As global markets experience a surge, with U.S. stock indexes climbing toward record highs and growth stocks outperforming value shares, investors are navigating a complex landscape shaped by inflation concerns and evolving trade policies. Amidst these developments, penny stocks continue to capture attention for their potential to offer significant growth at lower price points. Although the term "penny stocks" might seem outdated, these smaller or newer companies often present unique opportunities when backed by strong financials and solid fundamentals. In this article, we explore several promising penny stocks that stand out for their financial strength and potential for long-term success.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.90 | HK$45.23B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.52 | MYR2.56B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.875 | £469.93M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.05 | £327.19M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.942 | £150.13M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.855 | MYR283.81M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.95 | £448.86M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.07 | £305.33M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £4.28 | £81.63M | ★★★★☆☆ |

Click here to see the full list of 5,680 stocks from our Penny Stocks screener.

Let's explore several standout options from the results in the screener.

China Yongda Automobiles Services Holdings (SEHK:3669)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: China Yongda Automobiles Services Holdings Limited is an investment holding company that operates as a retailer and service provider for luxury and ultra-luxury passenger vehicles in China, with a market cap of HK$4.75 billion.

Operations: The company generates revenue through two main segments: Passenger Vehicle Sales and Services, which contributed CN¥67.59 billion, and Automobile Operating Lease Services, which accounted for CN¥448.73 million.

Market Cap: HK$4.75B

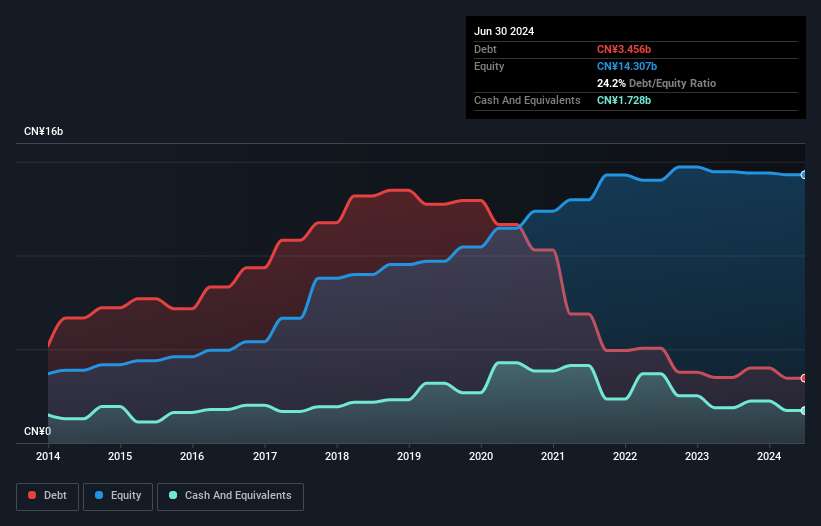

China Yongda Automobiles Services Holdings, with a market cap of HK$4.75 billion, operates in the luxury vehicle sector in China. Despite negative earnings growth over the past year and declining profit margins, its debt situation has improved significantly over five years, with a reduced debt-to-equity ratio from 131.5% to 24.2%. The company's short-term assets comfortably cover both short-term and long-term liabilities, indicating financial stability. While trading at a significant discount to estimated fair value and having high-quality earnings, it faces challenges like low return on equity and an unstable dividend track record amidst forecasts of moderate earnings growth ahead.

- Dive into the specifics of China Yongda Automobiles Services Holdings here with our thorough balance sheet health report.

- Assess China Yongda Automobiles Services Holdings' future earnings estimates with our detailed growth reports.

Changshu Fengfan Power Equipment (SHSE:601700)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Changshu Fengfan Power Equipment Co., Ltd. (ticker: SHSE:601700) operates in the power equipment industry and has a market cap of approximately CN¥5.11 billion.

Operations: Changshu Fengfan Power Equipment Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥5.11B

Changshu Fengfan Power Equipment Co., Ltd., with a market cap of CN¥5.11 billion, has shown impressive earnings growth of 193.2% over the past year, outpacing the industry significantly. The company maintains stable weekly volatility and a satisfactory net debt to equity ratio of 36.2%. While short-term assets exceed both short-term and long-term liabilities, indicating solid financial footing, its operating cash flow is negative, raising concerns about debt coverage. Despite improved profit margins and high-quality earnings, the return on equity remains low at 4.9%, and dividends are not well covered by free cash flows.

- Click here to discover the nuances of Changshu Fengfan Power Equipment with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Changshu Fengfan Power Equipment's track record.

Shanghai YongLi Belting (SZSE:300230)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Shanghai YongLi Belting Co., Ltd develops, produces, and sells conveyor belts with a market cap of CN¥3.68 billion.

Operations: Shanghai YongLi Belting Co., Ltd has not reported any specific revenue segments.

Market Cap: CN¥3.68B

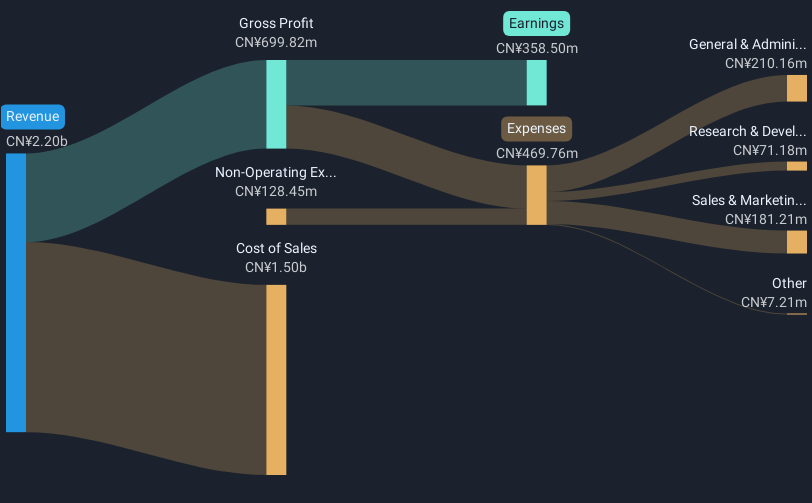

Shanghai YongLi Belting Co., Ltd., with a market cap of CN¥3.68 billion, has demonstrated robust earnings growth of 63.6% over the past year, significantly surpassing the industry average. The company benefits from a strong financial position, with short-term assets (CN¥2.2 billion) exceeding both short- and long-term liabilities, and more cash than total debt, ensuring debt coverage isn't an issue. However, its Return on Equity is low at 11.4%, and recent results were influenced by a large one-off gain of CN¥157.8 million. A Special Shareholders Meeting is scheduled to discuss governance changes and audit appointments.

- Get an in-depth perspective on Shanghai YongLi Belting's performance by reading our balance sheet health report here.

- Evaluate Shanghai YongLi Belting's historical performance by accessing our past performance report.

Seize The Opportunity

- Click here to access our complete index of 5,680 Penny Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300230

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives