- Hong Kong

- /

- Specialty Stores

- /

- SEHK:3669

I Ran A Stock Scan For Earnings Growth And China Yongda Automobiles Services Holdings (HKG:3669) Passed With Ease

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in China Yongda Automobiles Services Holdings (HKG:3669). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for China Yongda Automobiles Services Holdings

How Fast Is China Yongda Automobiles Services Holdings Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. As a tree reaches steadily for the sky, China Yongda Automobiles Services Holdings's EPS has grown 21% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

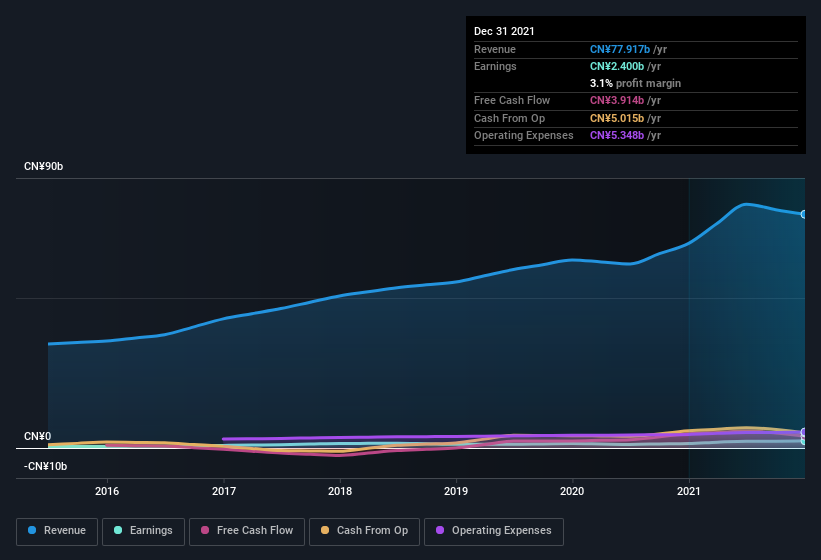

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). While we note China Yongda Automobiles Services Holdings's EBIT margins were flat over the last year, revenue grew by a solid 14% to CN¥78b. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for China Yongda Automobiles Services Holdings's future profits.

Are China Yongda Automobiles Services Holdings Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

One shining light for China Yongda Automobiles Services Holdings is the serious outlay one insider has made to buy shares, in the last year. Specifically, in one large transaction Chairman of the Board of Directors Tak On Cheung paid HK$12m, for stock at HK$11.91 per share. It doesn't get much better than that, in terms of large investments from insiders.

The good news, alongside the insider buying, for China Yongda Automobiles Services Holdings bulls is that insiders (collectively) have a meaningful investment in the stock. Notably, they have an enormous stake in the company, worth CN¥4.8b. That equates to 33% of the company, making insiders powerful and aligned with other shareholders. So it might be my imagination, but I do sense the glimmer of an opportunity.

Should You Add China Yongda Automobiles Services Holdings To Your Watchlist?

You can't deny that China Yongda Automobiles Services Holdings has grown its earnings per share at a very impressive rate. That's attractive. Better still, insiders own a large chunk of the company and one has even been buying more shares. So it's fair to say I think this stock may well deserve a spot on your watchlist. It is worth noting though that we have found 2 warning signs for China Yongda Automobiles Services Holdings that you need to take into consideration.

As a growth investor I do like to see insider buying. But China Yongda Automobiles Services Holdings isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3669

China Yongda Automobiles Services Holdings

An investment holding company, operates as a passenger vehicle retailer and service provider for luxury and ultra-luxury brands in the People’s Republic of China.

Excellent balance sheet average dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion