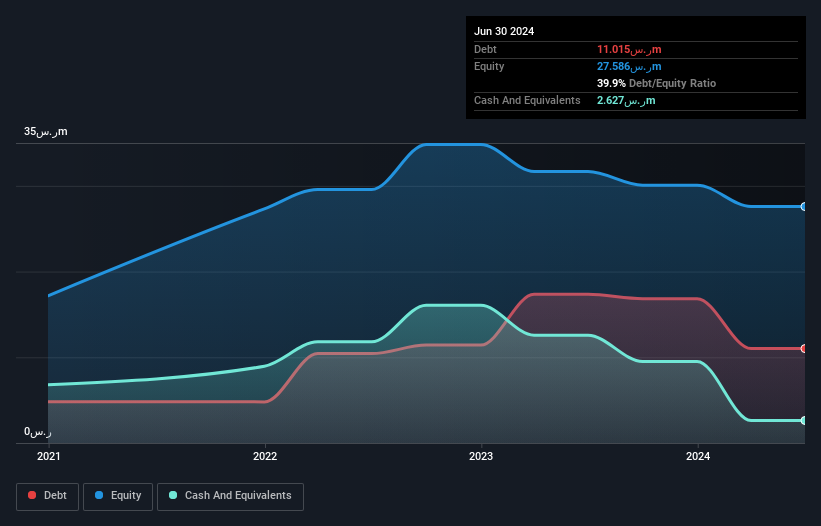

Molan Steel, with a market cap of SAR99.22 million, operates in the steel industry but remains unprofitable with declining earnings over the past five years. Despite this, its short-term assets of SAR38.6 million comfortably cover both short and long-term liabilities, indicating a stable financial position in that regard. The company's net debt to equity ratio is satisfactory at 30.4%, though it faces challenges with high share price volatility and limited cash runway if free cash flow trends persist. While shareholders haven't faced dilution recently, the lack of profitability remains a significant concern for potential investors.

- Click to explore a detailed breakdown of our findings in Molan Steel's financial health report.

- Gain insights into Molan Steel's past trends and performance with our report on the company's historical track record.

Kong Sun Holdings (SEHK:295)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Kong Sun Holdings Limited is an investment holding company that focuses on investing in, operating, and maintaining solar power plants in the People’s Republic of China, with a market cap of approximately HK$344.18 million.

Operations: The company's revenue is primarily derived from its solar power plants segment, generating CN¥371.88 million, complemented by CN¥94.00 million from financial services.

Market Cap: HK$344.18M

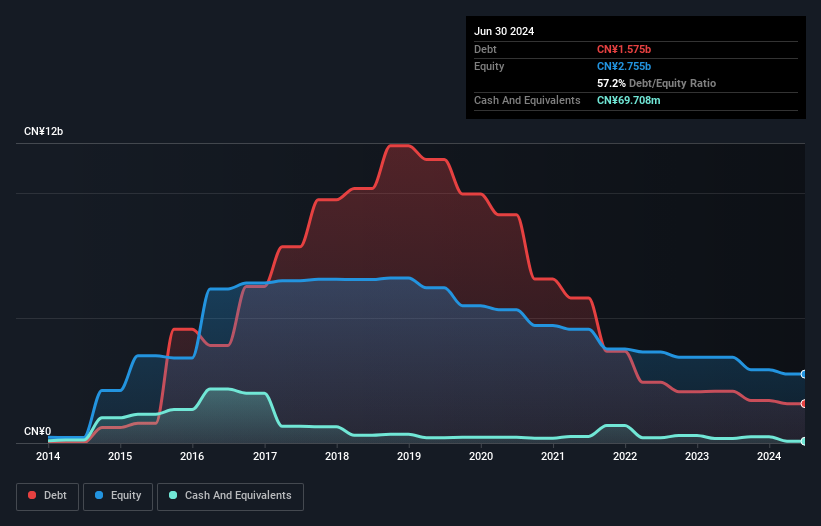

Kong Sun Holdings, with a market cap of HK$344.18 million, focuses on solar power in China. Although unprofitable, it has reduced losses by 6.7% annually over five years and maintains a positive cash flow runway exceeding three years. The company's short-term assets of CN¥2.9 billion surpass both short-term and long-term liabilities, suggesting financial stability despite its high net debt to equity ratio of 54.6%. Recent shareholder meetings addressed finance lease agreements, reflecting ongoing strategic adjustments. However, increased share price volatility and an inexperienced board present challenges for investors considering this stock.

- Click here to discover the nuances of Kong Sun Holdings with our detailed analytical financial health report.

- Assess Kong Sun Holdings' previous results with our detailed historical performance reports.

China Best Group Holding (SEHK:370)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: China Best Group Holding Limited is an investment holding company that trades in electronic appliances across the People’s Republic of China, Singapore, and Hong Kong, with a market cap of HK$554.25 million.

Operations: The company's revenue is primarily derived from building construction contracting (HK$72.40 million), centralised heating (HK$50.07 million), geothermal energy (HK$16.87 million), customised technical support (HK$14.87 million), money lending (HK$6.98 million), and property investment (HK$6.32 million).

Market Cap: HK$554.25M

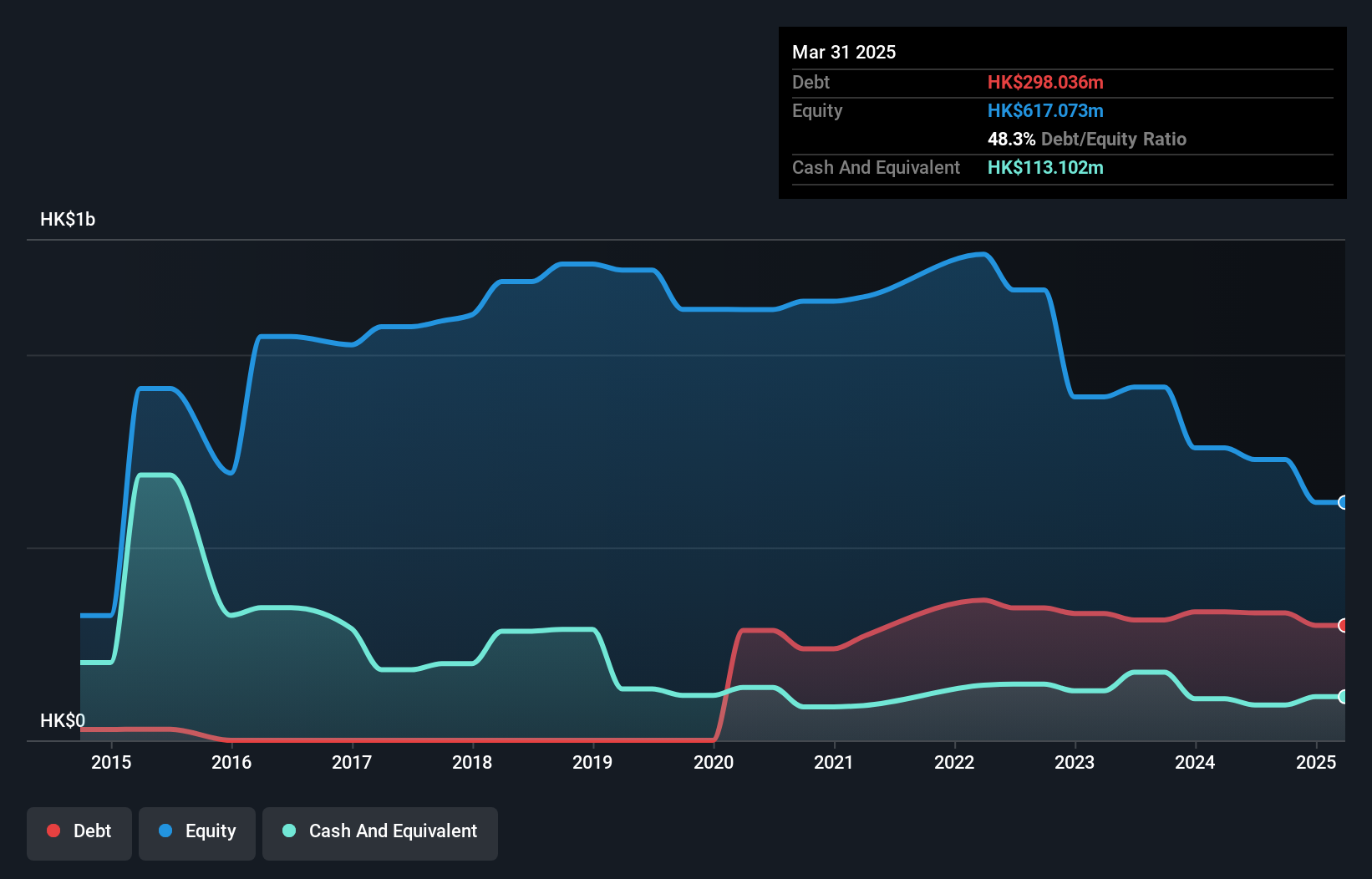

China Best Group Holding, with a market cap of HK$554.25 million, is currently unprofitable with declining earnings over the past five years. Despite this, it maintains financial stability as its short-term assets of HK$1 billion exceed liabilities and it has a satisfactory net debt to equity ratio of 32.8%. The company reported sales of HK$64.18 million for the recent half-year period but continues to incur losses, albeit reduced from the previous year. Management changes include Mr. Fan Jie's resignation as executive director while remaining in other roles within the company’s subsidiaries and strategic department.

- Click here and access our complete financial health analysis report to understand the dynamics of China Best Group Holding.

- Gain insights into China Best Group Holding's historical outcomes by reviewing our past performance report.

Taking Advantage

- Unlock our comprehensive list of 5,763 Penny Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:9553

Molan Steel

Produces and supplies steel products to the construction and steel fabrication industries in Saudi Arabia and internationally.

Adequate balance sheet slight.

Market Insights

Community Narratives